Nevada Self-Employed Independent Contractor Esthetics Agreement

Description

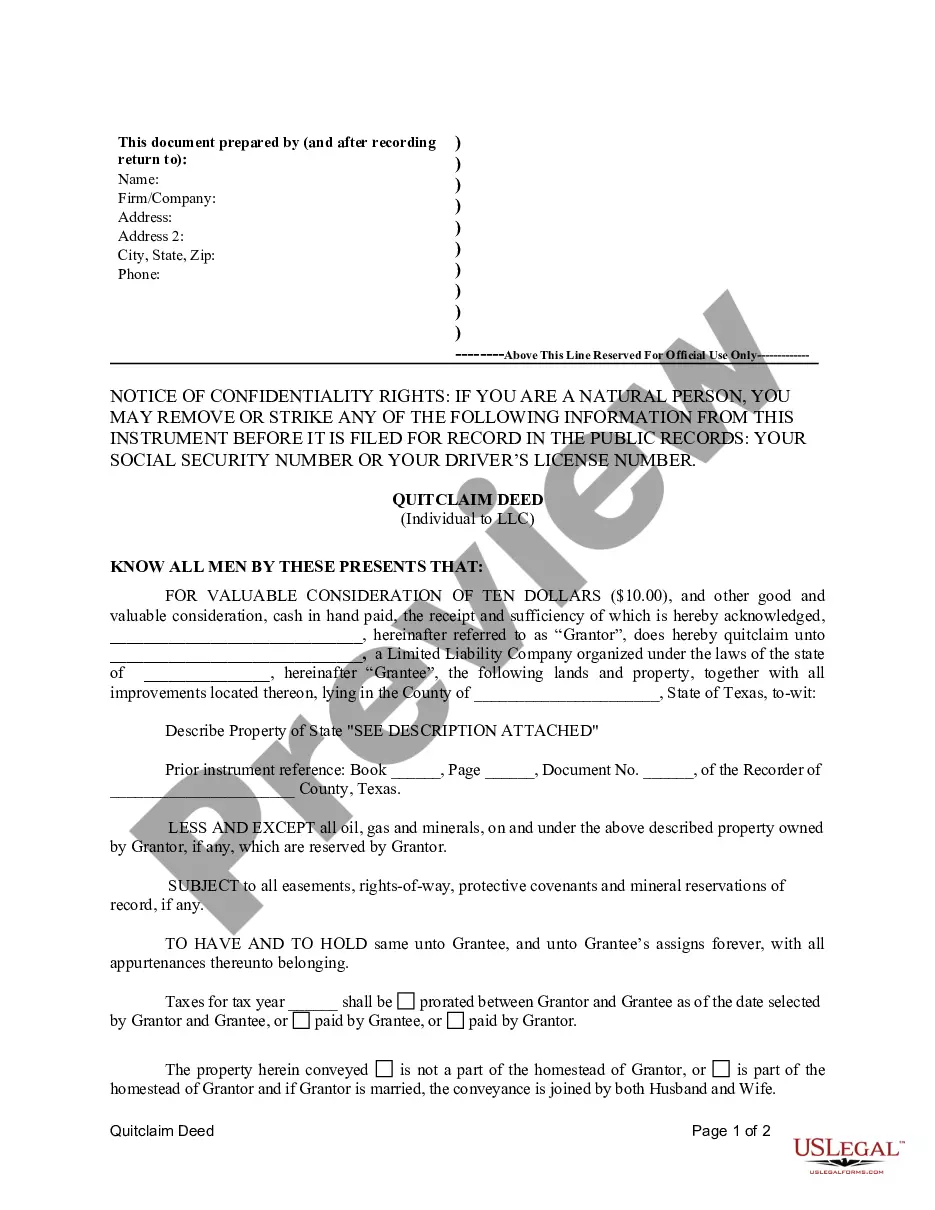

How to fill out Self-Employed Independent Contractor Esthetics Agreement?

Are you currently in a situation where you require documents for both business or personal purposes almost all the time.

There are numerous legal document templates accessible on the web, but locating trustworthy ones isn’t easy.

US Legal Forms provides thousands of form templates, including the Nevada Self-Employed Independent Contractor Esthetics Agreement, designed to meet state and federal requirements.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors.

The service offers properly crafted legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Nevada Self-Employed Independent Contractor Esthetics Agreement template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Utilize the Review button to inspect the form.

- Check the summary to confirm you have selected the right form.

- If the form isn’t what you need, use the Lookup field to find the form that fits your needs and requirements.

- Once you find the correct form, click Buy now.

- Select the pricing plan you want, enter the required details to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

- Access all of the document templates you have purchased in the My documents section. You can retrieve another copy of the Nevada Self-Employed Independent Contractor Esthetics Agreement anytime, if necessary. Just follow the necessary form to download or print the document template.

Form popularity

FAQ

The independent contractor law in Nevada defines the relationship between contractors and businesses, emphasizing the importance of independence in performing work. Contractors should have control over how they complete their tasks, which distinguishes them from employees. Understanding these laws helps protect both parties involved in a Nevada Self-Employed Independent Contractor Esthetics Agreement. For detailed insights and support, consider exploring resources available on the USLegalForms platform.

Yes, an independent contractor in Nevada typically needs a business license to operate legally. This requirement helps ensure compliance with state regulations and can vary based on the type of services provided. It's advisable to check with local authorities for specific licensing requirements. For those creating a Nevada Self-Employed Independent Contractor Esthetics Agreement, understanding these regulations is crucial for a smooth operation.

Creating an independent contractor agreement is essential for establishing clear terms between you and the contractor. Start by outlining the scope of work, payment terms, and deadlines. It's important to include clauses that address confidentiality and termination conditions. Utilizing a Nevada Self-Employed Independent Contractor Esthetics Agreement template from USLegalForms can simplify this process and ensure you cover all necessary legal bases.

To fill out a Nevada Self-Employed Independent Contractor Esthetics Agreement, begin by entering your name and the name of the business hiring you. Clearly describe the services to be performed, payment terms, and duration of the agreement. It’s important to review the entire document for clarity and completeness before both parties sign to ensure full understanding and agreement.

Filling out an independent contractor form involves providing your personal and business information accurately. Start by entering your name, address, and taxpayer identification number on the W-9 form. Then, ensure that you accurately describe the services you will provide in the Nevada Self-Employed Independent Contractor Esthetics Agreement, ensuring alignment with your discussion with the hiring party.

An independent contractor usually needs to fill out a W-9 form to provide their taxpayer identification number. This form is essential for the business hiring them to report income to the IRS. Additionally, the Nevada Self-Employed Independent Contractor Esthetics Agreement should be completed to outline the working relationship and responsibilities.

To write a Nevada Self-Employed Independent Contractor Esthetics Agreement, start by identifying the parties involved and clearly outlining the scope of work. Include important details like payment terms, deadlines, and any specific requirements for the esthetics services. It is essential to ensure both parties understand their rights and obligations, and consulting a legal expert can further enhance this document's effectiveness.

Writing a contract as an independent contractor involves outlining the scope of work, payment terms, and duration of the agreement. It's important to address confidentiality, liability, and termination clauses to ensure clarity and protection for both parties. Utilizing templates through platforms like uslegalforms can simplify this process, helping you draft a comprehensive Nevada Self-Employed Independent Contractor Esthetics Agreement that meets legal standards.

Legal requirements for independent contractors in Nevada include registering your business, obtaining the necessary permits, and adhering to tax obligations. Contractors must also ensure their services meet state regulations concerning their field, such as health and safety codes. Additionally, a Nevada Self-Employed Independent Contractor Esthetics Agreement can help outline mutual responsibilities and protect both parties legally.

In Nevada, if you are performing work that encompasses construction or alteration, a contractor license is typically required. However, estheticians functioning as independent contractors can often operate without a specific contractor license, provided they follow the relevant regulations for their trade. It is vital to understand these legal frameworks to protect your business and client interests, ideally formalized in a Nevada Self-Employed Independent Contractor Esthetics Agreement.