Nevada Underwriter Agreement - Self-Employed Independent Contractor

Description

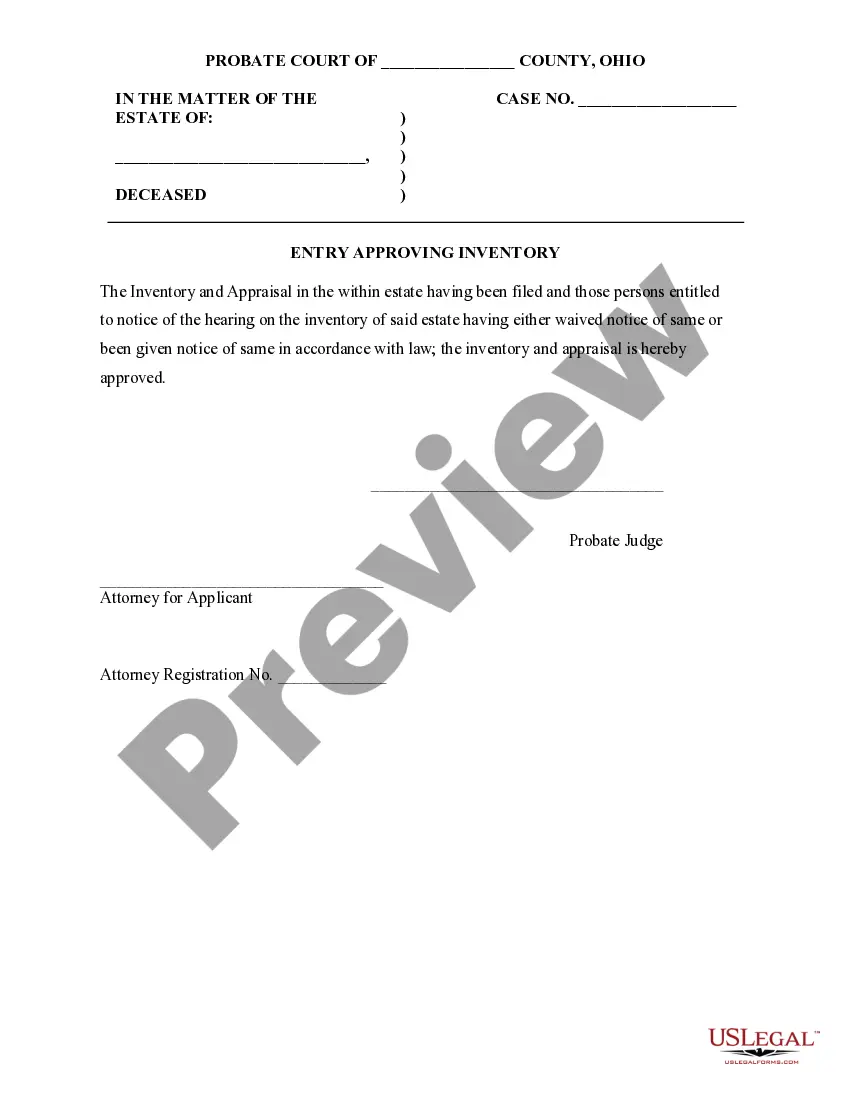

How to fill out Underwriter Agreement - Self-Employed Independent Contractor?

Selecting the optimal authentic document template can be challenging. Certainly, there are numerous designs available online, but how can you locate the authentic form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Nevada Underwriter Agreement - Self-Employed Independent Contractor, which you can utilize for both business and personal purposes. All the forms are reviewed by professionals and comply with state and federal requirements.

If you are already registered, Log In to your account and click the Download button to access the Nevada Underwriter Agreement - Self-Employed Independent Contractor. Use your account to view the legal documents you have previously ordered. Navigate to the My documents section of your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are some simple guidelines for you to follow: First, ensure that you have chosen the correct form for your region/state. You can preview the document using the Preview button and review the document details to confirm it is suitable for you. If the form does not meet your requirements, utilize the Search field to find the correct form. Once you are certain that the document is accurate, click the Purchase now button to obtain the form. Select the pricing plan you desire and enter the required information. Create your account and complete your order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Nevada Underwriter Agreement - Self-Employed Independent Contractor.

- US Legal Forms is the largest repository of legal forms where you can find a variety of document templates.

- Use the service to download professionally crafted documents that adhere to state regulations.

- The forms are vetted by experts to ensure compliance.

- You can access previous orders easily through your account.

- Preview documents before finalizing your selection.

- Make sure to select the correct form for your location.

Form popularity

FAQ

Creating an independent contractor agreement involves several essential steps, especially if you are pursuing a Nevada Underwriter Agreement - Self-Employed Independent Contractor. First, clearly outline the scope of work, responsibilities, and payment terms for the contractor. Specify the duration of the agreement and include details about confidentiality and property rights. For convenience, consider using the uSlegalforms platform, which provides tailored templates that simplify the process of drafting a legally sound agreement.

Independent contractors in Nevada must comply with local licensing, tax obligations, and any industry-specific regulations. It's vital to understand contracts and agreements, like the Nevada Underwriter Agreement - Self-Employed Independent Contractor, to ensure legal compliance and protect your interests. Platforms like uslegalforms can help you navigate these requirements efficiently.

The key difference lies in control and independence. Independent contractors set their own schedules, choose their clients, and manage their own taxes. In contrast, employees are subject to company policies and receive benefits. The Nevada Underwriter Agreement - Self-Employed Independent Contractor reinforces this independence and clarifies your operational freedoms.

The 4/10 rule allows independent contractors in Nevada to work four 10-hour days instead of the standard five days in a week. This flexibility promotes better work-life balance. For those adhering to the Nevada Underwriter Agreement - Self-Employed Independent Contractor, understanding this rule can enhance your scheduling and productivity.

In Nevada, you can perform limited work without a contractor license, but the specifics vary by industry. Generally, if your work involves a substantial investment or risk, a license is likely required. Familiarizing yourself with the Nevada Underwriter Agreement - Self-Employed Independent Contractor helps clarify what activities can be performed without licensing.

In Nevada, independent contractors often need a business license, depending on the type of work they do. This license legitimizes your business and ensures compliance with state regulations. For those working under the Nevada Underwriter Agreement - Self-Employed Independent Contractor, obtaining the necessary licenses is crucial for operating legally.

Yes, an independent contractor is typically considered self-employed. This status means that you run your own business, make your own decisions, and invoice clients directly for your services. Under the Nevada Underwriter Agreement - Self-Employed Independent Contractor, you operate independently without the constraints that come with traditional employment.

Filling out an independent contractor form involves providing accurate details about your identity, the services you will deliver, and payment information. Ensure that you include start and end dates, as well as any essential clauses for your specific field. Using our USLegalForms platform can streamline this process, making it easier to create a compliant Nevada Underwriter Agreement - Self-Employed Independent Contractor.

In Nevada, independent contractors typically do not need workers' compensation insurance unless they have employees or work in specific industries. However, it's smart to consider potential risks associated with your work. Understanding your responsibilities under the Nevada Underwriter Agreement - Self-Employed Independent Contractor can guide you in deciding whether to opt for workers' compensation.

When writing an independent contractor agreement, begin with a clear title and introduction that identifies the parties involved. Outline the project scope, payment structure, and timelines to avoid misunderstandings. Remember to include terms that reflect a Nevada Underwriter Agreement - Self-Employed Independent Contractor, as this will help protect both parties legally.