Nevada Temporary Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Temporary Worker Agreement - Self-Employed Independent Contractor?

Finding the appropriate legal document template can be quite challenging. Naturally, there are numerous templates accessible online, but how do you find the legal form you require.

Use the US Legal Forms website. The platform offers thousands of templates, including the Nevada Temporary Worker Agreement - Self-Employed Independent Contractor, suitable for business and personal needs. All of the forms are reviewed by professionals and comply with local and federal regulations.

If you are already registered, Log In to your account and click the Obtain button to download the Nevada Temporary Worker Agreement - Self-Employed Independent Contractor. Utilize your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

Finally, complete, modify, print, and sign the acquired Nevada Temporary Worker Agreement - Self-Employed Independent Contractor. US Legal Forms boasts the largest collection of legal forms, providing a variety of document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

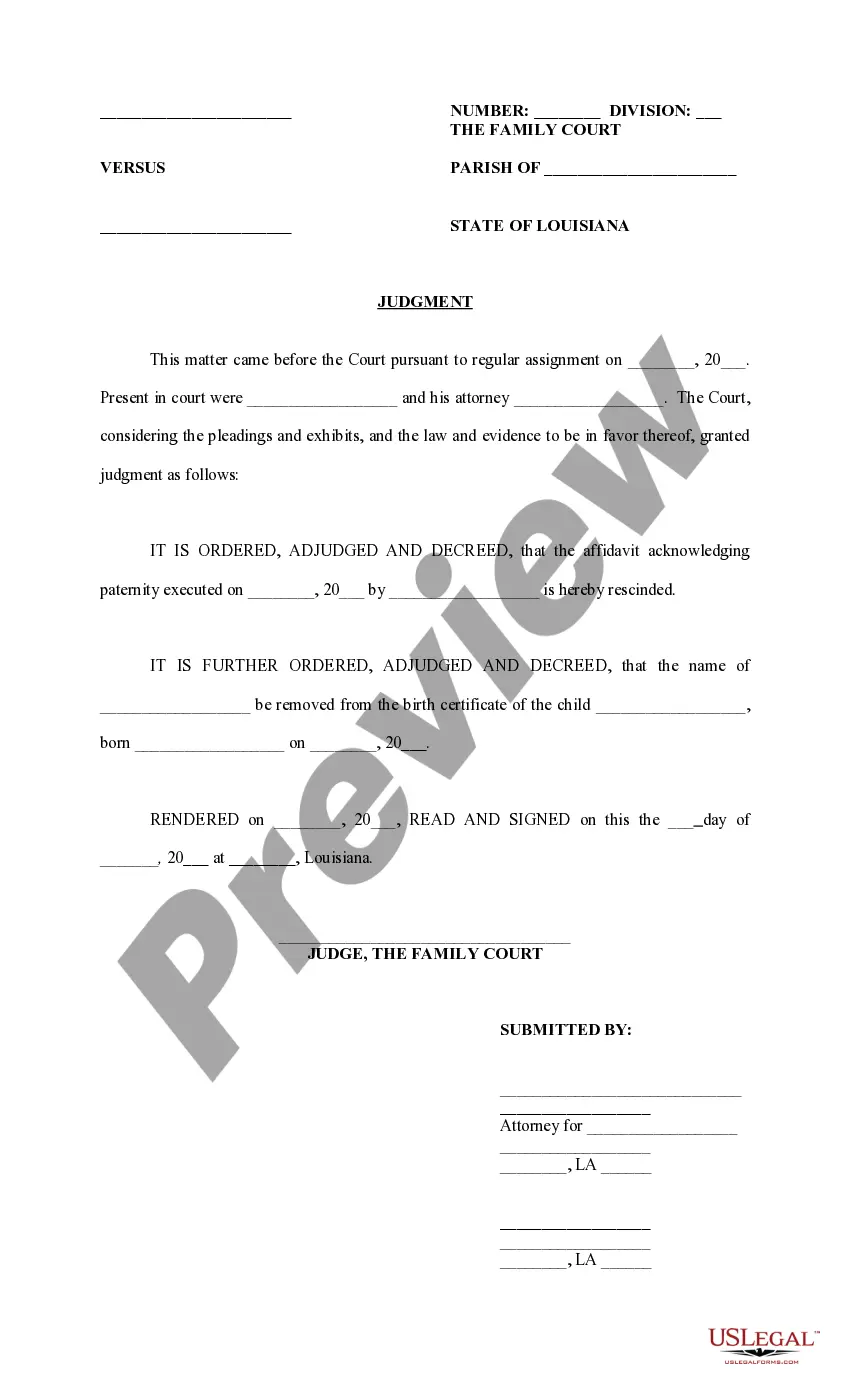

- First, ensure you have chosen the correct form for your city/region. You can preview the form using the Review button and read the form details to confirm it is the right one for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are certain that the form is correct, click the Get now button to obtain the form.

- Select the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the document format and download the legal document template to your device.

Form popularity

FAQ

The terms 'temporary employee' and 'independent contractor' often cause confusion, but they are distinctly different. A temporary employee works under the control of an employer for a limited time, while an independent contractor operates their own business and retains control over how they complete tasks. When considering a Nevada Temporary Worker Agreement - Self-Employed Independent Contractor, it is crucial to recognize that independent contractors typically have more flexibility regarding their work conditions and schedules. For those seeking to enter this arrangement, USLegalForms offers resources to help you draft an effective agreement that clearly outlines the relationship.

Filling out an independent contractor agreement requires attention to detail. Begin by entering the full names and addresses of both parties involved, and then fill in the specifics of the work scope and payment. When dealing with a Nevada Temporary Worker Agreement - Self-Employed Independent Contractor, ensure you include timelines and conditions for termination. Tools like USLegalForms offer guidance to help you blank out common pitfalls.

Writing an independent contractor agreement involves outlining the terms of your working relationship clearly. Start with the contract’s title, and include details like project specifics, payment terms, and deadlines. The Nevada Temporary Worker Agreement - Self-Employed Independent Contractor should also specify the rights and responsibilities of both parties. Using service providers like USLegalForms can simplify this process with templates.

In Nevada, independent contractors generally do not need workers' compensation insurance, but there are exceptions. If you work alongside other employees or if your contract specifies it, a Nevada Temporary Worker Agreement - Self-Employed Independent Contractor might require coverage. It's vital to understand your obligations under state laws. Consider consulting a legal expert or using platforms like USLegalForms to ensure compliance.

Yes, a self-employed person can and should have a contract. A Nevada Temporary Worker Agreement - Self-Employed Independent Contractor serves as a formal contract that outlines the scope of work, payment terms, and other essential details. This agreement helps protect both parties involved, ensuring clarity in the working relationship. With uslegalforms, you can easily create your own contract that meets your specific needs, providing peace of mind for your business.

To provide proof of employment as an independent contractor, you can use a Nevada Temporary Worker Agreement - Self-Employed Independent Contractor. This document outlines your work relationship and helps clarify the terms of your service. Additionally, you may consider providing invoices, bank statements, or tax documents that display your income as evidence of your work. Uslegalforms offers templates for these agreements, simplifying the process for you.

In Nevada, 1099 employees typically do not need workers' compensation insurance, as they are considered independent contractors. However, exceptions may apply based on the nature of the work or contracts involved. It is prudent to review your situation thoroughly and consult resources like the Nevada Temporary Worker Agreement - Self-Employed Independent Contractor to ensure you are properly informed and protected.

Independent contractors in Nevada should consider general liability insurance to protect against unforeseen claims, along with professional liability insurance if they offer specialized services. Having adequate insurance demonstrates professionalism and may enhance client trust. When developing your Nevada Temporary Worker Agreement - Self-Employed Independent Contractor, indicate the necessary insurance coverage to safeguard both parties.

Creating an independent contractor agreement involves outlining the scope of work, payment terms, and responsibilities of both parties. You can start by including essential details such as deadlines, deliverables, and conditions for termination. Consider using the Nevada Temporary Worker Agreement - Self-Employed Independent Contractor template available through US Legal Forms to save time while ensuring all legal essentials are covered.

In most cases, independent contractors do not require a work permit in Nevada, as they operate independently. However, particular industries may enforce specific regulations. It's advisable to consult local authorities when drafting your Nevada Temporary Worker Agreement - Self-Employed Independent Contractor to ensure compliance with any applicable licensing or zoning laws.