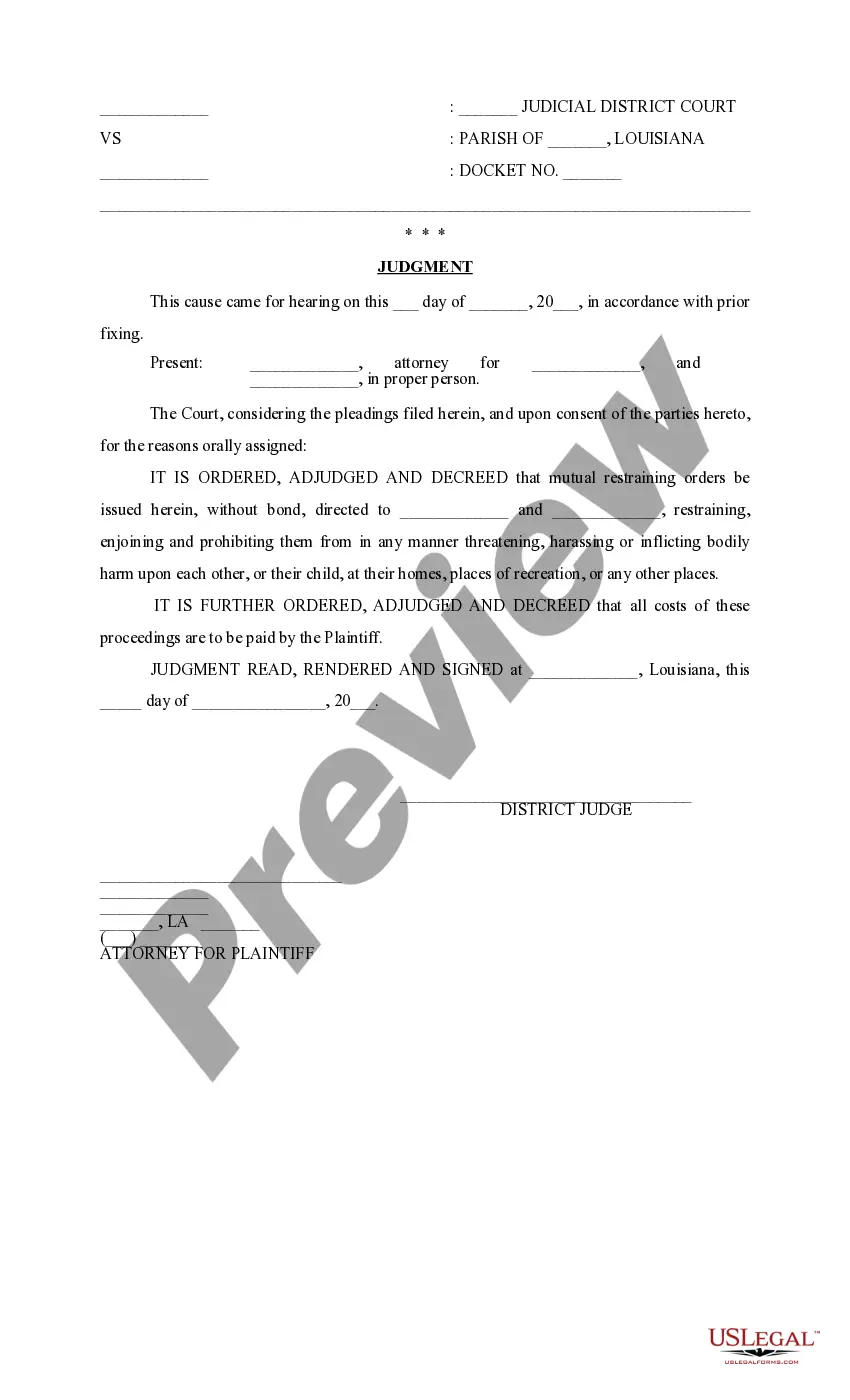

This due diligence workform is used to review property information and title commitments and policies in business transactions.

Nevada Fee Interest Workform

Description

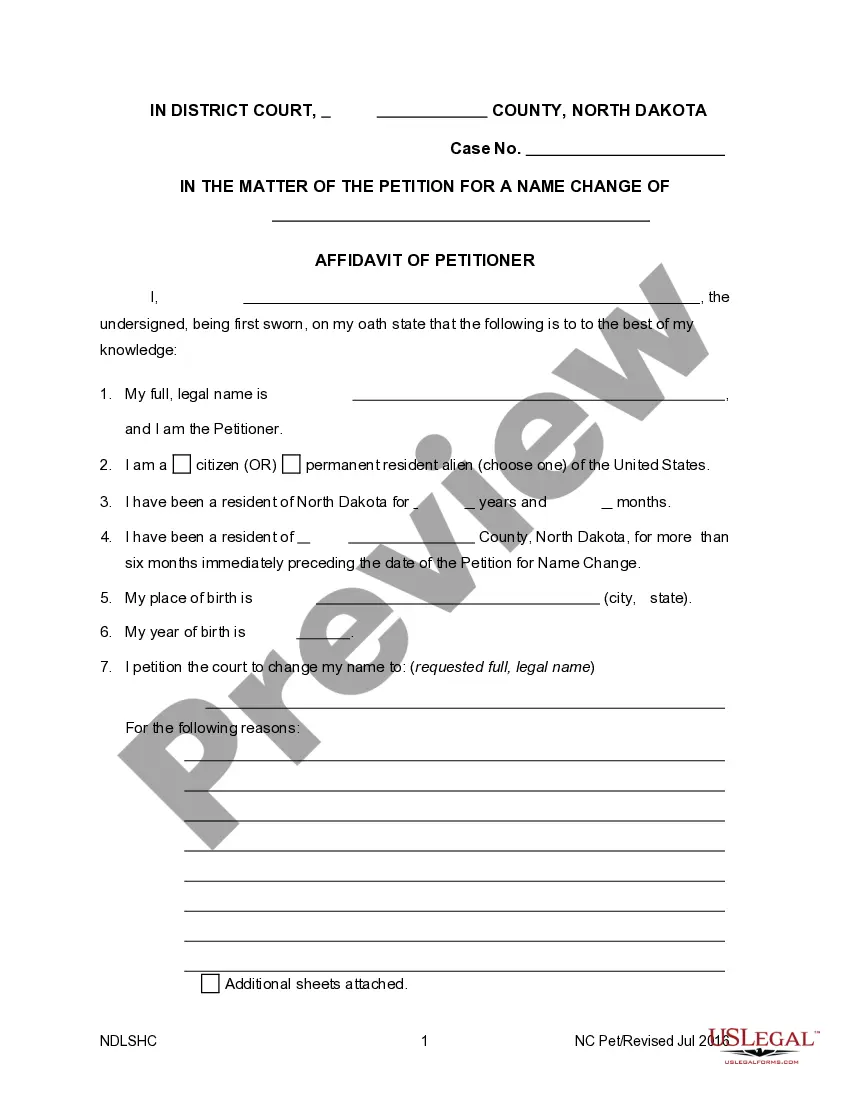

How to fill out Fee Interest Workform?

Locating the appropriate legal document template may present challenges. Of course, there are numerous designs accessible online, but how will you secure the legal form you need? Visit the US Legal Forms website. The service offers thousands of templates, including the Nevada Fee Interest Workform, which can be utilized for both business and personal purposes.

All templates are vetted by professionals and comply with state and federal regulations. If you are already a member, Log In to your account and click the Obtain button to retrieve the Nevada Fee Interest Workform. Use your account to search for the legal documents you have previously ordered. Go to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, make sure you have selected the correct form for your city/state. You may browse the form using the Review option and read the form description to confirm this is the right one for you.

US Legal Forms is the largest collection of legal documents where you can discover various document templates. Utilize the service to download professionally crafted papers that adhere to state requirements.

- If the form does not satisfy your needs, utilize the Search box to locate the correct form.

- Once you are sure that the form is accurate, click the Acquire now button to obtain the form.

- Select the pricing plan you would like and enter the required details.

- Create your account and complete the payment using your PayPal account or credit card.

- Choose the document format and download the legal document template to your device.

- Complete, edit, print, and sign the downloaded Nevada Fee Interest Workform.

Form popularity

FAQ

Fees are generally not subject to taxation in Nevada unless they directly relate to goods or taxable services. It is important to distinguish the context of the fees in question. Using resources like the Nevada Fee Interest Workform can assist you in understanding your specific tax responsibilities.

Typically, fees are not taxed unless related to taxable goods or services. Clarifying the type of fee and its context is essential to determining tax obligations. Therefore, reviewing the specifics with tools like the Nevada Fee Interest Workform can help ensure correct reporting.

In Nevada, service fees can be taxable based on the service's nature and if it is associated with the sale of goods. Some services are exempt, while others may attract taxes. For comprehensive guidance, consider referring to the Nevada Fee Interest Workform to confirm your obligations regarding service fees.

Service fees may be taxed depending on the nature of the service and local regulations. In some cases, certain services are subject to sales tax, while others are not. Understanding the implications of service fees is crucial, especially when filing relevant forms like the Nevada Fee Interest Workform.

To fill out a Nevada resale certificate, ensure you provide your business details, including name, address, and seller’s permit number. Sign the certificate to verify your intent to resell the products or services. Utilizing the Nevada Fee Interest Workform can help streamline your financial records, aiding in accurate completion of your resale certificate.

Nevada is known for not taxing income, which includes salaries and interest earned. Additionally, there is no inventory tax, or estate tax, making it a business-friendly state. Knowing these details can help you take full advantage of the state's tax structure as you consider using the Nevada Fee Interest Workform.

Filing the Nevada commerce tax requires you to first determine if your business meets the income threshold. Once established, you can access the Nevada Department of Taxation's website to find the necessary forms. The Nevada Fee Interest Workform can be used to help manage relevant financial data while making your filing process smoother.

A C4 assessment evaluates property details documented in the C4 form. This assessment plays a vital role in understanding property value and the legal standing of interests. For those utilizing the Nevada Fee Interest Workform, a C4 assessment can highlight potential issues and ensure all property details align with legal requirements. By conducting such assessments, you enhance your awareness and decision-making when it comes to property transactions.

The C4 form acts as a crucial legal document for anyone involved in property transactions in Nevada. Specifically, it represents the Nevada Fee Interest Workform, which outlines property rights and obligations. Utilizing this form aids property owners in clarifying their rights and responsibilities. With the C4 form, you can navigate the complexities of property law more confidently.

A C4 form is a standardized legal template used primarily in property-related transactions. It is designed to capture essential details regarding property interests, including ownership and legal obligations. By employing the Nevada Fee Interest Workform, users can ensure they complete their property documentation accurately. Using this form simplifies the process and enhances legal compliance.