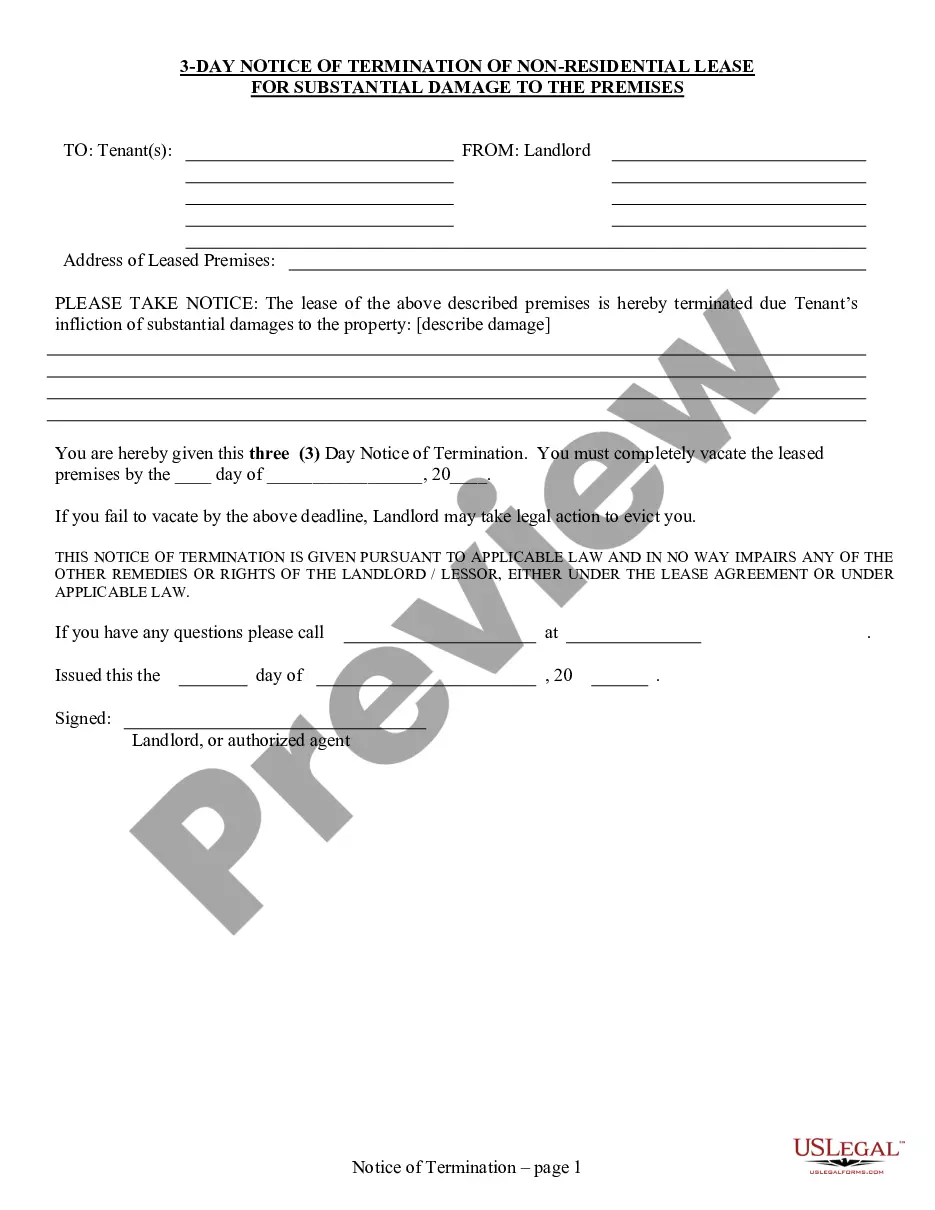

Nevada Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office

Description

How to fill out Notice Of Violation Of Fair Debt Act - Letter To Attorney Generals Office?

It is possible to commit several hours on-line trying to find the legitimate file template that suits the state and federal specifications you require. US Legal Forms offers a huge number of legitimate kinds which are examined by specialists. It is simple to down load or print out the Nevada Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office from your service.

If you already possess a US Legal Forms account, you are able to log in and click on the Download switch. Afterward, you are able to full, modify, print out, or sign the Nevada Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office. Every legitimate file template you purchase is your own permanently. To obtain yet another copy of the obtained type, visit the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms site the first time, follow the straightforward guidelines listed below:

- Very first, ensure that you have chosen the proper file template for the area/area of your choice. Read the type description to make sure you have picked out the correct type. If accessible, utilize the Preview switch to appear through the file template also.

- In order to get yet another variation of your type, utilize the Lookup field to obtain the template that suits you and specifications.

- After you have located the template you need, click on Buy now to continue.

- Choose the pricing program you need, key in your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can use your bank card or PayPal account to cover the legitimate type.

- Choose the structure of your file and down load it in your system.

- Make alterations in your file if possible. It is possible to full, modify and sign and print out Nevada Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office.

Download and print out a huge number of file templates while using US Legal Forms web site, which provides the biggest variety of legitimate kinds. Use expert and state-distinct templates to take on your organization or individual demands.

Form popularity

FAQ

With regards to the debt collection agency, you will need to respond to their letters or phone calls. Written communication is the wisest idea in this situation, and make sure to keep copies of any correspondence.

If you're not sure that the debt is yours, write the debt collector and dispute the debt or ask for more information. If the debt is yours, don't worry. Decide on the total amount you are willing to pay to settle the entire debt and negotiate with the debt collector for the rest to be forgiven.

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.

Responding to a debt collection letter depends on the type of debt your creditors are claiming you owe. If you feel the amount of the proposed debt is correct and you can afford to pay it, do so. This will be a sufficient form of response and should halt any collection activity.

If you receive a letter of claim and do not reply within 30 days, or you do not follow the pre-action protocol in any other way, the creditor can ask the court to increase the debt. They do not have to do this and are unlikely to do so if you agree you owe the money.

Responding to a debt collection letter depends on the type of debt your creditors are claiming you owe. If you feel the amount of the proposed debt is correct and you can afford to pay it, do so. This will be a sufficient form of response and should halt any collection activity.

Once you receive the validation information or notice from the debt collector during or after your initial communication with them, you have 30 days to dispute all or part of the debt, if you don't believe that you owe it. If you receive a validation notice, the end date of the 30-day period will be specified.

Consumers have 30 days from the initial communication about the debt (for example, the first letter received explaining the debt is in collections) to call the collector and ask for the debt to be verified in writing. The collector must return your request before it can start trying to collect the debt again.