Nevada Disclosure of Compensation of Attorney for Debtor - B 203

Description

How to fill out Disclosure Of Compensation Of Attorney For Debtor - B 203?

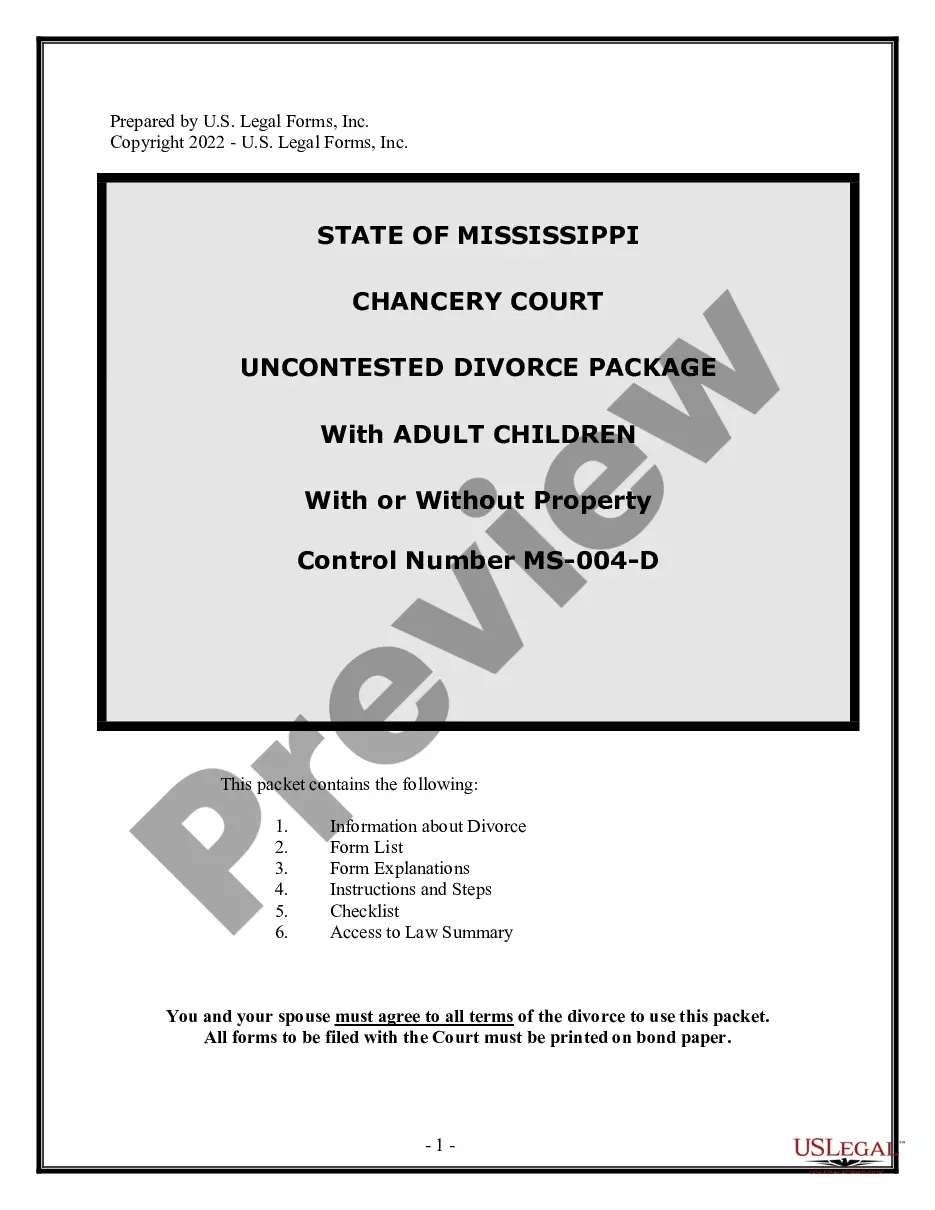

Choosing the right legal papers web template might be a struggle. Naturally, there are plenty of themes available online, but how would you find the legal type you will need? Take advantage of the US Legal Forms web site. The services gives 1000s of themes, such as the Nevada Disclosure of Compensation of Attorney for Debtor - B 203, which you can use for organization and personal demands. All of the kinds are examined by experts and meet federal and state needs.

When you are presently registered, log in to your profile and click the Obtain button to find the Nevada Disclosure of Compensation of Attorney for Debtor - B 203. Make use of your profile to look through the legal kinds you may have purchased previously. Go to the My Forms tab of your respective profile and obtain yet another version of your papers you will need.

When you are a brand new customer of US Legal Forms, listed here are basic recommendations that you should stick to:

- Very first, make sure you have selected the correct type to your town/region. You can check out the shape while using Review button and read the shape explanation to guarantee this is basically the right one for you.

- In the event the type is not going to meet your requirements, use the Seach field to find the right type.

- When you are certain that the shape is acceptable, go through the Get now button to find the type.

- Opt for the rates program you need and enter in the needed details. Design your profile and pay for the order utilizing your PayPal profile or Visa or Mastercard.

- Opt for the document formatting and obtain the legal papers web template to your system.

- Full, change and produce and indicator the attained Nevada Disclosure of Compensation of Attorney for Debtor - B 203.

US Legal Forms is the largest catalogue of legal kinds where you can discover various papers themes. Take advantage of the company to obtain expertly-produced files that stick to condition needs.

Form popularity

FAQ

Background. A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

The correct order of payment of claims from the debtor's estate would be: secured claims, priority claims, unsecured claims.

Chapter 13 and debt Firstly, all Chapter 13 payment plans must repay all priority claims and administrative expenses in full. These types of debts include taxes, child support, alimony, attorneys' fees and court costs.

In Chapter 13 bankruptcy, you propose a creditor repayment plan that lasts between three and five years. The plan length will depend on two factors: your monthly income, and. how much time you need to pay the required amount.

It's a Long Term Commitment ? Filing Chapter 13 bankruptcy requires you to make a long-term commitment to the process. Tough To Get Credit or a Mortgage for 7 Years ? Other impacts include the inability to get credit cards at a good rate, and filing Chapter 13 makes it tough to get a mortgage.