Nevada Wage Withholding Authorization

Description

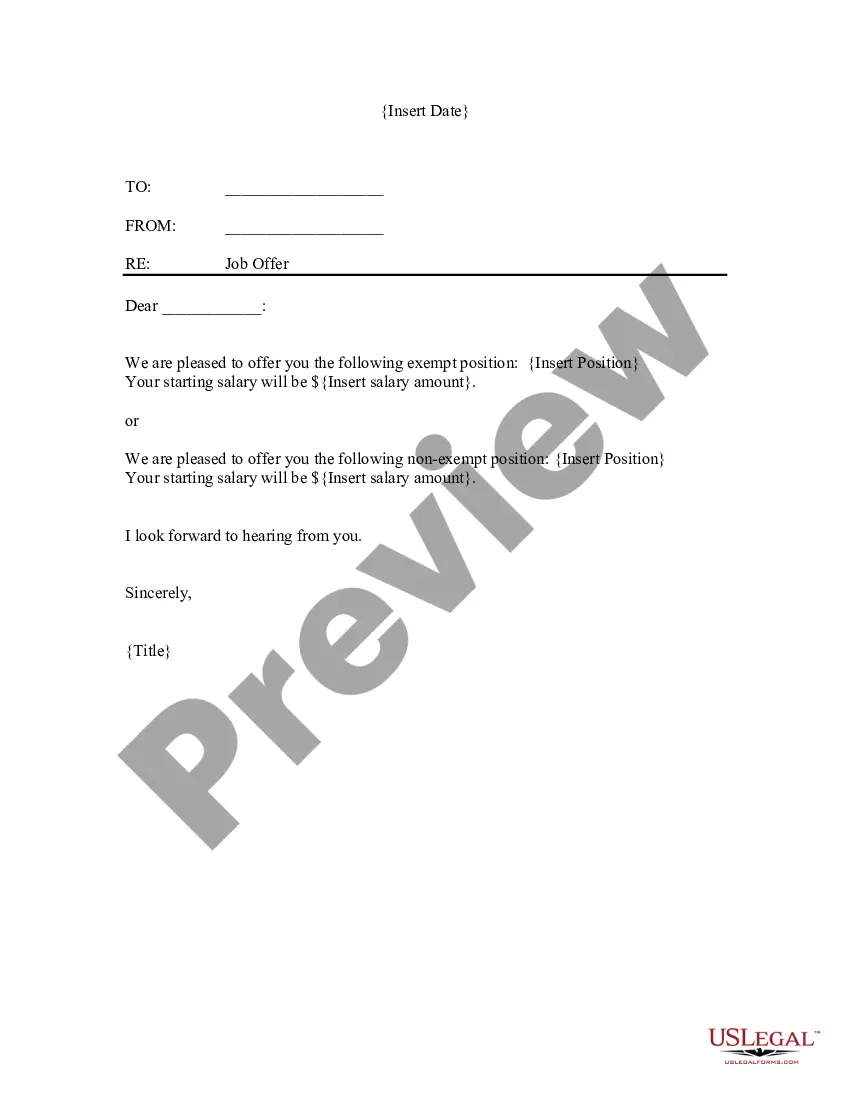

How to fill out Wage Withholding Authorization?

If you wish to compile, acquire, or generate legal document templates, utilize US Legal Forms, the largest collection of legal templates accessible online.

Employ the site’s straightforward and user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Each legal document template you purchase is yours indefinitely. You can access every form you downloaded within your account.

Click on the My documents section and select a form to print or download again. Stay competitive and secure, and print the Nevada Wage Withholding Authorization with US Legal Forms. Numerous professional and state-specific forms are available for your business or personal needs.

- Utilize US Legal Forms to find the Nevada Wage Withholding Authorization in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to obtain the Nevada Wage Withholding Authorization.

- You can also access forms you've previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct region/state.

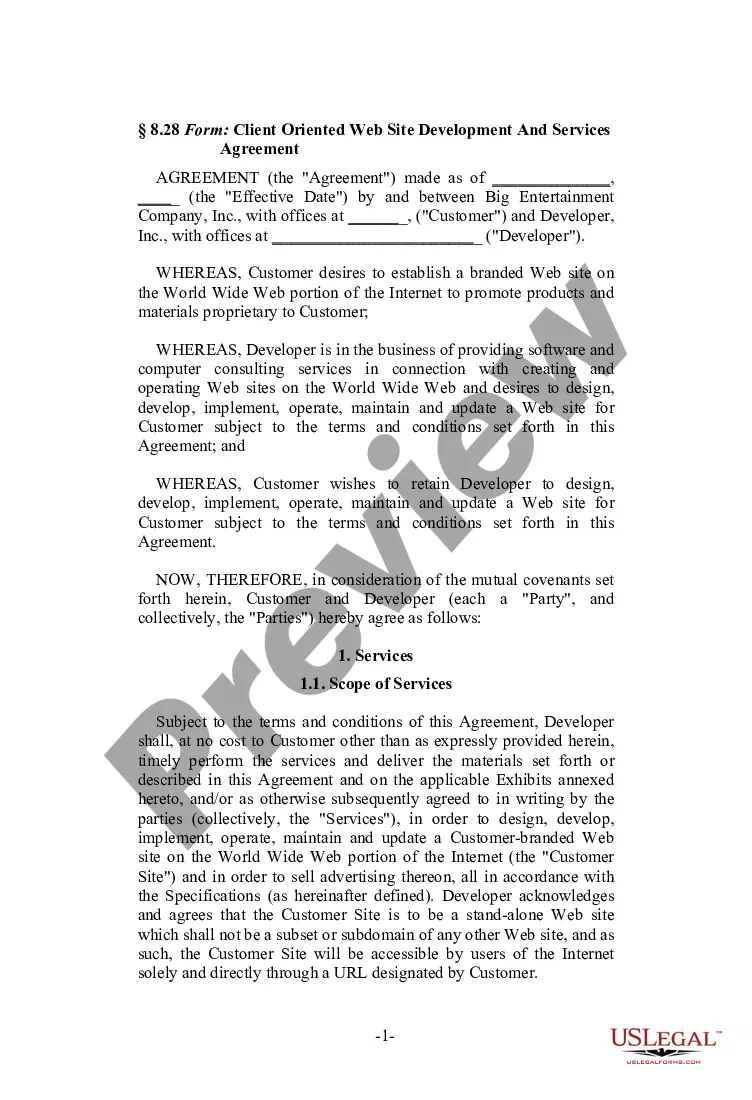

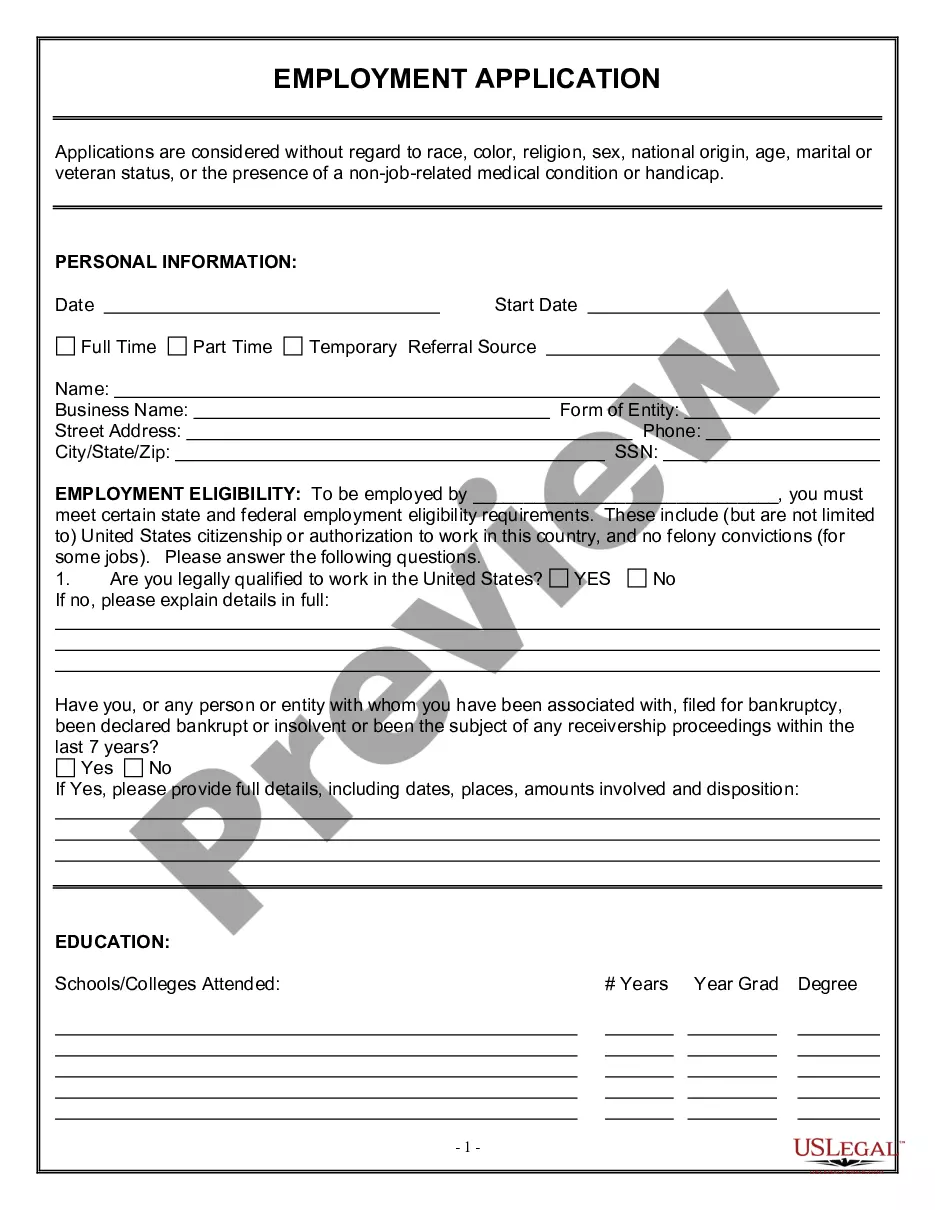

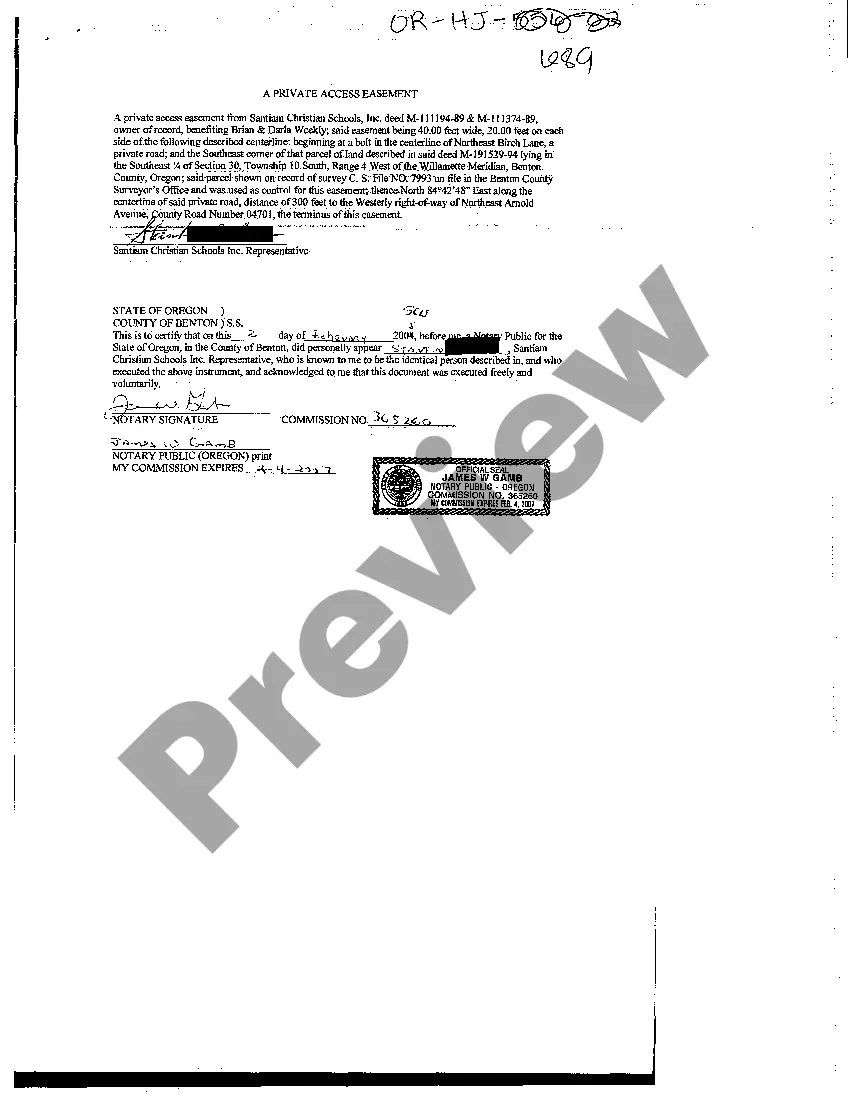

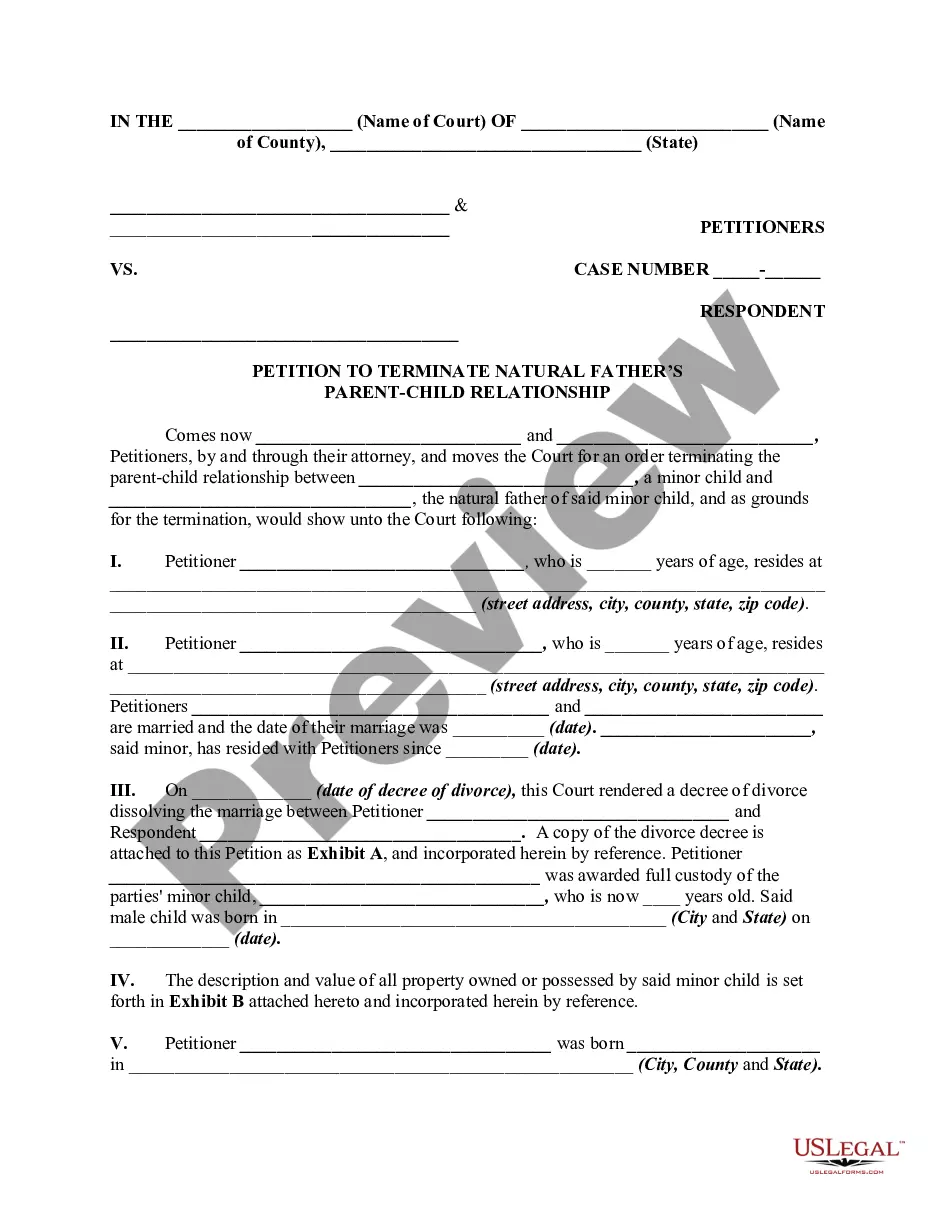

- Step 2. Use the Preview option to review the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Nevada Wage Withholding Authorization.

Form popularity

FAQ

Several states, including Florida, Texas, and Washington, do not impose state-level income taxes, which means they do not require state withholding. If you're considering employment or business operations in these states, understanding their tax obligations, such as Nevada Wage Withholding Authorization, can greatly benefit your planning. Always check local regulations to confirm your obligations.

If your employer fails to pay you on time, you can collect a penalty of one day's wages for every day your paycheck is late, up to 30 days.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

What Is a Wage Deduction Authorization Agreement? A wage deduction authorization agreement is a legal document that permits youthe employerto deduct the agreed-upon amount from an employee's salary. The reasons for the salary reduction vary.

This final paycheck should include all the wages and any other compensation that the employee has earned since the most recent paycheck. The employer may withhold a portion of the wages only for tax purposes and/or for reasons the employee agreed to (such as a corporate savings plan).

Mandatory deductions: Federal and state income tax, FICA taxes, and wage garnishments. Post-tax deductions: Garnishments, Roth IRA retirement plans and charitable donations. Voluntary deductions: Life insurance, job-related expenses and retirement plans.

In Nevada, at least two types of wage assignments are illegal: assignments given as security for loans (NV Rev. Stat. Sec. 675.340) and those made by an employee who has not satisfied a court order to repay a debt (NV Rev.

If the employee has breached their employment contract, the employer is legally allowed to withhold payment. This includes going on strike, choosing to work to rule, or deducting overpayment.

A.) If the employee quits employment, they must receive their final wages within 7 days or by the next regular pay day, whichever is earlier. If the employee is discharged, they must receive their final wages within 3 days (Nevada Revised Statutes 680.020-NRS 608.040).

If the employee has breached their employment contract, the employer is legally allowed to withhold payment. This includes going on strike, choosing to work to rule, or deducting overpayment.