Nevada Resolution of Meeting of LLC Members to Dissolve the Company

Description

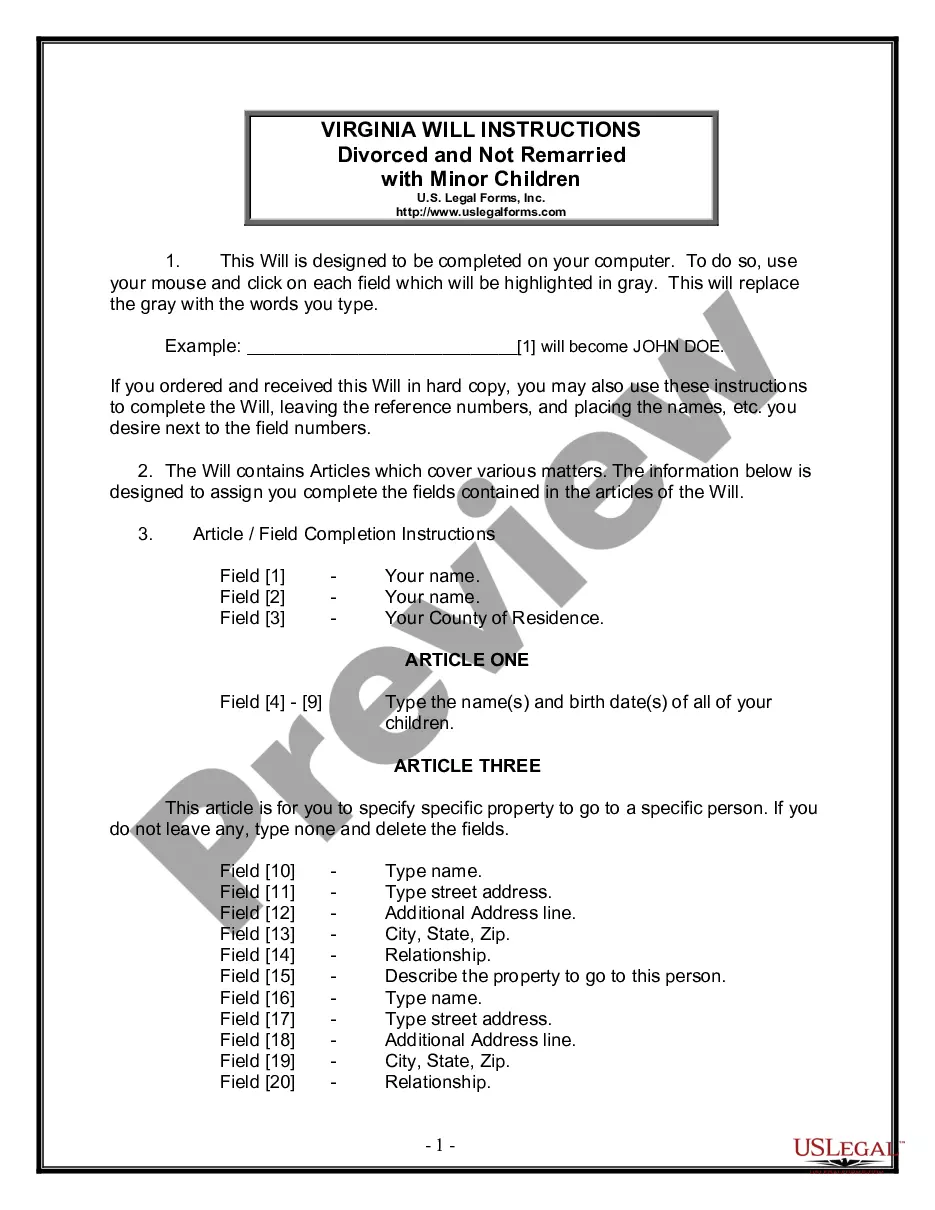

How to fill out Resolution Of Meeting Of LLC Members To Dissolve The Company?

If you seek to be thorough, obtain, or print authentic document templates, utilize US Legal Forms, the largest selection of legal documents that are accessible online.

Take advantage of the website's user-friendly and convenient search feature to find the forms you require.

Various templates for business and personal purposes are categorized by groups, states, or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

- Use US Legal Forms to find the Nevada Resolution of Meeting of LLC Members to Dissolve the Company with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Nevada Resolution of Meeting of LLC Members to Dissolve the Company.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse the content of the form. Remember to read the details.

Form popularity

FAQ

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets. Note that only those assets your company owns can be liquidated. Thus, you can't liquidate assets that are used as collateral for loans.

To dissolve your domestic LLC in Nevada, you must provide the completed Articles of Dissolution For a Nevada limited liability company and Customer Order Instructions forms to the Secretary of State by mail, fax, email or in person, along with the filing fee.

The process for dissolving Nevada LLC will take 7-10 business days from the day you file the proper documents. You can speed up the processing by requesting 24 hour, 2 hour or 1 hour processing although there will be a higher fee for the same.

A shareholder resolution to dissolve corporation agreement is an authorization used when shareholders, during a formal meeting, agree to dissolve the corporation.

How do you dissolve a Nevada limited liability company? To dissolve your domestic LLC in Nevada, you must provide the completed Articles of Dissolution For a Nevada limited liability company and Customer Order Instructions forms to the Secretary of State by mail, fax, email or in person, along with the filing fee.

To dissolve an LLC in Nevada, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Nevada LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

There is a $100 fee to file the articles of dissolution. The document should be processed within about one week. You can pay additional fees for expedited processing. Nevada does not require you to obtain tax clearance from the Department of Texation in order to dissolve your LLC.