Nevada Checklist for Developing Service Standards

Description

How to fill out Checklist For Developing Service Standards?

If you need to compile, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly search to find the documents you require.

Many templates for corporate and personal purposes are categorized by sections and states, or keywords.

Every legal document template you acquire is yours indefinitely.

You will have access to all forms you have downloaded within your account. Navigate to the My documents section and select a form to print or download again.

- Use US Legal Forms to access the Nevada Checklist for Establishing Service Standards with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Nevada Checklist for Establishing Service Standards.

- You can also find forms you have previously downloaded in the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

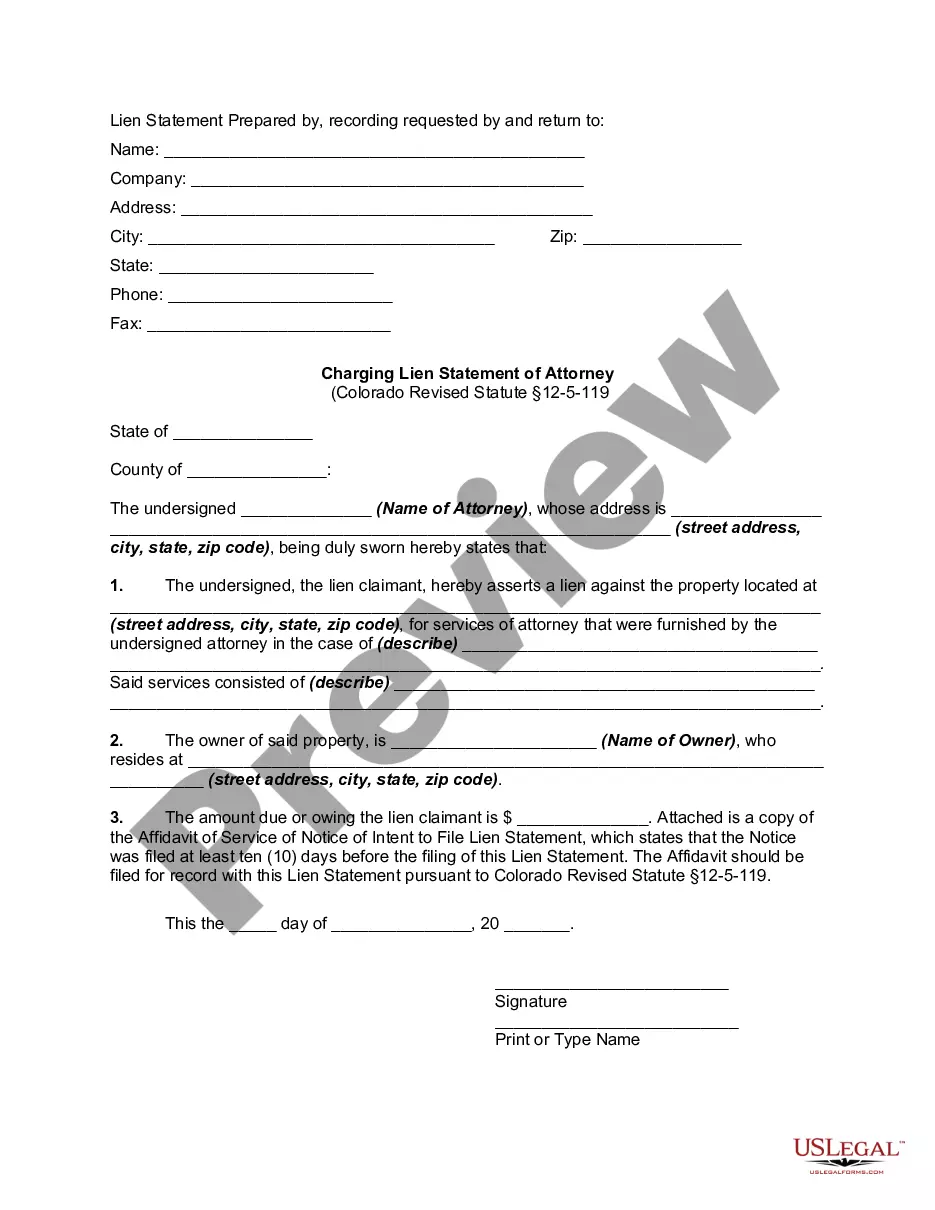

- Step 2. Utilize the Preview option to review the contents of the form. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative legal form templates.

- Step 4. Once you have found the form you need, click the Buy Now button. Choose the pricing plan you prefer and enter your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Nevada Checklist for Establishing Service Standards.

Form popularity

FAQ

An S corporation is required to file several important forms, including Form 2553 to elect S corp status and the annual tax return Form 1120S. Additionally, depending on your business’s operations, you may need to file various state-level forms as required by Nevada regulations. Following the Nevada Checklist for Developing Service Standards will keep you organized and help you stay compliant. Consider uslegalforms to access the necessary forms and additional support.

To amend your Articles of Organization in Nevada, you must file an amendment form with the Secretary of State. This form should outline the specific changes you are making to your organization. Additionally, reviewing the Nevada Checklist for Developing Service Standards can help ensure that you include all required information. If you need support throughout the amendment process, uslegalforms offers templates and guidance to simplify your task.

Establishing an S Corporation in Nevada involves several steps. First, you must choose a unique business name and file the Articles of Incorporation with the state. After that, complete and submit IRS Form 2553 to obtain S corp status. For a smooth process, utilize the Nevada Checklist for Developing Service Standards and consider resources like uslegalforms to gather all necessary forms and instructions.

To file for an S Corporation in Nevada, you need Articles of Incorporation, which require basic information about your business. Additionally, you will need to prepare Form 2553 to elect S Corporation status with the IRS. Following the Nevada Checklist for Developing Service Standards ensures that you include all necessary details and maximize your compliance with state laws. If you find this process overwhelming, consider using uslegalforms for clear instructions and form templates.

Yes, you can file for an S corporation yourself, but it requires careful attention to detail. You will need to complete and submit specific forms to the Nevada Secretary of State, including the Articles of Incorporation and Form 2553 for S corp election. Utilizing resources like the Nevada Checklist for Developing Service Standards can help streamline this process and prevent errors. However, many people choose to work with professionals to ensure all requirements are met accurately.

To do business in Nevada, you must register your business entity with the state. This includes obtaining a business license and selecting an appropriate business structure, such as an LLC or corporation. Additionally, consider reviewing the Nevada Checklist for Developing Service Standards to ensure compliance with local regulations and fees. Using uslegalforms can simplify the registration process by providing necessary forms and guidance.