Nevada Business Start-up Checklist

Description

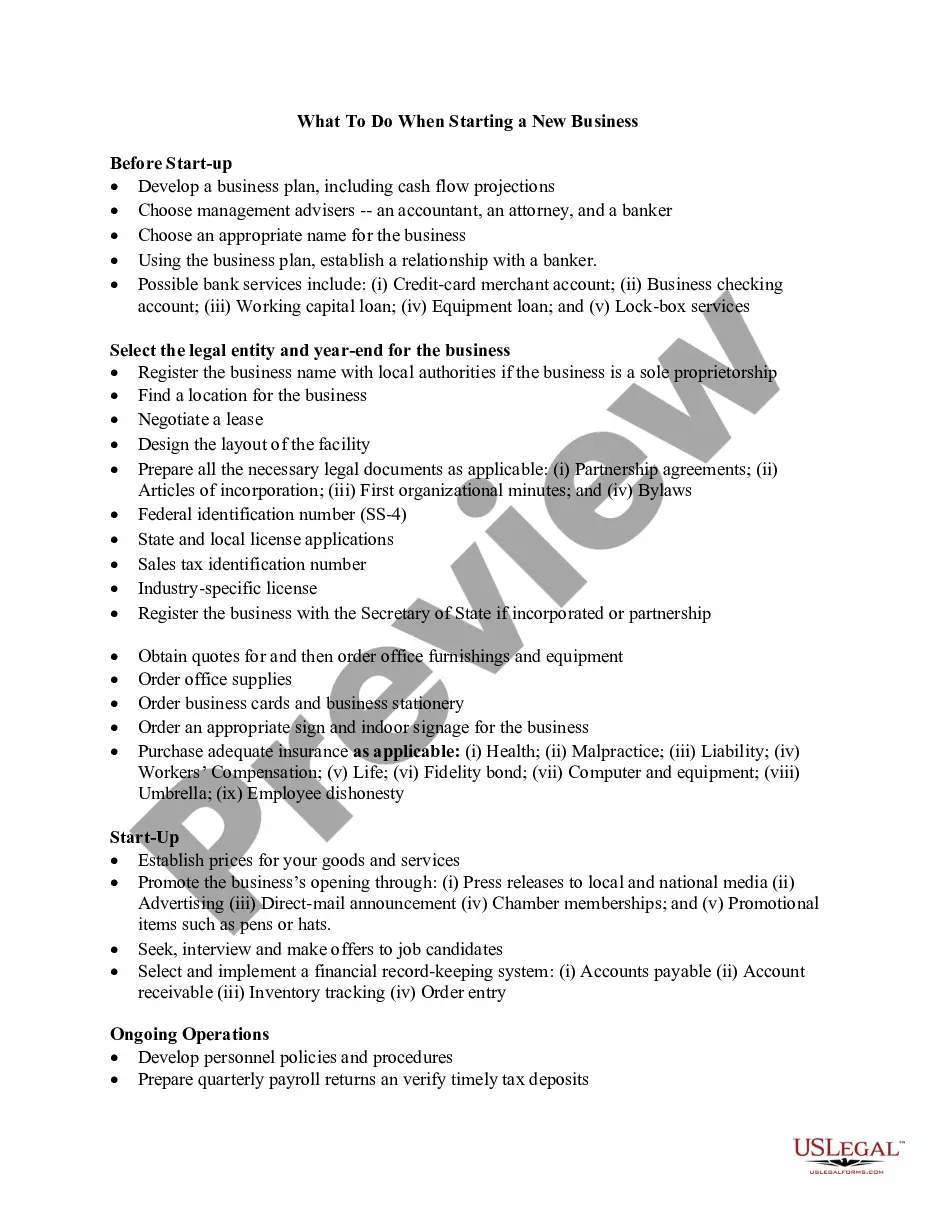

How to fill out Business Start-up Checklist?

Are you in a situation where you need to have documents for either business or personal reasons almost every day.

There are many legal document templates accessible online, but finding forms you can trust is not easy.

US Legal Forms offers thousands of document templates, including the Nevada Business Start-up Checklist, that are designed to fulfill federal and state regulations.

Once you find the correct form, click Buy now.

Select the pricing plan you prefer, provide the required information to create your account, and complete your purchase using PayPal or credit card. Choose a convenient document format and download your copy. You can find all the document templates you have purchased in the My documents section. You can download an additional copy of the Nevada Business Start-up Checklist at any time, if needed. Just select the required form to download or print the template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid errors. The service offers properly prepared legal document templates that can be utilized for various purposes. Create a free account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nevada Business Start-up Checklist template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct region/state.

- Use the Preview button to check the document.

- Read the description to ensure you have selected the correct form.

- If the document is not what you're looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

All businesses operating in Nevada must obtain a State Business License issued by the Nevada Secretary of State. The license is renewable annually. You may apply online or obtain the forms from their website ( ).

Business Plan. Almost every business needs a little funding to get started.Partnership Agreement.LLC Operating Agreement.Buy/Sell Agreement.Employment Agreement.Employee Handbook.Non-Disclosure Agreement.Non-Compete Agreement.More items...

The State Business License Fee is $500 for Corporations, and $200 for all other business types. The State Business License must be renewed annually. For entities that are formed under NRS Title 7, the business license fee is due at the time an Initial List of Officers or Annual List of Officers is due.

Here are the main steps for starting a business in Nevada.Choose a Business Structure.Name Your Business.Designate a Registered Agent.Find a Business Location.Register Your Business.Obtain an EIN.Open a Business Bank Account.Seek Funding for Your Business.More items...?

Las Vegas is also one of the most tax-friendly cities in the country. There is no business income tax, personal income tax, franchise tax or gift tax. Wages are lower than the national average as well, making it cheaper to hire labor.

It's also a great place to own a business, thanks to numerous tax breaks, a robust economy and a low cost of living. While most people might think of the state of Nevada as being nothing more than mile after mile of cacti and desert, it's actually an incredibly compelling proposition for companies.

It is a business-friendly state with a very low-regulation environment, a streamlined licensing and approval processes, and a favorable tax environment for business and industry. A state with the workforce development, education and infrastructure in place to support our economic development.

Nevada offers a wide range of benefits as a state of incorporation, including its ease of registration, relatively low corporate taxes and lack of state taxes. Nevada also offers strong privacy protections to business owners and a business-friendly environment.

The State Business License Fee is $500 for Corporations, and $200 for all other business types. The State Business License must be renewed annually. For entities that are formed under NRS Title 7, the business license fee is due at the time an Initial List of Officers or Annual List of Officers is due.