Nevada Business Deductions Checklist

Description

How to fill out Business Deductions Checklist?

If you want to be thorough, download, or create valid document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site’s straightforward and convenient search to locate the documents you need. Various templates for business and personal purposes are categorized by groups and states, or keywords.

Use US Legal Forms to find the Nevada Business Deductions Checklist with just a few clicks.

Every legal document template you acquire is yours permanently. You have access to every form you have purchased in your account. Click the My documents section and select a form to print or download again.

Complete and download, and print the Nevada Business Deductions Checklist with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Nevada Business Deductions Checklist.

- You can also access forms you previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

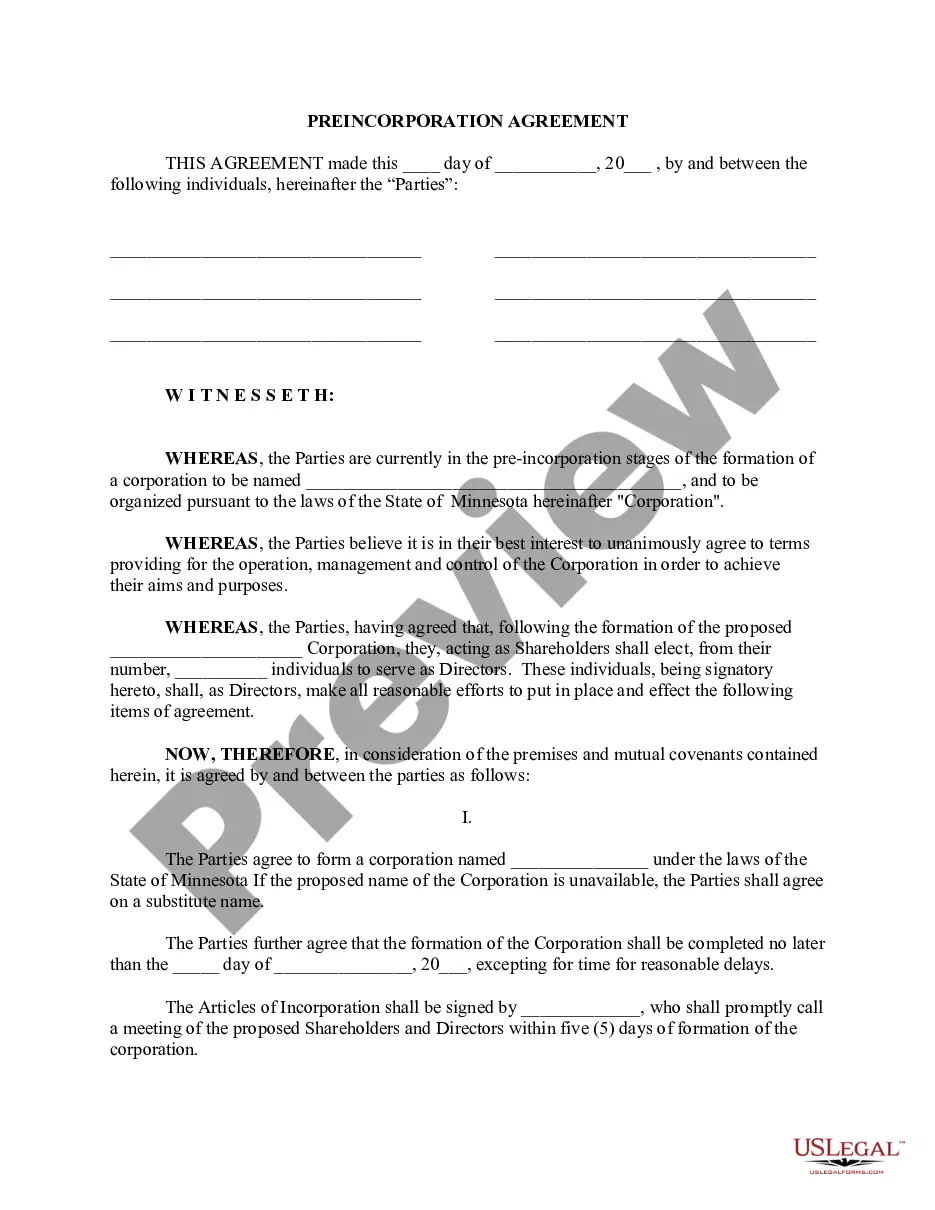

- Step 2. Use the Preview option to review the contents of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have identified the form you need, click on the Purchase now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the purchase process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Nevada Business Deductions Checklist.

Form popularity

FAQ

To acquire your Nevada MBT number, you must register your business with the Nevada Department of Taxation. This registration process can typically be completed online, making it simple and direct. Once registered, keep your MBT number handy as it is vital for filing taxes and refers back to your Nevada Business Deductions Checklist.

You can obtain your Nevada employer account number by registering with the Nevada Department of Employment, Training and Rehabilitation (DETR). This process can also be done online for convenience. This number is crucial for managing employee information and tax deductions, which can be organized using your Nevada Business Deductions Checklist.

To get your MBT number in Nevada, you must register your business with the Nevada Department of Taxation. This process can be completed online through their official website. After completing the registration, you will receive your MBT number, which is essential for tax purposes and aligns with your Nevada Business Deductions Checklist.

Businesses structured as sole proprietorships, partnerships, S corporations, and certain trusts may qualify for a 20% pass-through deduction. To ensure you meet all criteria, refer to the Nevada Business Deductions Checklist. These deductions can significantly reduce your taxable income, making it vital to understand your eligibility.

Yes, you need proof to write off business expenses. Acceptable documentation includes receipts, invoices, and bank statements that verify the expenses. Using a Nevada Business Deductions Checklist can help you keep your records organized and ensure you have sufficient proof for each deduction you wish to claim.

To obtain a business deduction, you must identify eligible expenses related to your business activities. Common deductible expenses include costs for supplies, travel, and advertising. Keep track of your expenses throughout the year using a Nevada Business Deductions Checklist to ensure you do not miss any potential deductions come tax time.

Some expenses are fully deductible, such as business-related meals, travel costs, and office supplies. However, the expenses must be necessary and directly related to your business activities. The Nevada Business Deductions Checklist will help you identify which expenses qualify for full deduction. Utilizing tools and resources from USLegalForms can simplify your understanding of deductible expenses, ultimately benefiting your bottom line.

Filling out a Schedule C to report business income requires you to provide detailed information about your gross income and expenses. Start by listing all income sources, then categorize your expenses according to the guidelines outlined in the Nevada Business Deductions Checklist. It is essential to maintain accurate records throughout the year to simplify this process. If you need assistance, consider using resources from USLegalForms for thorough guidance.

Yes, you can write off your cell phone bill if you use it for business purposes. It is important to keep detailed records of your business-related calls and the percentage of personal use. Including this information in your Nevada Business Deductions Checklist can help you accurately deduct the appropriate portion of your bill. Using a platform like USLegalForms can guide you through the documentation process.

To deduct business expenses, you first need to identify which costs are related to your business operations. Common deductions include office supplies, travel expenses, and utility bills. You will document these expenses on your tax return, specifically on the Nevada Business Deductions Checklist, which helps ensure you don't miss any deductible items. Remember, proper documentation is key to maximizing your deductions.