Nevada Sample Letter for Return Authorization

Description

How to fill out Sample Letter For Return Authorization?

It is feasible to spend hours online attempting to locate the legal document template that fulfills the federal and state requirements you need.

US Legal Forms offers a multitude of legal forms that have been reviewed by professionals.

It is easy to obtain or create the Nevada Sample Letter for Return Authorization from the platform.

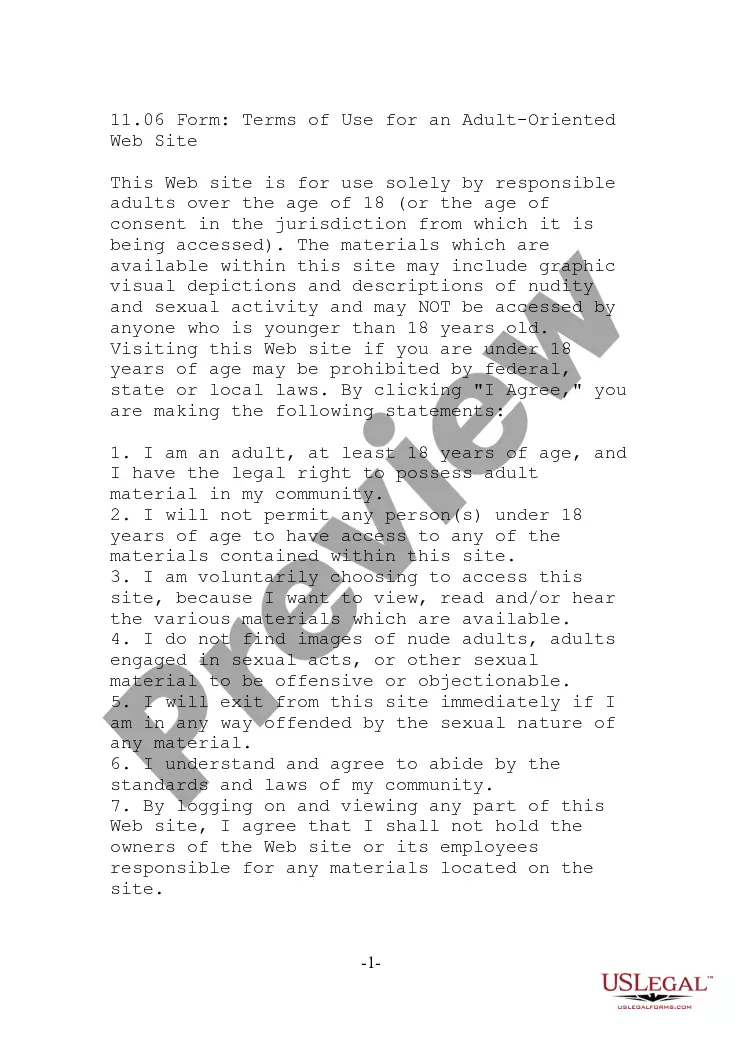

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Nevada Sample Letter for Return Authorization.

- Each legal document template you acquire is yours permanently.

- To obtain another version of the downloaded form, visit the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the straightforward directions below.

- First, ensure that you have selected the correct document template for your state/region of choice.

- Review the form description to confirm you have chosen the appropriate document.

Form popularity

FAQ

The form for power of attorney for taxes is typically Form 2848, which allows you to appoint someone to manage your tax affairs on your behalf. This is essential for ensuring that your tax issues are handled efficiently and effectively. Consider using a Nevada Sample Letter for Return Authorization to ensure that you empower your representative with clear authority.

The 2848 tax form, or Power of Attorney and Declaration of Representative, grants authority to a person to act on your behalf for tax matters before the IRS. This form allows your representative to discuss your account and file documents. When dealing with tax authorities, a Nevada Sample Letter for Return Authorization can enhance your representative's authority.

You can find your Nevada modified business tax number by checking your business registration documents or contacting the Nevada Department of Taxation. Additionally, business owners typically receive this number upon registering for business tax purposes. It's a good idea to keep a Nevada Sample Letter for Return Authorization handy for any necessary clarifications with state authorities.

No, Nevada does not impose a state income tax, which can be a significant advantage for individuals and businesses residing there. This absence of a state income tax can lead to higher disposable income and economic growth. If you're navigating tax-related matters, consider utilizing a Nevada Sample Letter for Return Authorization to manage any required documentation effectively.

A power of attorney is not responsible for filing taxes on behalf of the taxpayer, but can facilitate the process. The designated individual can act on your behalf and assist in preparing and filing tax documents, however, the final responsibility remains with you. Using a Nevada Sample Letter for Return Authorization can clarify the extent of the powers granted.

To send your 2848 form to the IRS, you typically mail it to the address specified for the specific situation outlined on the form itself. Usually, the IRS accepts this form at the designated address for the applicable tax return. Be sure to include a Nevada Sample Letter for Return Authorization if you want to provide further clarification regarding the authority granted.

The power of attorney form for Nevada taxes allows you to designate someone to act on your behalf when dealing with tax matters. This form authorizes your representative to handle your tax concerns, including the submission of documents and communications with the tax authorities. Utilizing a Nevada Sample Letter for Return Authorization can further streamline this process by granting permission for returns and related matters.

You can obtain a Nevada resale certificate by applying through the Nevada Department of Taxation. The application typically requires documentation proving your business operations. To facilitate this process, a Nevada Sample Letter for Return Authorization might be beneficial to provide the necessary context regarding your request.

Generally, you do not need to file a state tax return in Nevada due to the absence of a personal income tax. However, it’s important to check the specific circumstances of your income. If you find yourself in a unique situation or need assistance, consider using a Nevada Sample Letter for Return Authorization to address any filing obligations you might have.

Nevada does not offer tax refunds for personal income tax because it does not collect such tax. However, businesses may be eligible for refunds on other taxes. If you're unsure how this applies to your situation, a Nevada Sample Letter for Return Authorization can help clarify any potential refund inquiries you might have.