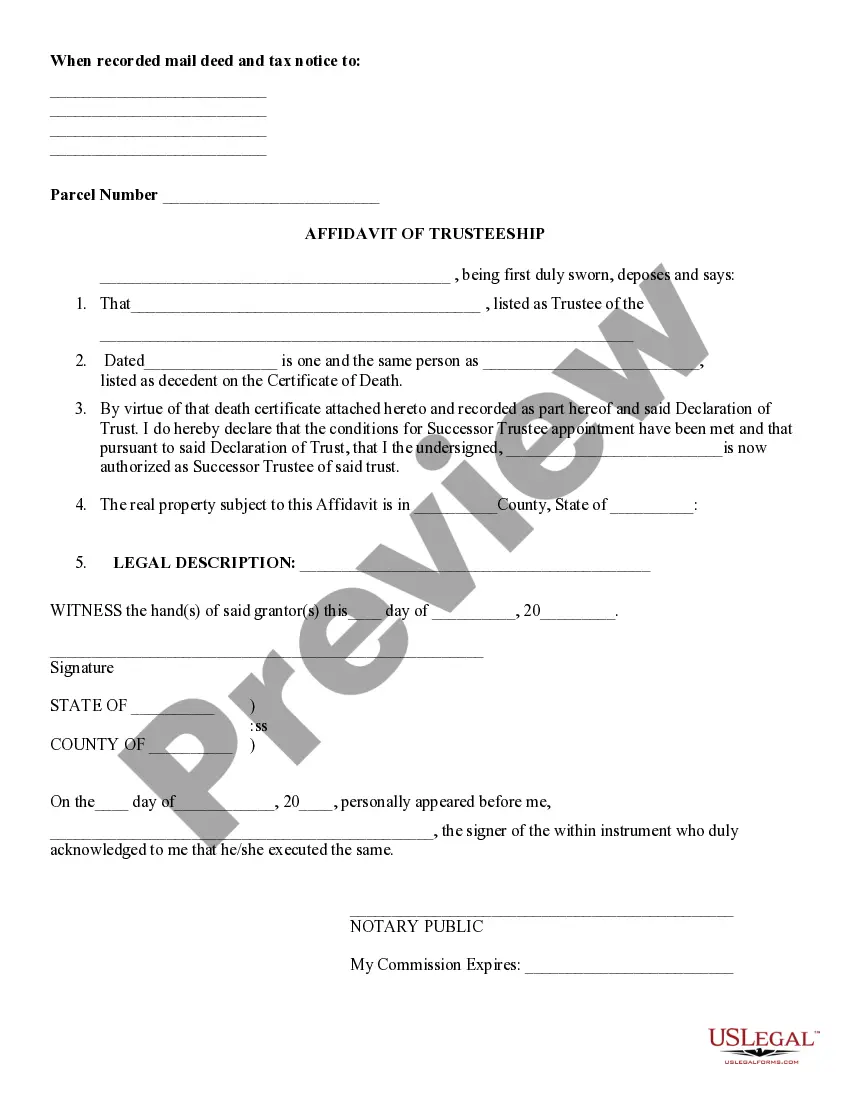

Nevada Certificate of Trust for Successor Trustee

Description

How to fill out Certificate Of Trust For Successor Trustee?

You may commit several hours online searching for the lawful file design which fits the state and federal specifications you want. US Legal Forms offers thousands of lawful forms which are analyzed by professionals. You can actually acquire or produce the Nevada Certificate of Trust for Successor Trustee from the support.

If you have a US Legal Forms bank account, you are able to log in and then click the Download button. Afterward, you are able to comprehensive, change, produce, or indicator the Nevada Certificate of Trust for Successor Trustee. Each lawful file design you get is your own eternally. To have another copy associated with a bought form, proceed to the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms website the first time, keep to the simple recommendations under:

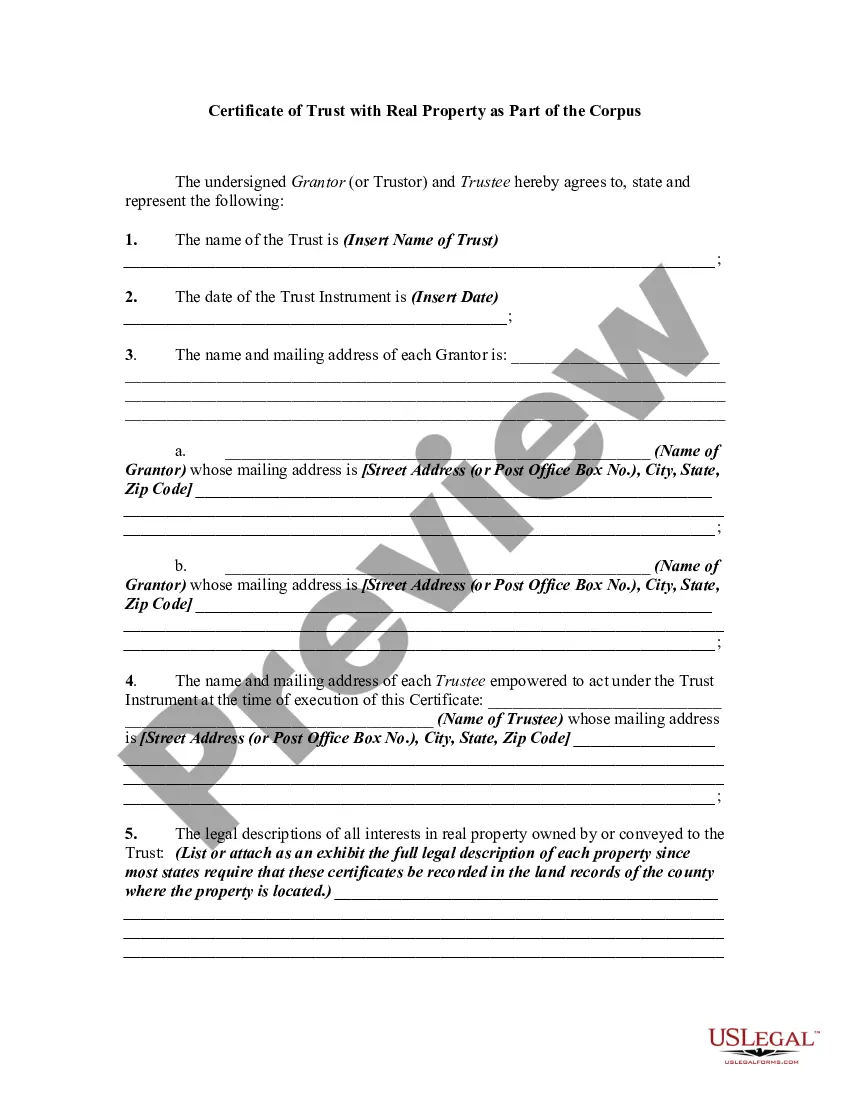

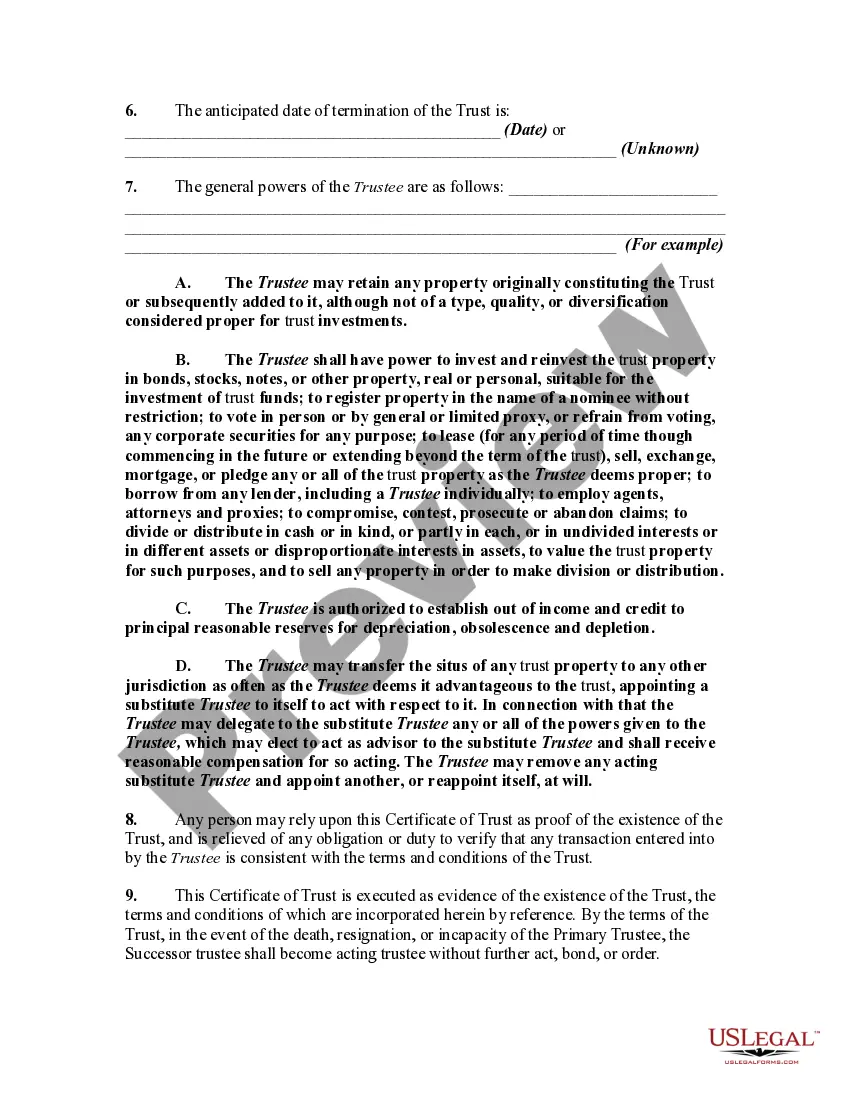

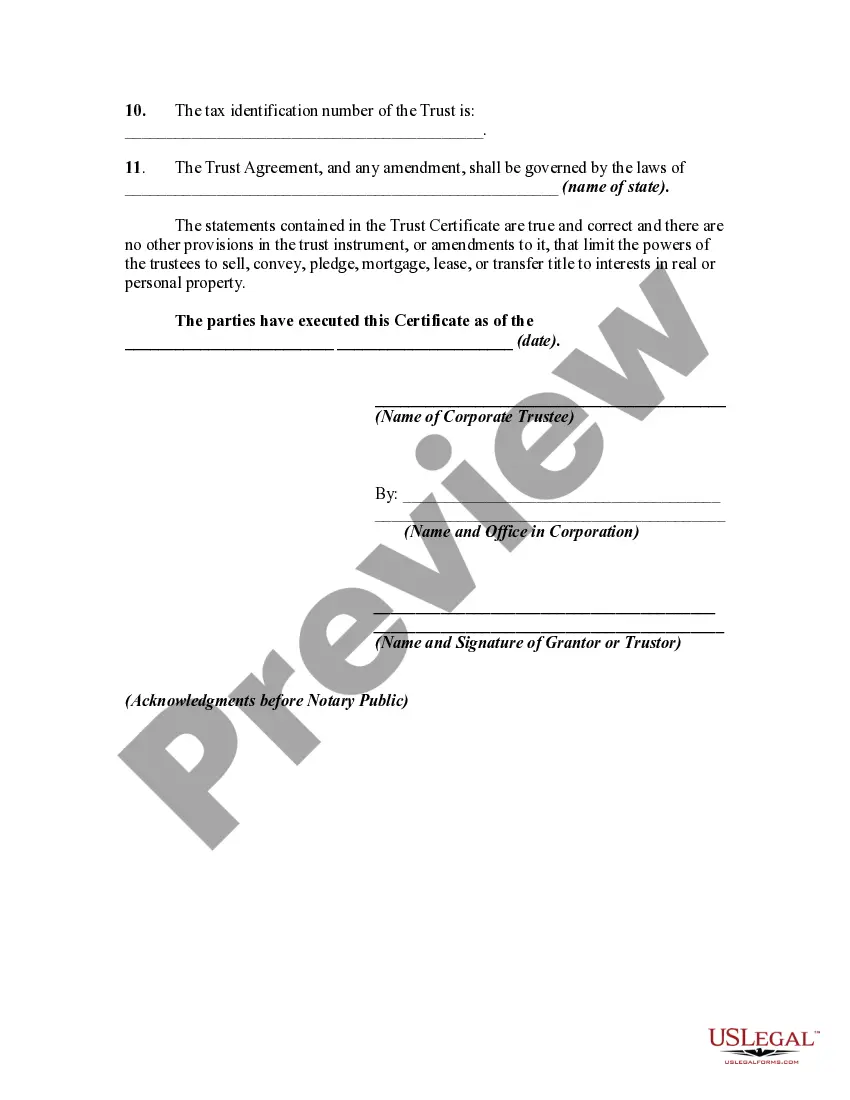

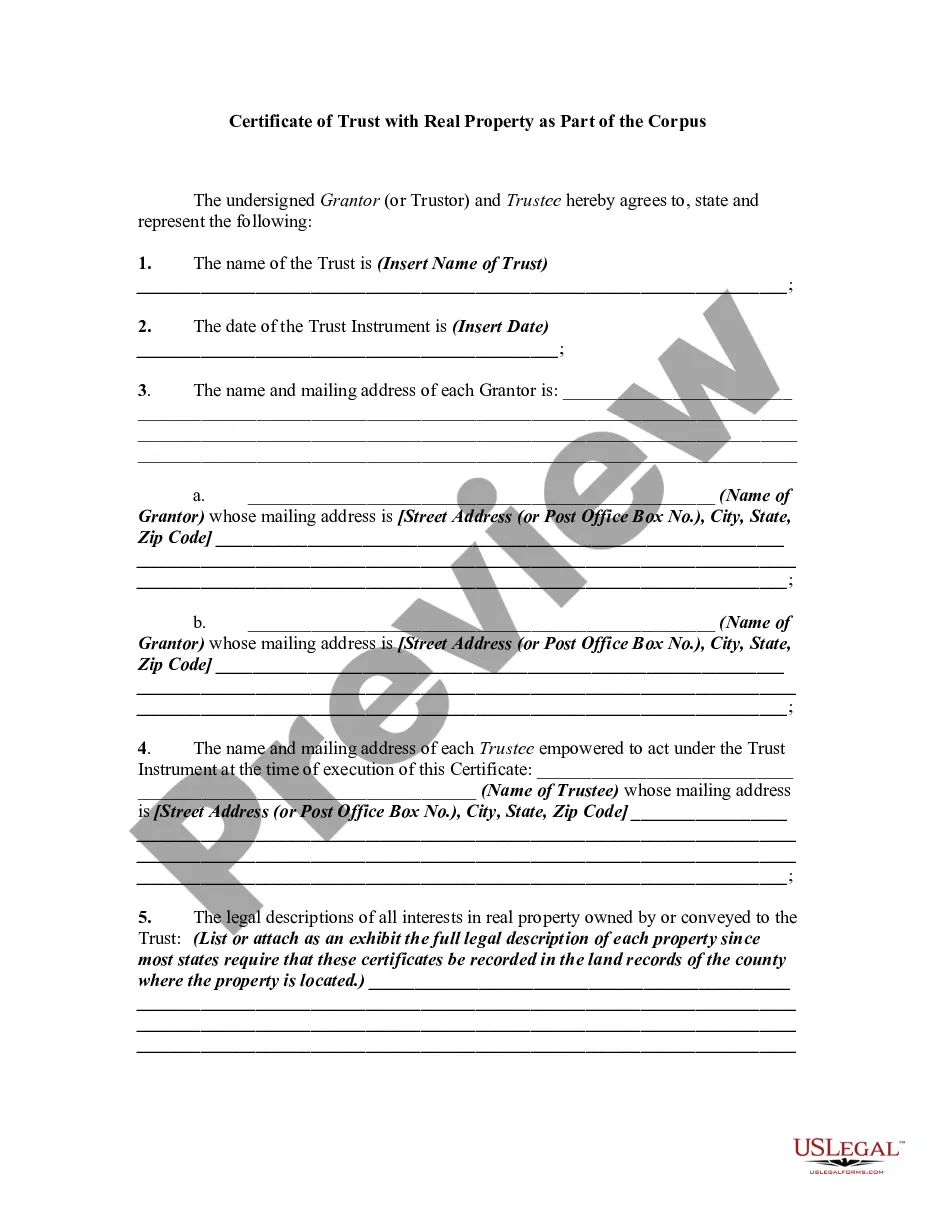

- Initial, be sure that you have chosen the right file design for that area/metropolis of your choice. Browse the form outline to ensure you have selected the appropriate form. If readily available, take advantage of the Review button to search through the file design too.

- In order to discover another model from the form, take advantage of the Look for discipline to obtain the design that fits your needs and specifications.

- After you have located the design you want, just click Get now to carry on.

- Select the pricing prepare you want, type in your accreditations, and sign up for a free account on US Legal Forms.

- Full the transaction. You can utilize your charge card or PayPal bank account to fund the lawful form.

- Select the format from the file and acquire it to the gadget.

- Make alterations to the file if necessary. You may comprehensive, change and indicator and produce Nevada Certificate of Trust for Successor Trustee.

Download and produce thousands of file web templates while using US Legal Forms web site, that provides the greatest selection of lawful forms. Use professional and express-certain web templates to tackle your business or specific demands.

Form popularity

FAQ

Should I Record My Trust? The Clark County, Nevada, Recorder's Office (which serves Las Vegas, Henderson, Boulder City, North Las Vegas, Mesquite among other towns) will accept your trust for filing if you want. It's your choice whether to record the trust or not.

Notice should be mailed to all of at Trust's beneficiaries and other interested parties within ninety (90) days of the Decedent's date of death. Such beneficiaries and other interested parties then have only one hundred twenty (120) days for such mailing to bring an action to contest the validity of the Trust.

To make a living trust in Nevada, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

The notice provided by the trustee must contain: (a) The identity of the settlor of the trust and the date of execution of the trust instrument; (b) The name, mailing address and telephone number of any trustee of the trust; (c) Any provision of the trust instrument which pertains to the beneficiary or notice that the ...

No. Unlike a Will that does need to be filed with the Clerk of Court within a certain amount of days following the passing of the deceased, a trust can allow you to keep personal financial information out of probate.

Privacy is one of the key benefits of a living trust Nevada. A will becomes public record when it goes through probate. A trust does not become public record. Your assets, beneficiaries, and the terms of the trust remain private.

There are three ways to get a certificate of trust made: With a lawyer. An estate planning attorney can draft a certificate of trust for you to accompany your trust. With estate planning software. ... With a state-specific form from a financial institution or notary public.

The big keys you need to make a trust are: Intent to make a trust (California Probate Code section 15201); Mental Capacity to make a trust; A trust must have property (PC 15202) There must be a legal purpose to trust (PC15203) A trust must have a beneficiary (PC 15205)

Under Nevada trust law, any individual may create a legally valid trust where they act as both the settlor and the beneficiary of the trust. The settlor may also serve as the trustee. This allows the settlor to maintain control of the assets held in the trust.

A Nevada certification of trust is a document presented by a trustee, either voluntarily or upon request, to any party conducting business with a trustee. In Nevada, the certificate is codified at NRS 164.410.