Nevada Power of Attorney by Trustee of Trust

Description

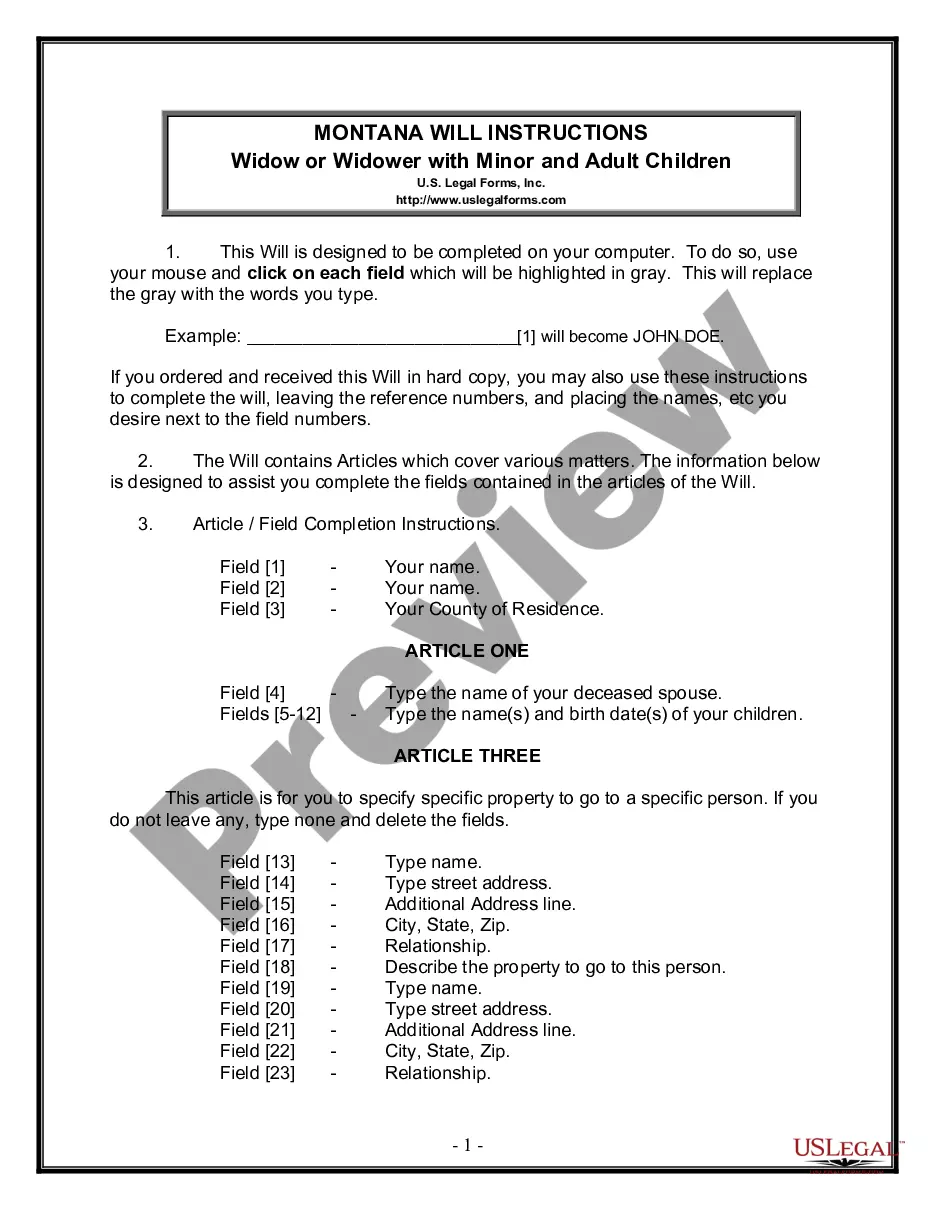

How to fill out Power Of Attorney By Trustee Of Trust?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the site, you will encounter a vast number of forms for both business and personal needs, categorized by types, claims, or keywords. You can find the latest versions of forms like the Nevada Power of Attorney from Trustee of Trust in moments.

If you already have a subscription, Log In and download the Nevada Power of Attorney from Trustee of Trust in the US Legal Forms catalog. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents tab of your account.

Choose the format and download the form to your device.

Edit the form. Complete, modify, and print or sign the downloaded Nevada Power of Attorney by Trustee of Trust. Every template you added to your account does not have an expiration date, meaning it is yours indefinitely. Therefore, if you need to download or print another copy, simply visit the My documents section and click on the form you require. Access the Nevada Power of Attorney by Trustee of Trust with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a wide range of professional and state-specific templates that meet your business or personal needs and requirements.

- If this is your first time using US Legal Forms, here are some simple steps to get started.

- Ensure you have selected the correct form for your area/region. Click the Preview button to check the form's details.

- Review the form information to confirm you have selected the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your information to sign up for an account.

- Process the purchase. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust. Both roles involve duties that are legally required.

1) Duty to Administer Trust Governed by Instrument (Section 16000). 2) Duty of Loyalty to Beneficiaries (Section 16002). 3) Duty to Deal Impartially with Beneficiaries (Section 16003).

The trustee cannot fail to carry out the wishes and intent of the settlor and cannot act in bad faith, fail to represent the best interests of the beneficiaries at all times during the existence of the trust and fail to follow the terms of the trust. A trustee cannot fail to carry out their duties.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust. Both roles involve duties that are legally required.

The trustee usually has the power to retain trust property, reinvest trust property or, with or without court authorization, sell, convey, exchange, partition, and divide trust property. Typically the trustee will have the power to manage, control, improve, and maintain all real and personal trust property.

The trustee usually has the power to retain trust property, reinvest trust property or, with or without court authorization, sell, convey, exchange, partition, and divide trust property. Typically the trustee will have the power to manage, control, improve, and maintain all real and personal trust property.

What Power Does a Trustee Have Over a TrustBuying and selling of Assets.Determining distributions to the beneficiaries under the trust instrument.Hiring and firing advisors.Making income distributions.Power to lease.Power to Administer the Trust.Duty to defend the Trust.Duty to Report.More items...

Trustee's DutiesA trustee can also have the power to invade principal to make a distribution to a particular beneficiary to the exclusion of other beneficiaries. A trustee has very broad powers not only to control the distributions in amount and timing, but also to invest the principal.

The trustee cannot fail to carry out the wishes and intent of the settlor and cannot act in bad faith, fail to represent the best interests of the beneficiaries at all times during the existence of the trust and fail to follow the terms of the trust. A trustee cannot fail to carry out their duties.

A Trustee is considered the legal owner of all Trust assets. And as the legal owner, the Trustee has the right to manage the Trust assets unilaterally, without direction or input from the beneficiaries.