Nevada Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

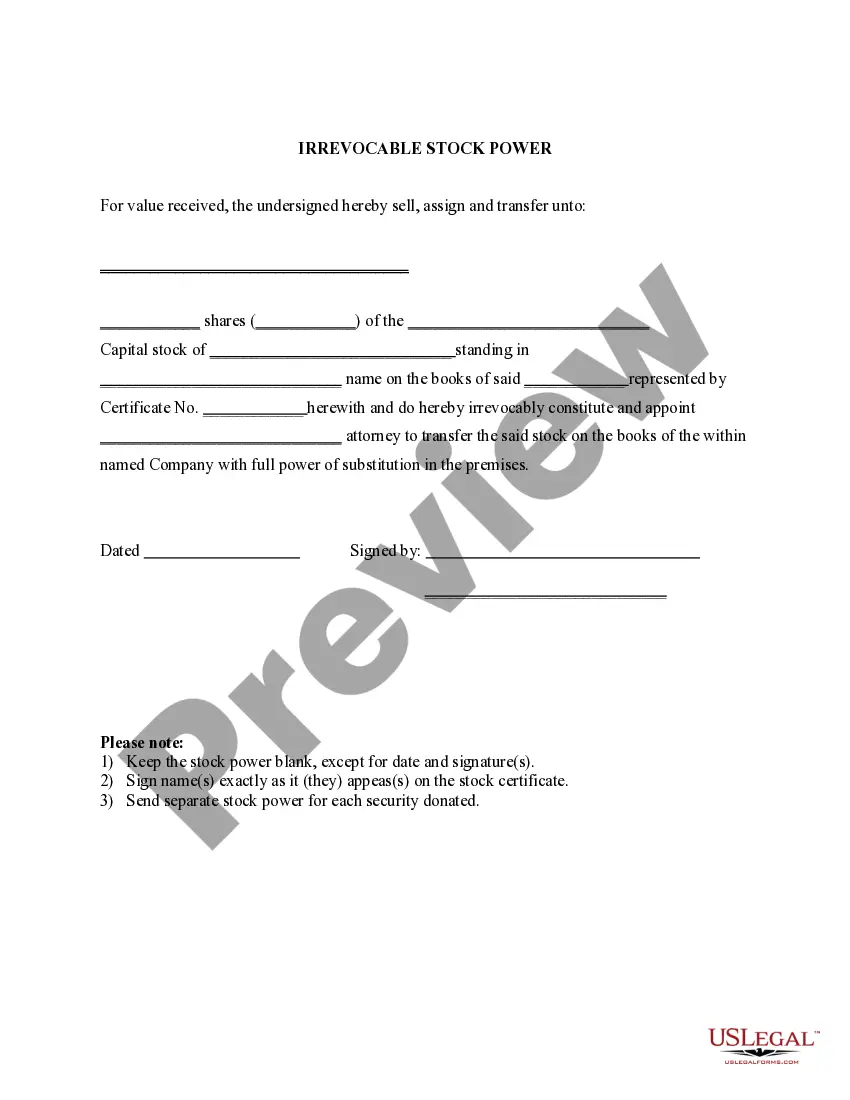

How to fill out Irrevocable Power Of Attorney For Transfer Of Stock By Executor?

Are you currently in a position in which you require files for both business or individual reasons just about every day? There are a variety of legal record layouts accessible on the Internet, but getting versions you can depend on isn`t simple. US Legal Forms provides a huge number of type layouts, much like the Nevada Irrevocable Power of Attorney for Transfer of Stock by Executor, that are composed to satisfy state and federal requirements.

If you are previously informed about US Legal Forms site and get your account, simply log in. Following that, it is possible to download the Nevada Irrevocable Power of Attorney for Transfer of Stock by Executor web template.

Unless you provide an profile and need to begin using US Legal Forms, follow these steps:

- Find the type you require and ensure it is to the appropriate metropolis/area.

- Make use of the Preview button to analyze the shape.

- See the outline to ensure that you have chosen the correct type.

- If the type isn`t what you`re seeking, make use of the Look for area to obtain the type that suits you and requirements.

- When you obtain the appropriate type, click Get now.

- Select the pricing strategy you desire, complete the specified info to generate your bank account, and purchase the order with your PayPal or bank card.

- Select a practical file format and download your backup.

Discover all of the record layouts you might have purchased in the My Forms menu. You can get a more backup of Nevada Irrevocable Power of Attorney for Transfer of Stock by Executor at any time, if needed. Just click on the needed type to download or print out the record web template.

Use US Legal Forms, by far the most considerable assortment of legal kinds, to save time and avoid faults. The service provides expertly manufactured legal record layouts which you can use for a variety of reasons. Create your account on US Legal Forms and start making your life easier.

Form popularity

FAQ

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

Moving Stocks or Bonds to a Trust To put stocks or bonds that you hold into a trust, you typically use a document called a securities assignment (sometimes called a "stock power"). This document asks the securities' transfer agent for permission to transfer the securities to your trust.

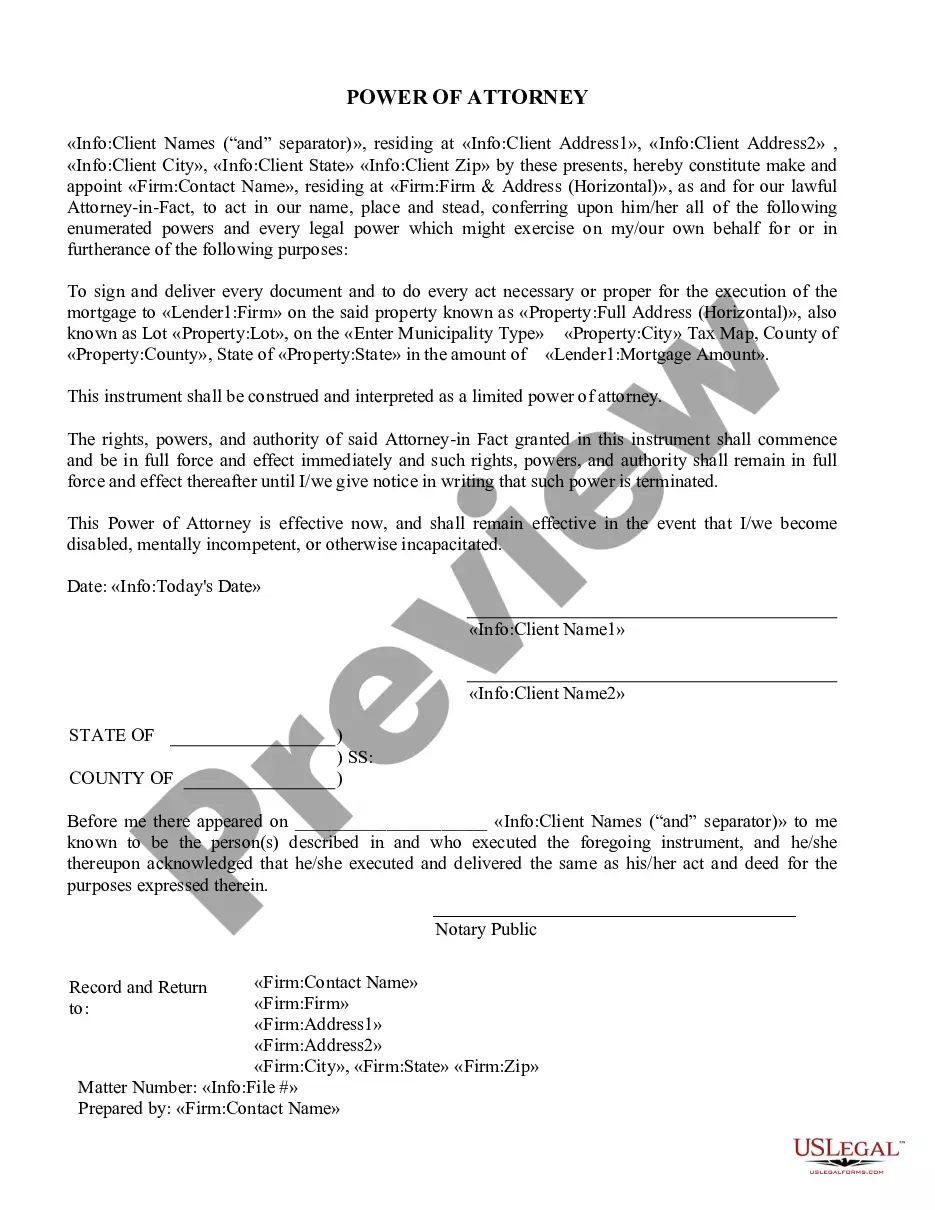

The power of attorney must be in writing and contain your signature to be effective. It may also but need not be notarized. The document may alternatively be witnessed by two adult witnesses who personally know you.

Registration of power of attorney is optional In India, where the 'Registration Act, 1908', is in force, the Power of Attorney should be authenticated by a Sub-Registrar only, otherwise it must be properly notarized by the notary especially where in case power to sell land is granted to the agent.

Nevada law specifies that the person granting the power must write and sign their power of attorney document. To make the document legal, you must either get a notary public's signature or have two adults who personally know you watch you signing and sign themselves as witnesses.

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

Irrevocable Trust DisadvantagesInflexible structure. You don't have any wiggle room if you're the grantor of an irrevocable trust, compared to a revocable trust.Loss of control over assets. You have no control to retrieve or even manage your former assets that you assign to an irrevocable trust.Unforeseen changes.

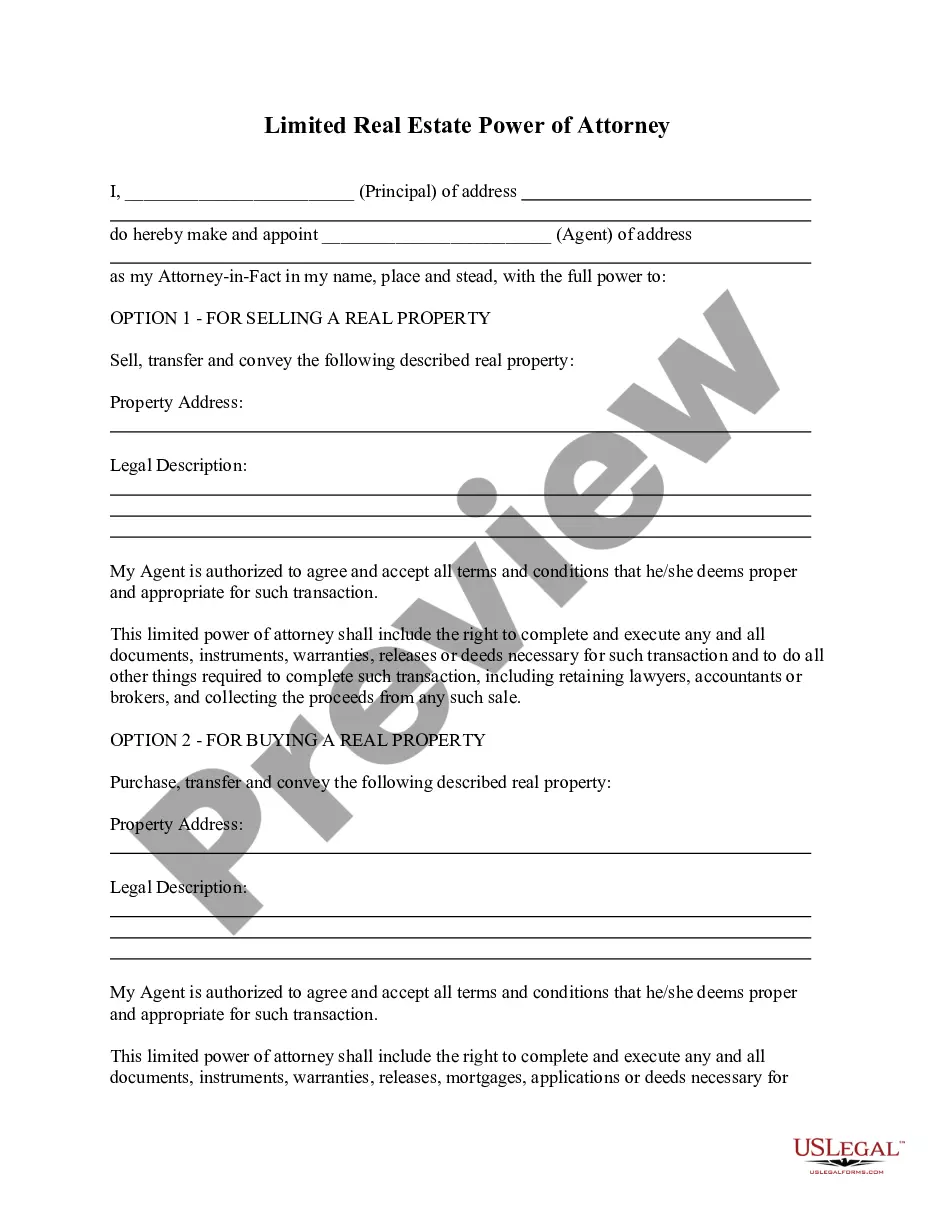

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

If you initialed "real property," giving your agent the power to conduct transactions with real estate, you should also file a copy of your POA in the land records office in the county where you own real estate or expect to transact real estate. In Nevada, this office is called the county recorder's office.