A Nevada Affidavit of Entitlement to Estate is a legal document used in the state of Nevada to establish an individual’s right to property or other assets that have been left unclaimed or abandoned by a deceased person. This document is used when a person dies without a will or other estate planning documents. It is also used when the deceased person's estate is insolvent or to help establish ownership of assets that have been disputed. The Nevada Affidavit of Entitlement to Estate can be used to establish the following: Warshipip rights to an estate, including the identity of heirs and their entitlement to the estate. • The right of an individual to receive a particular asset, such as a car or a house, from the estate of a deceased person. • The right of an individual to receive money from the estate of a deceased person. • The right of an individual to receive property, such as real estate, from the estate of a deceased person. • The right of an individual to receive tangible personal property, such as jewelry or furniture, from the estate of a deceased person. • The right of an individual to receive an inheritance from the estate of a deceased person. There are two types of Nevada Affidavit of Entitlement to Estate: a Small Estate Affidavit for estates valued at $150,000 or less and a Regular Affidavit for estates valued at more than $150,000. Both types of affidavits must be completed and signed by all interested parties in order to be valid.

Nevada Affidavit of Entitlement to Estate

Description

How to fill out Nevada Affidavit Of Entitlement To Estate?

Dealing with official paperwork requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Nevada Affidavit of Entitlement to Estate template from our library, you can be certain it meets federal and state laws.

Working with our service is straightforward and quick. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your Nevada Affidavit of Entitlement to Estate within minutes:

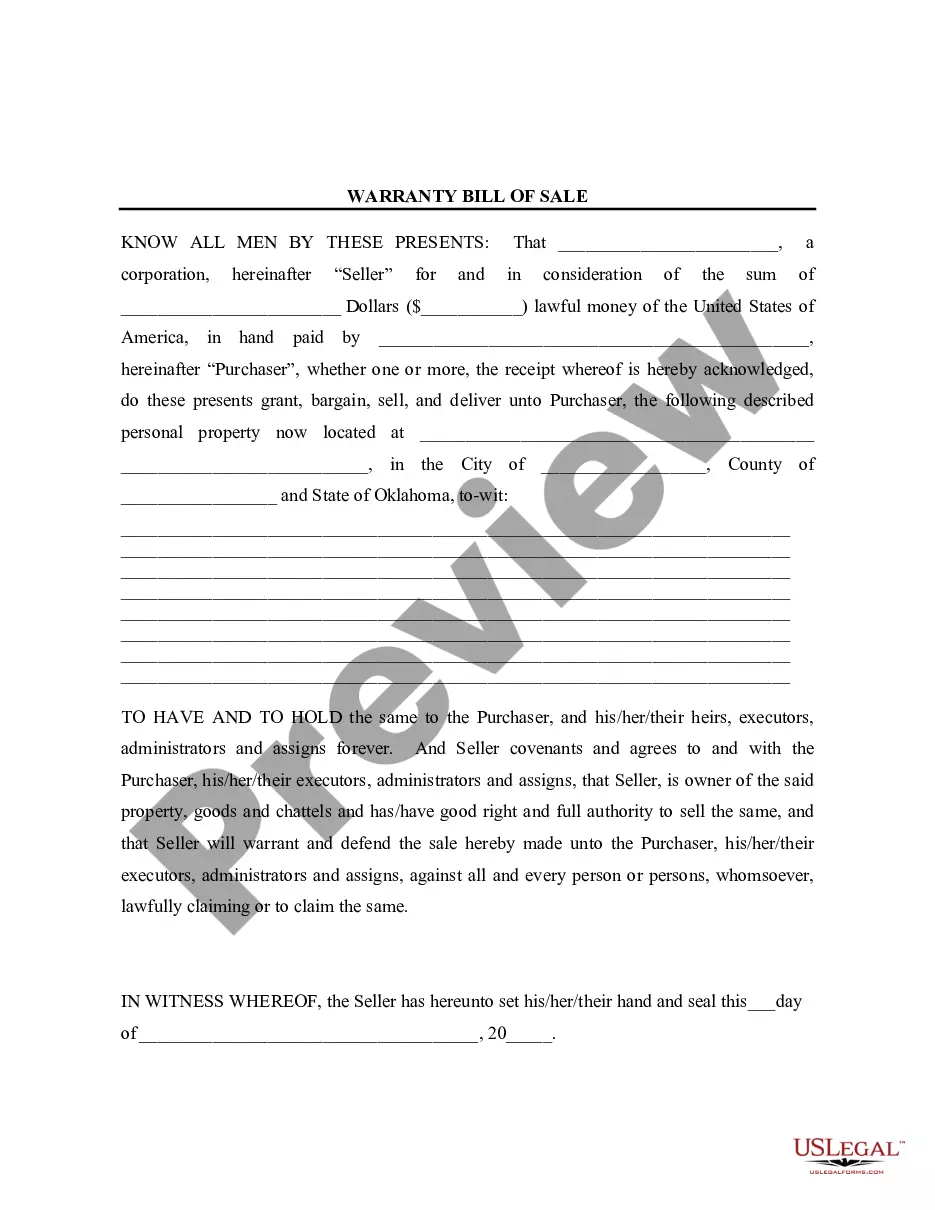

- Make sure to carefully examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative official template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Nevada Affidavit of Entitlement to Estate in the format you prefer. If it’s your first time with our service, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the Nevada Affidavit of Entitlement to Estate you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

Forty days after their death, you can file the affidavit in the local Probate Court in the county where the deceased resided. For example, if your loved one lived or died in Clark County, you would file with the county recorder in Clark County Probate Court. You will need to pay a small fee for recording the affidavit.

If the person leaves a spouse, but no parents, descendants, or siblings, the spouse gets it all. N.R.S. 134.050(4). If the person leaves no spouse, parents, or descendants, the it all goes to the siblings, or if a sibling has died to that sibling's children.

Trusts Can Help You Avoid Probate Most of the time, Nevada residents do this by creating revocable living trusts. This type of trust is organized and then handed over to a trustee upon the death of the person who created the trust. The trustee then has the right to distribute the property after the decedent's passing.

If you die without a will, your half of all shared property goes to your spouse. However, if you kept any separate property through prenuptial agreements, your child is entitled to half of that, and your spouse would get the other half.

Nevada law allows a simplified process for estates that do not include real property (homes or land) and are less than $25,000 (not including the value of vehicles).

A person who dies without a will has died ?intestate?, and his or her estate will be administered by a court-appointed administrator, and that person's assets pass to his or her heirs, who are those designated under state law to inherit the estate.

Generally speaking, if you are unmarried and die intestate in Nevada and have children, your children will inherit your estate in equal shares. If you die with no children but with living parents, your estate will pass on to your parents. If your parents are not alive, the estate then goes to your siblings.

Nevada also allows married parties to also take title in community property with rights of survivorship as well. The right of survivorship means that a decedent's interest passes upon death to the remaining spouse.