Nevada Affidavit of Entitlement to Decedent's Estate of Less Than $100,000

Description

How to fill out Nevada Affidavit Of Entitlement To Decedent's Estate Of Less Than $100,000?

US Legal Forms is a unique platform where you can find any legal or tax document for submitting, such as Nevada Affidavit of Entitlement to Decedent's Estate of Less Than 25,000. If you’re tired with wasting time seeking suitable samples and paying money on papers preparation/attorney charges, then US Legal Forms is precisely what you’re looking for.

To reap all the service’s benefits, you don't have to download any application but just pick a subscription plan and create your account. If you already have one, just log in and get an appropriate template, download it, and fill it out. Downloaded documents are kept in the My Forms folder.

If you don't have a subscription but need Nevada Affidavit of Entitlement to Decedent's Estate of Less Than 25,000, check out the guidelines below:

- check out the form you’re taking a look at is valid in the state you want it in.

- Preview the sample and look at its description.

- Simply click Buy Now to get to the sign up webpage.

- Select a pricing plan and continue signing up by providing some info.

- Pick a payment method to finish the sign up.

- Download the file by choosing the preferred file format (.docx or .pdf)

Now, fill out the document online or print out it. If you are unsure about your Nevada Affidavit of Entitlement to Decedent's Estate of Less Than 25,000 form, speak to a lawyer to analyze it before you send out or file it. Start hassle-free!

Form popularity

FAQ

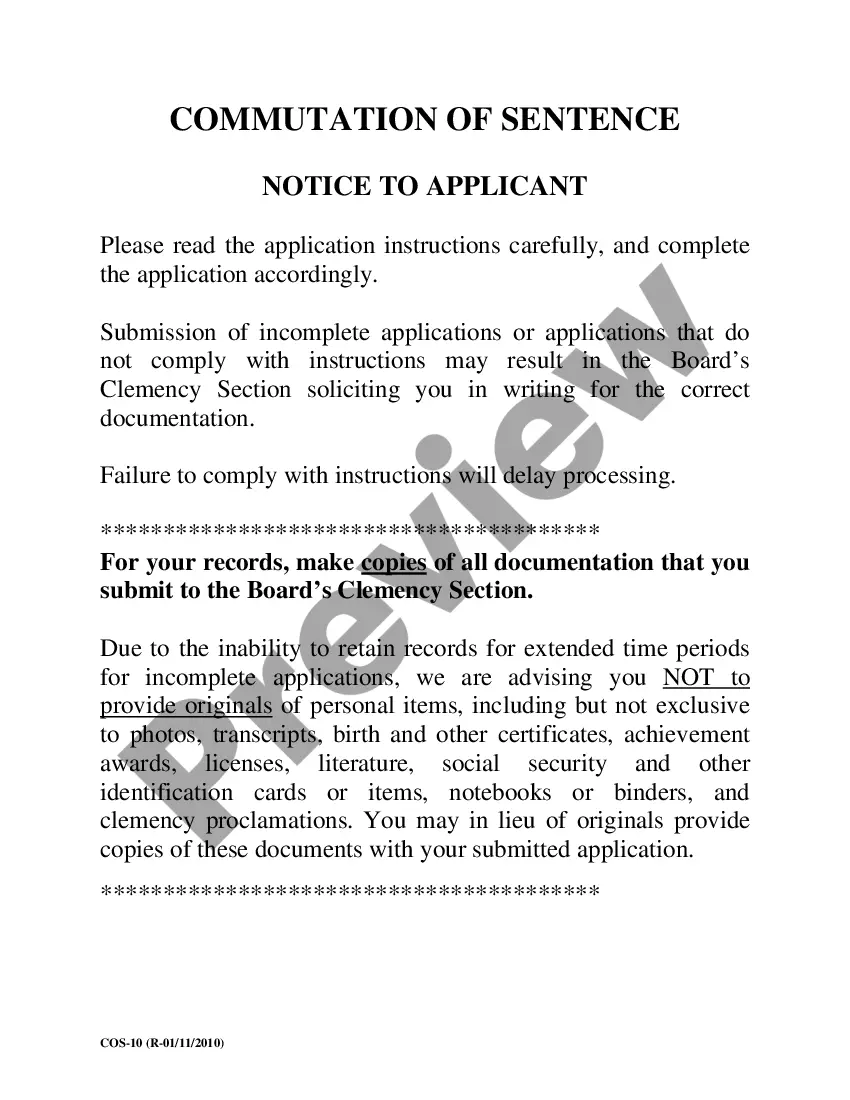

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

To be able to file a small estate affidavit in Texas for a loved one, when no will was executed, you must be a person who would inherit under Texas intestacy law (this is generally the spouse and children, or other close relatives if there are no spouse or children).

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

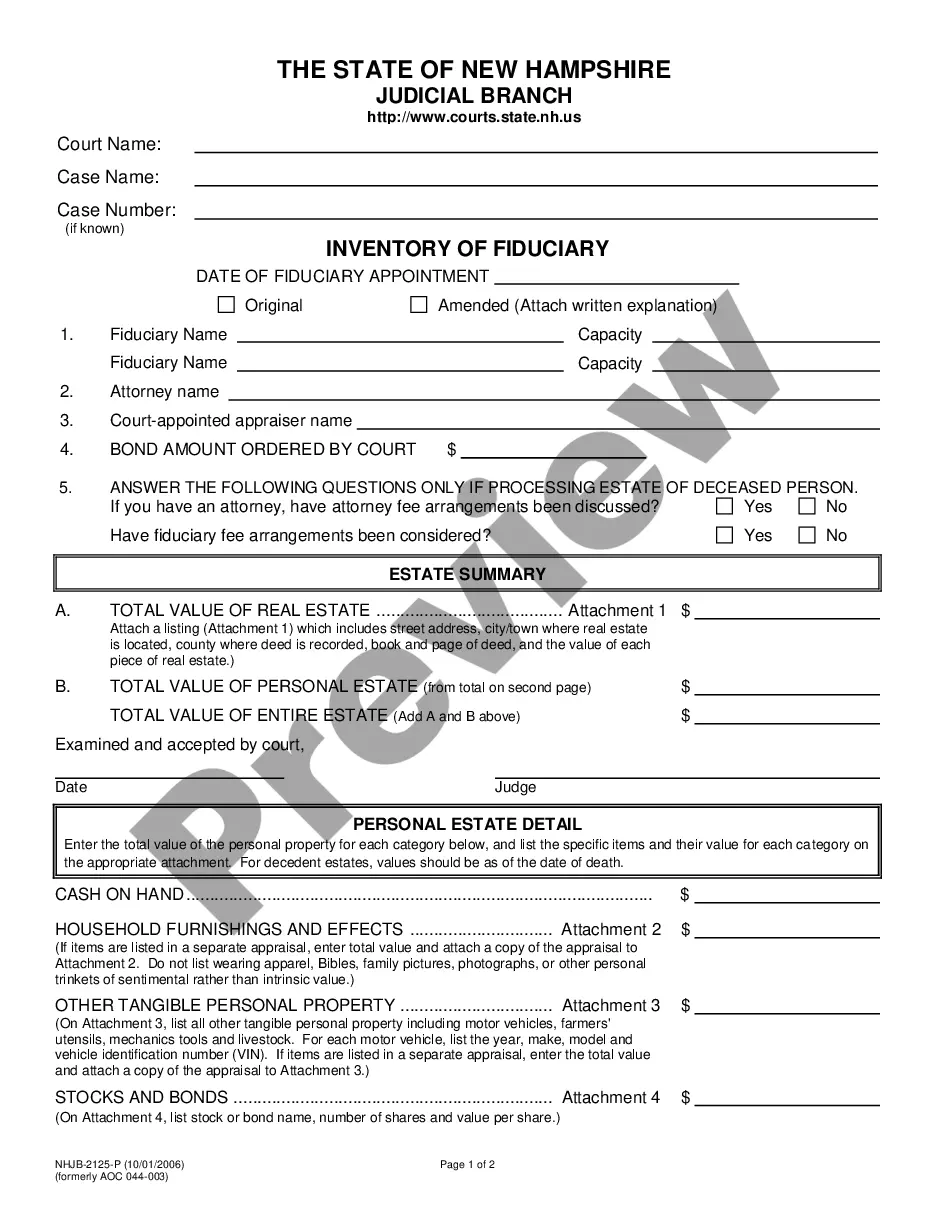

In Nevada, if the total amount of the deceased person's assets exceeds $20,000, or if real estate is involved, probate (or administration) will be required and there is normally no reason to delay starting the process.The petitioner will receive a court order directing the distribution of the estate property.

The Illinois small estate affidavit provides a streamlined way for an heir-at-law of a decedent to gather and distribute the assets of the estate of a person who died, provided that no other petition to open an estate in probate court has been filed and that the assets of the person who died do not exceed $100,000.

The process should take around 60 days. Estates over $100,000 in value require formal administration. The timeframe for estates valued at $100,000 to $300,000 take approximately four to six months to administer, depending on complexity.

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

You can use the simplified small estate process in Nevada if: The gross value of the estate doesn't exceed $300,000, if court approves. Nev. Rev. Stat.