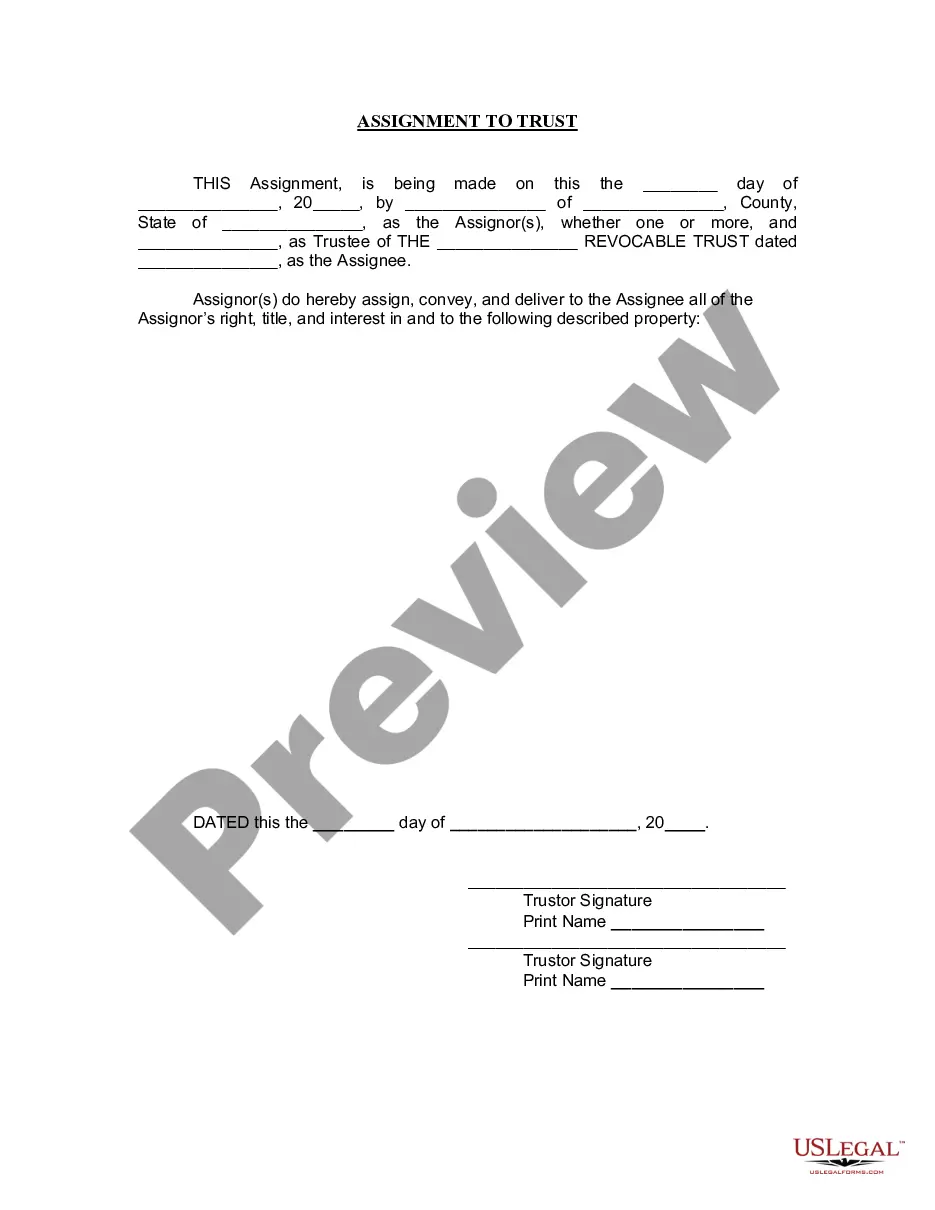

Nevada Assignment to Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Nevada Assignment To Living Trust?

US Legal Forms is actually a special system where you can find any legal or tax form for completing, including Nevada Assignment to Living Trust. If you’re tired of wasting time looking for suitable examples and paying money on papers preparation/attorney charges, then US Legal Forms is exactly what you’re seeking.

To experience all of the service’s benefits, you don't need to download any software but simply select a subscription plan and create your account. If you already have one, just log in and get an appropriate sample, download it, and fill it out. Downloaded files are saved in the My Forms folder.

If you don't have a subscription but need Nevada Assignment to Living Trust, take a look at the instructions below:

- make sure that the form you’re considering is valid in the state you want it in.

- Preview the form its description.

- Simply click Buy Now to reach the sign up webpage.

- Select a pricing plan and carry on signing up by entering some info.

- Select a payment method to complete the sign up.

- Save the document by choosing your preferred file format (.docx or .pdf)

Now, fill out the file online or print out it. If you feel unsure concerning your Nevada Assignment to Living Trust template, contact a legal professional to analyze it before you send out or file it. Get started hassle-free!

Form popularity

FAQ

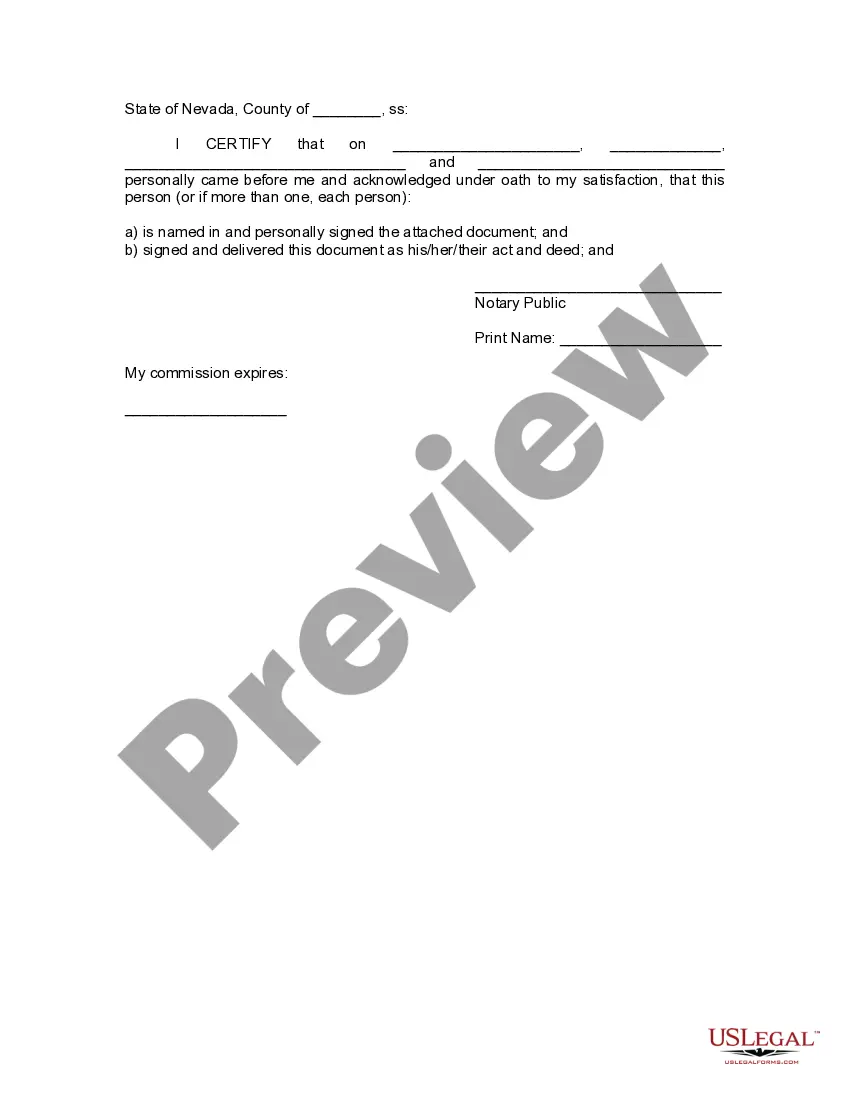

Normally a Nevada trust only requires a notary public affirmation; that is, witnesses are not required. If however the trust is likely to be administered in a state that requires witnesses, sound discretion would mandate that witnesses and a notary public be used in executing the trust.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Irrevocable trusts require a legally enforceable trust agreement.Once the trust agreement is ready for signature, the parties must sign in the presence of witnesses and the document should be notarized.

In most places, a living trust document, unlike a will, does not need to be signed in front of witnesses.But you do need to sign your living trust document in front of a notary public for your state. If you create a shared living trust, both of you need to sign the trust document in front of the notary.

The cost will vary. There will be two types of fees that you will encounter legal fees and filing fees. For lawyer fees, many offer living will trust packages that range from $1,000 $5,000. The cost is dependent on how complex your case is and what you need included.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.

The average cost for an attorney to create your trust ranges from $1,000 to $1,500 for an individual and $1,200 to $1,500 for a couple. Legal fees vary by location, so your costs could be much higher or slightly lower.