This is a form of a Partial Release of Judgment Lien.

New Mexico Partial Release of Judgment Lien

Description

How to fill out Partial Release Of Judgment Lien?

If you need to full, acquire, or produce legitimate document templates, use US Legal Forms, the most important assortment of legitimate types, that can be found on the web. Use the site`s simple and easy practical research to get the documents you require. Different templates for enterprise and personal reasons are sorted by classes and states, or keywords. Use US Legal Forms to get the New Mexico Partial Release of Judgment Lien within a number of clicks.

If you are currently a US Legal Forms client, log in to the bank account and click on the Acquire switch to find the New Mexico Partial Release of Judgment Lien. You can also access types you earlier acquired from the My Forms tab of the bank account.

If you are using US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape to the appropriate town/country.

- Step 2. Utilize the Preview choice to look over the form`s articles. Never forget about to learn the explanation.

- Step 3. If you are not satisfied together with the kind, take advantage of the Lookup industry on top of the screen to discover other types of the legitimate kind design.

- Step 4. Once you have discovered the shape you require, click on the Buy now switch. Select the rates strategy you choose and add your accreditations to register for the bank account.

- Step 5. Approach the deal. You can utilize your credit card or PayPal bank account to finish the deal.

- Step 6. Select the formatting of the legitimate kind and acquire it on the product.

- Step 7. Comprehensive, revise and produce or signal the New Mexico Partial Release of Judgment Lien.

Every single legitimate document design you purchase is your own eternally. You might have acces to each kind you acquired within your acccount. Click the My Forms segment and pick a kind to produce or acquire again.

Be competitive and acquire, and produce the New Mexico Partial Release of Judgment Lien with US Legal Forms. There are thousands of skilled and status-distinct types you can utilize for the enterprise or personal requirements.

Form popularity

FAQ

NEW MEXICO A judgment is a lien on the real estate of the judgment debtor and expires after fourteen years.

Your Texas judgment lien release attorney will help you provide the necessary documents. You might need to submit an affidavit that states that the property is your homestead. The creditor also might require a tax certificate that proves you've filed for homestead exemption.

Any money judgment rendered in the supreme court, court of appeals, district court or metropolitan court shall be docketed by the clerk of the court and a transcript or abstract of judgment may be issued by the clerk upon request of the parties.

How does a creditor go about getting a judgment lien in New Mexico? To properly attach the lien, the creditor files the judgment with the county clerk in any New Mexico county where the debtor owns property now or may own property in the future.

General liens apply to all property owned by the debtor. For example, if you fail to pay your federal income taxes, the government could place a lien against everything you own, not just your house. Specific liens, on the other hand, apply to one specific asset.

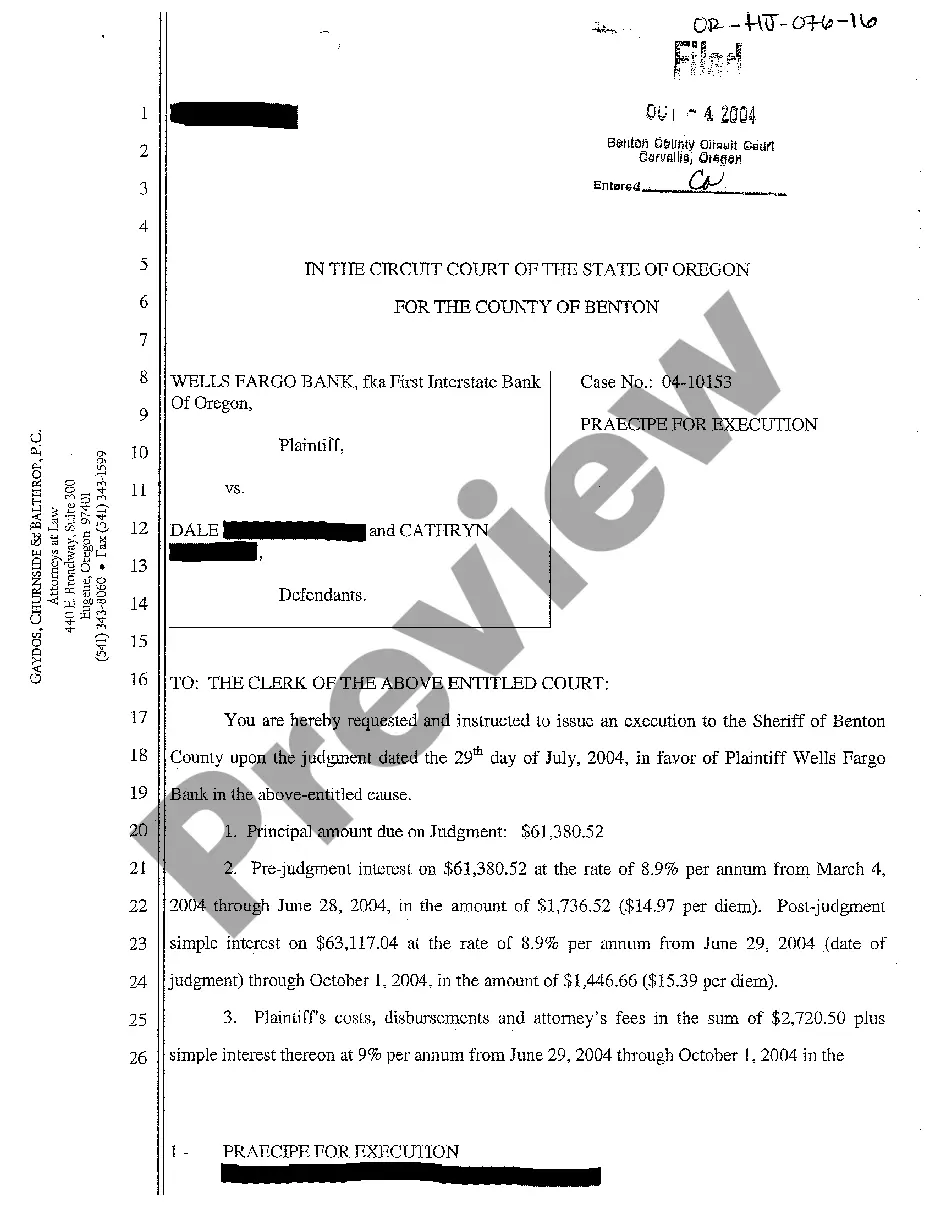

Execution of a Judgment is the legal process of enforcing a Judgment by seizing and selling the Debtor's property. A Writ of Execution permits the Sheriff to take and sell the Debtor's property.

Once entered, a judgment is enforceable in New Mexico for fourteen years and cannot be renewed.

Unless the judgment has been stayed, the clerk of the court shall issue a writ of execution for seizure of property to satisfy a judgment on an underlying dispute: (1) if the judgment debtor is not a natural person, at any time after the filing of the judgment; or (2) if the judgment debtor is a natural person: (a) ...