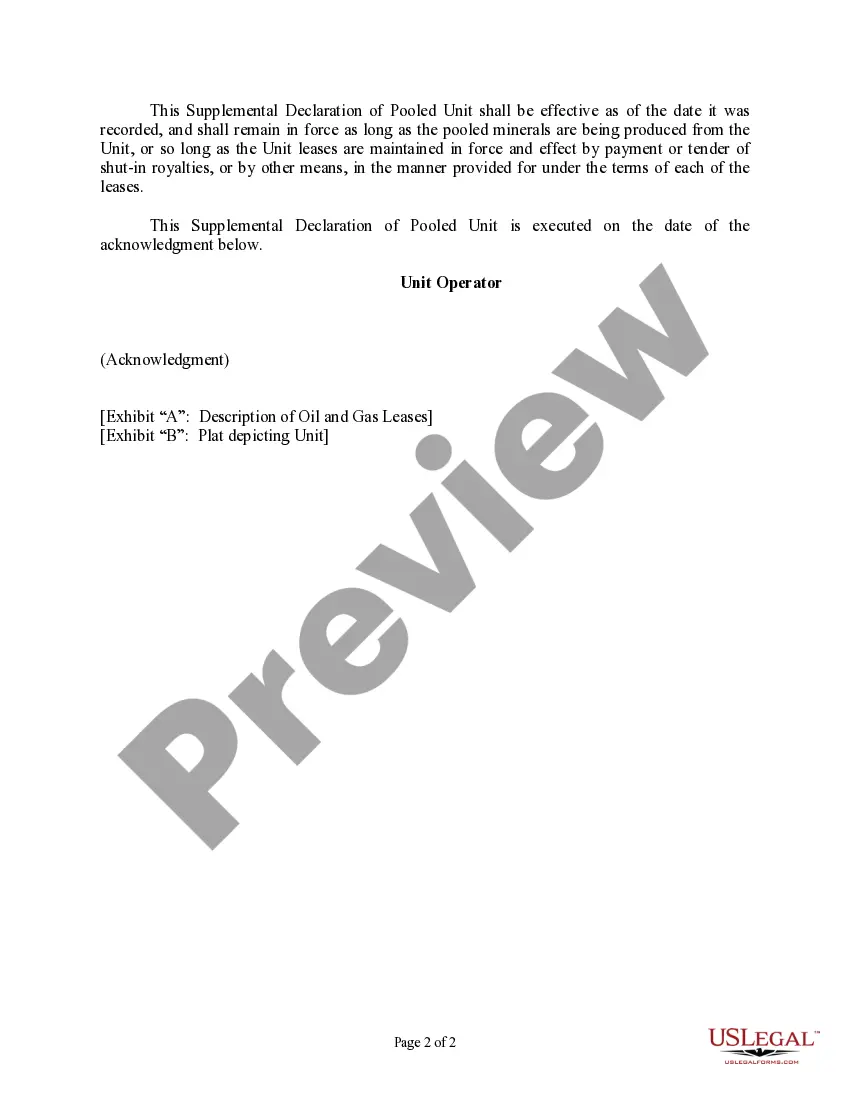

This declaration is used when a unit operator desires to supplement and amend a Declaration of Pooled Unit to include in the unit the oil, gas and mineral leases described in Exhibit A to this Supplement, covering lands within the confines of the Unit Area.

New Mexico Supplemental Declaration of Pooled Unit

Description

How to fill out Supplemental Declaration Of Pooled Unit?

If you want to complete, acquire, or printing lawful file layouts, use US Legal Forms, the largest variety of lawful varieties, which can be found on the web. Use the site`s easy and practical look for to obtain the documents you need. Numerous layouts for company and individual functions are sorted by classes and claims, or keywords. Use US Legal Forms to obtain the New Mexico Supplemental Declaration of Pooled Unit in just a couple of clicks.

If you are previously a US Legal Forms consumer, log in for your account and click on the Download option to get the New Mexico Supplemental Declaration of Pooled Unit. You can also access varieties you formerly acquired inside the My Forms tab of your respective account.

If you work with US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have chosen the form for the appropriate city/nation.

- Step 2. Make use of the Preview option to look through the form`s content material. Don`t overlook to see the information.

- Step 3. If you are unsatisfied with the form, utilize the Search area towards the top of the screen to discover other types in the lawful form template.

- Step 4. Upon having found the form you need, click on the Purchase now option. Opt for the prices plan you like and include your qualifications to sign up to have an account.

- Step 5. Approach the financial transaction. You may use your credit card or PayPal account to perform the financial transaction.

- Step 6. Select the formatting in the lawful form and acquire it in your device.

- Step 7. Total, revise and printing or sign the New Mexico Supplemental Declaration of Pooled Unit.

Every lawful file template you buy is yours for a long time. You may have acces to every single form you acquired in your acccount. Select the My Forms section and choose a form to printing or acquire again.

Compete and acquire, and printing the New Mexico Supplemental Declaration of Pooled Unit with US Legal Forms. There are thousands of skilled and condition-specific varieties you can use for your company or individual demands.

Form popularity

FAQ

Whether you have an offer on the table or not, you may have good reasons to sell your mineral rights: To pursue other opportunities. If you have a nonproducing property, you might have to wait years for anything to happen ? and nothing may ever happen, even after multiple leases. Should You Sell Your Mineral Rights? - Bessemer Trust bessemertrust.com ? insights ? a-closer-look... bessemertrust.com ? insights ? a-closer-look...

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

To transfer any rights to minerals successfully, follow these steps: The new owner has to acquire a copy of the deed for the site at a local courthouse in New Mexico. Review the deed to ensure it matches the description and to ensure that the so-called rights to any minerals are included in the property deed. Mineral Rights in New Mexico ? Lease, Buy and Sell - Pheasant Energy pheasantenergy.com ? new-mexico-mineral-... pheasantenergy.com ? new-mexico-mineral-...

Taxes: The #1 reason for selling mineral rights is taxes. If you inherited mineral rights and then sold them for $100,000, you could pay only $5,250 in taxes and keep $94,750. If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect.

Compulsory pooling orders the division enters pursuant to NMSA 1978, Section 70-2-17, as amended, may provide for the recovery, out of the share of production allocable to the working interest of a party that elects not to pay its proportionate share of well costs in advance, in addition to reasonable well costs and ... N.M. Code R. § 19.15.13.8 - CHARGE FOR RISK | State Regulations cornell.edu ? 19-15-13-8-NMAC cornell.edu ? 19-15-13-8-NMAC

BUREAU OF LAND MANAGEMENT: The BLM New Mexico Field Office maintains information on mineral rights and has a public information room at 301 Dinosaur Trail, Santa Fe, NM 87508, (505) 954-2000, where that information can be researched. FAQ - Mineral Rights, Claims and Geology - EMNRD nm.gov ? mmd ? faq-mineral-rights-... nm.gov ? mmd ? faq-mineral-rights-...

Unsolicited purchase offers are happening in greater numbers and for greater ? sometimes much greater ? amounts than in the past. The upshot? Sometimes selling makes good sense. Indeed, depending on your situation, the sale of your mineral rights can represent a prudent ? and even compelling ? opportunity.

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future.