New Mexico Subordination by Mineral Owners of Rights to Make Use of the Surface Estate - Transfer

Description

How to fill out Subordination By Mineral Owners Of Rights To Make Use Of The Surface Estate - Transfer?

Have you been in a place that you will need documents for possibly company or individual uses just about every working day? There are plenty of legal papers layouts available on the Internet, but locating versions you can rely on isn`t simple. US Legal Forms gives thousands of type layouts, just like the New Mexico Subordination by Mineral Owners of Rights to Make Use of the Surface Estate - Transfer, which can be written in order to meet state and federal demands.

In case you are currently acquainted with US Legal Forms web site and also have your account, just log in. Afterward, you are able to obtain the New Mexico Subordination by Mineral Owners of Rights to Make Use of the Surface Estate - Transfer template.

If you do not come with an profile and wish to begin using US Legal Forms, adopt these measures:

- Obtain the type you will need and ensure it is for your appropriate city/county.

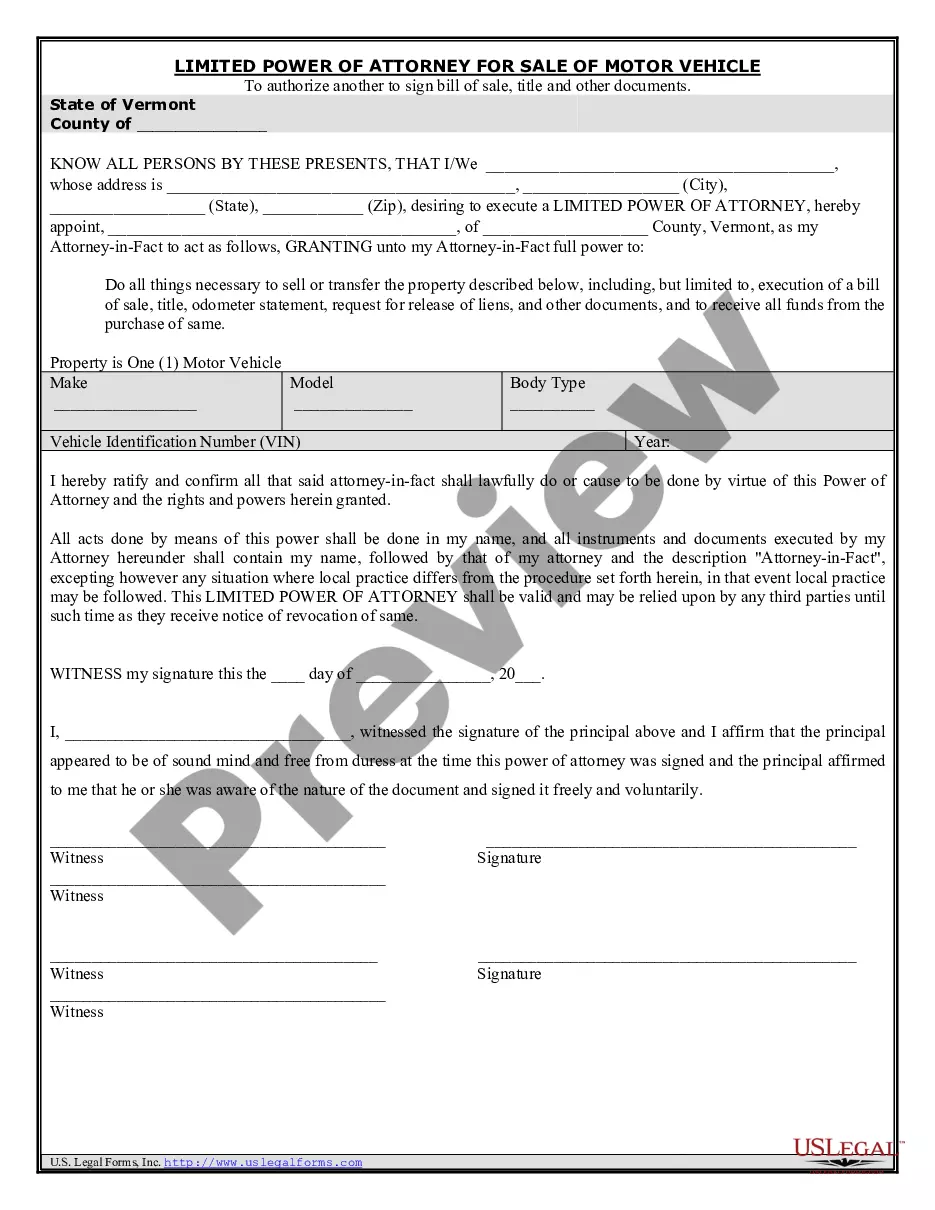

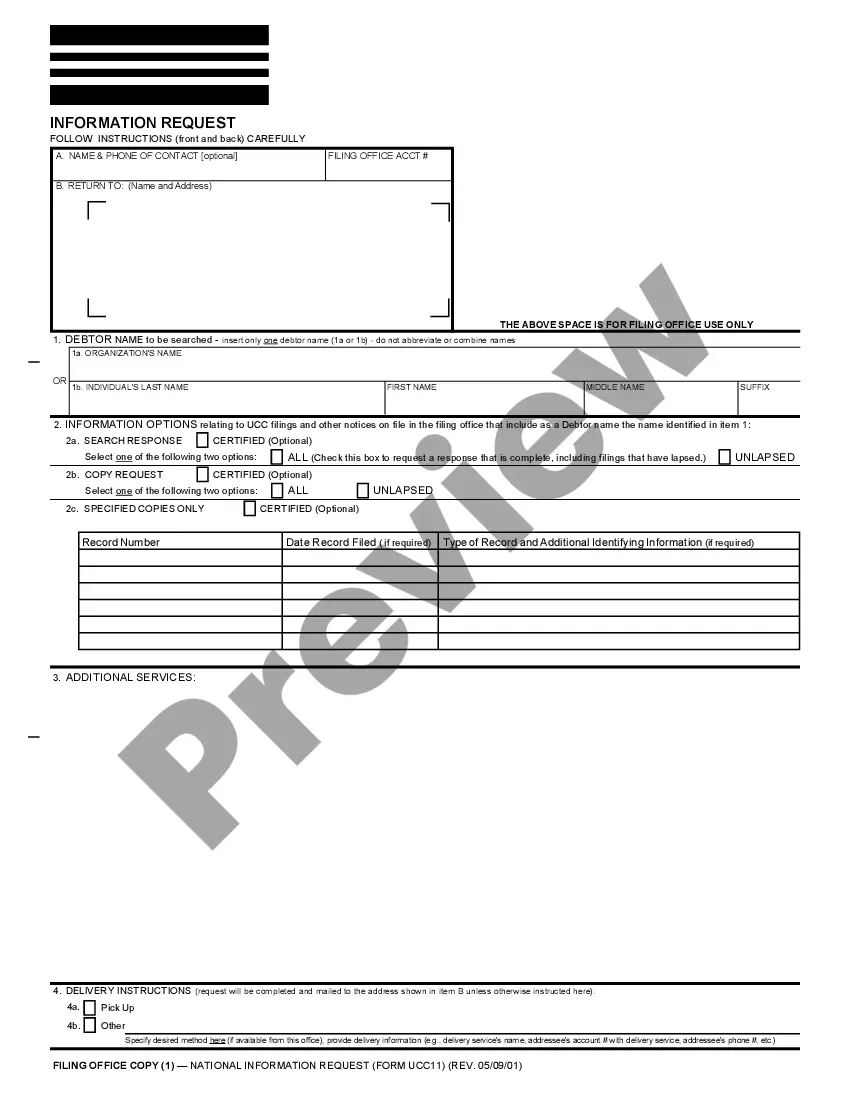

- Use the Review button to check the form.

- Read the explanation to actually have chosen the appropriate type.

- If the type isn`t what you`re trying to find, make use of the Lookup field to find the type that suits you and demands.

- Whenever you get the appropriate type, simply click Buy now.

- Choose the rates plan you desire, fill in the desired details to produce your bank account, and pay for an order making use of your PayPal or Visa or Mastercard.

- Choose a practical document file format and obtain your version.

Find all the papers layouts you may have bought in the My Forms food list. You can obtain a more version of New Mexico Subordination by Mineral Owners of Rights to Make Use of the Surface Estate - Transfer whenever, if needed. Just click the needed type to obtain or print out the papers template.

Use US Legal Forms, the most comprehensive variety of legal types, to conserve efforts and steer clear of blunders. The service gives appropriately produced legal papers layouts that can be used for a selection of uses. Create your account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

Mineral rights can expire if the owner does not renew them or if they go unclaimed for a certain period of time. Mineral rights can also be sold, fractionalized, or transferred through gifting or inheritance.

To transfer any rights to minerals successfully, follow these steps: The new owner has to acquire a copy of the deed for the site at a local courthouse in New Mexico. Review the deed to ensure it matches the description and to ensure that the so-called rights to any minerals are included in the property deed.

Whether mineral rights transfer with the property depends on the estate type. If it's a severed estate, surface rights and mineral rights are separate and do not transfer together. However, if it's a unified estate, the land and the mineral rights can be conveyed with the property.

Minerals include gold, silver, coal, oil, and gas. If you want to transfer the rights to these minerals to another party, you can do so in a variety of ways: by deed, will, or lease. Before you transfer mineral rights, you should confirm that you own the rights that you seek to transfer.

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

In the United States, mineral rights can be sold or conveyed separately from property rights. As a result, owning a piece of land does not necessarily mean you also own the rights to the minerals beneath it. If you didn't know this, you're not alone. Many property owners do not understand mineral rights.