Mississippi Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction

Description

How to fill out Sale Of Business - Bill Of Sale For Personal Assets - Asset Purchase Transaction?

Are you currently in the location where you require documentation for possible business or personal purposes almost every working day.

There are numerous legal document templates accessible on the web, but finding ones you can rely on is quite challenging.

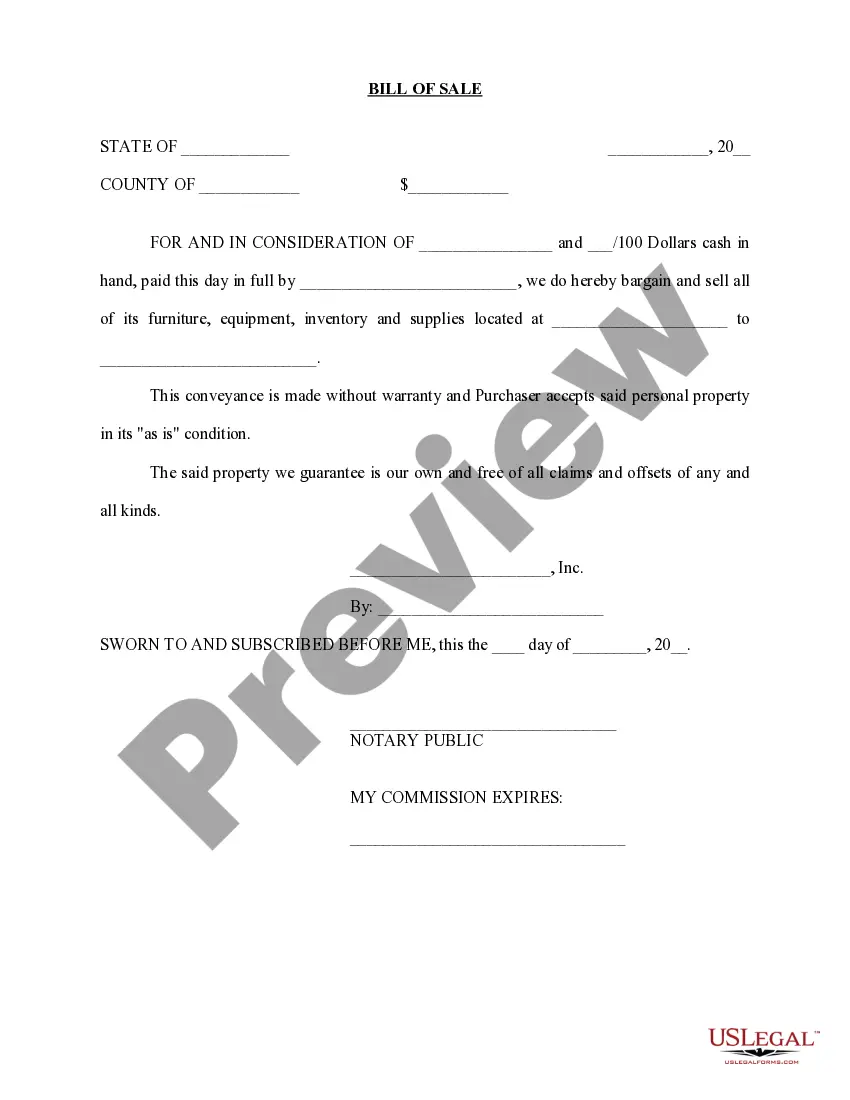

US Legal Forms provides thousands of form templates, such as the Mississippi Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction, which are designed to comply with federal and state regulations.

Once you find the correct form, click on Get now.

Select the pricing plan you want, enter the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Mississippi Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/county.

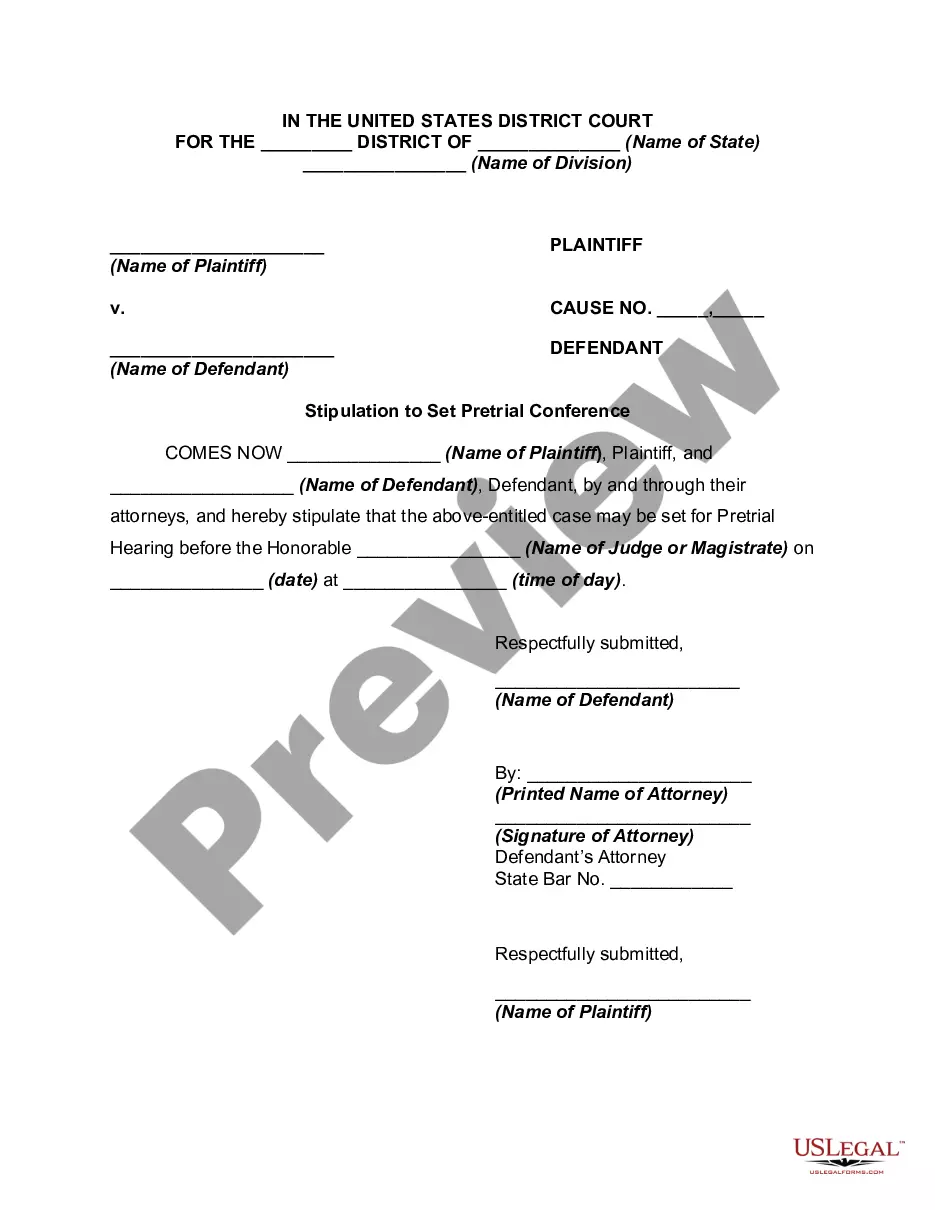

- Utilize the Preview button to view the document.

- Check the outline to confirm you have selected the correct form.

- In case the form is not what you are searching for, use the Lookup field to find the form that fits your requirements.

Form popularity

FAQ

Yes, you can sell a house as is in Mississippi, but you must disclose any known defects to potential buyers. Selling as is means you will not make repairs or improvements, which can benefit sellers looking for a quick transaction. In the context of a Mississippi Sale of Business - Bill of Sale for Personal Assets, providing clear terms in the sale agreement helps avoid misunderstandings regarding property condition.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

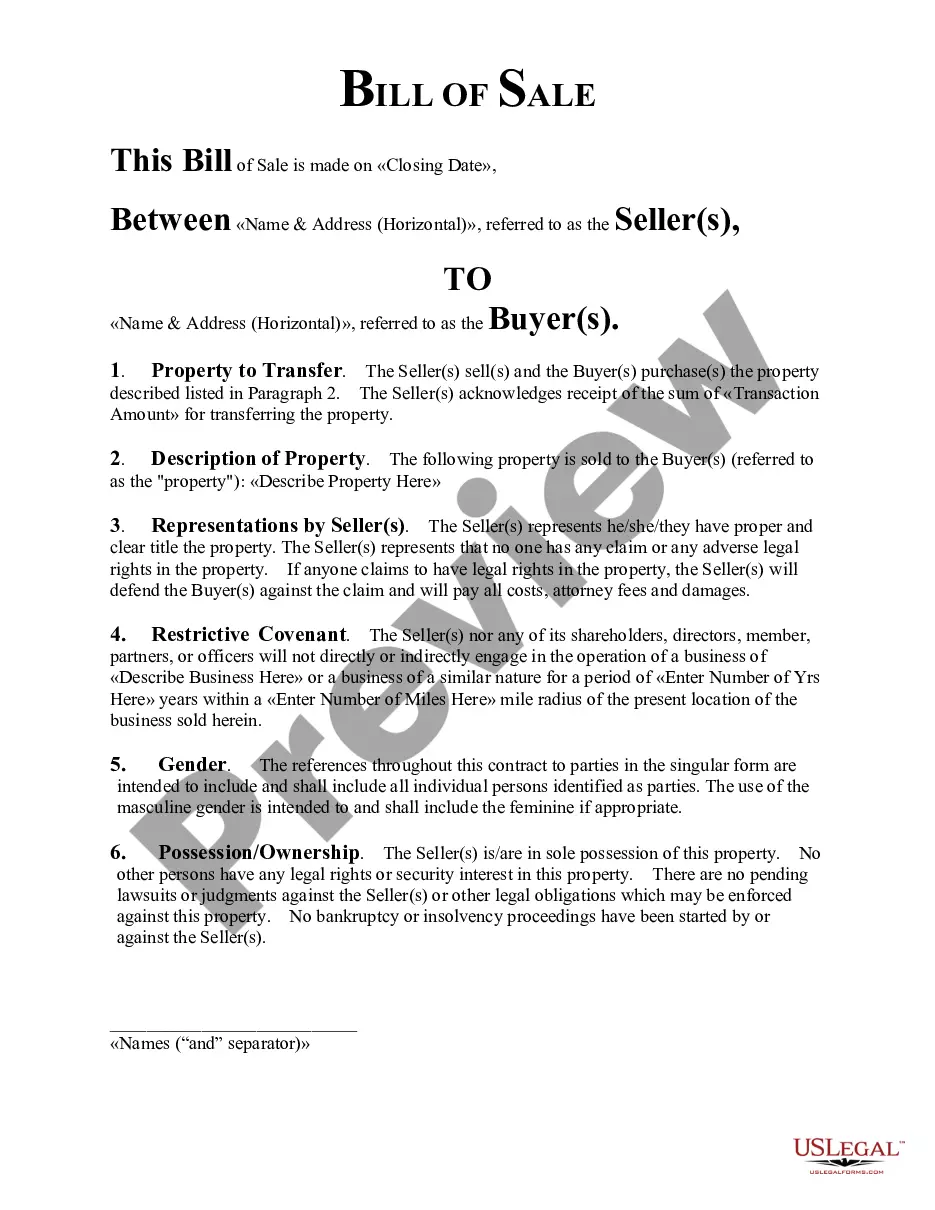

A business asset purchase agreement (APA) is a standard merger & acquisition contract that contains the terms for transferring an asset between parties. The terms in an APA provide key logistics about the deal (e.g., purchase price, closing date, payment, etc.) along with the rights and obligations of the parties.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

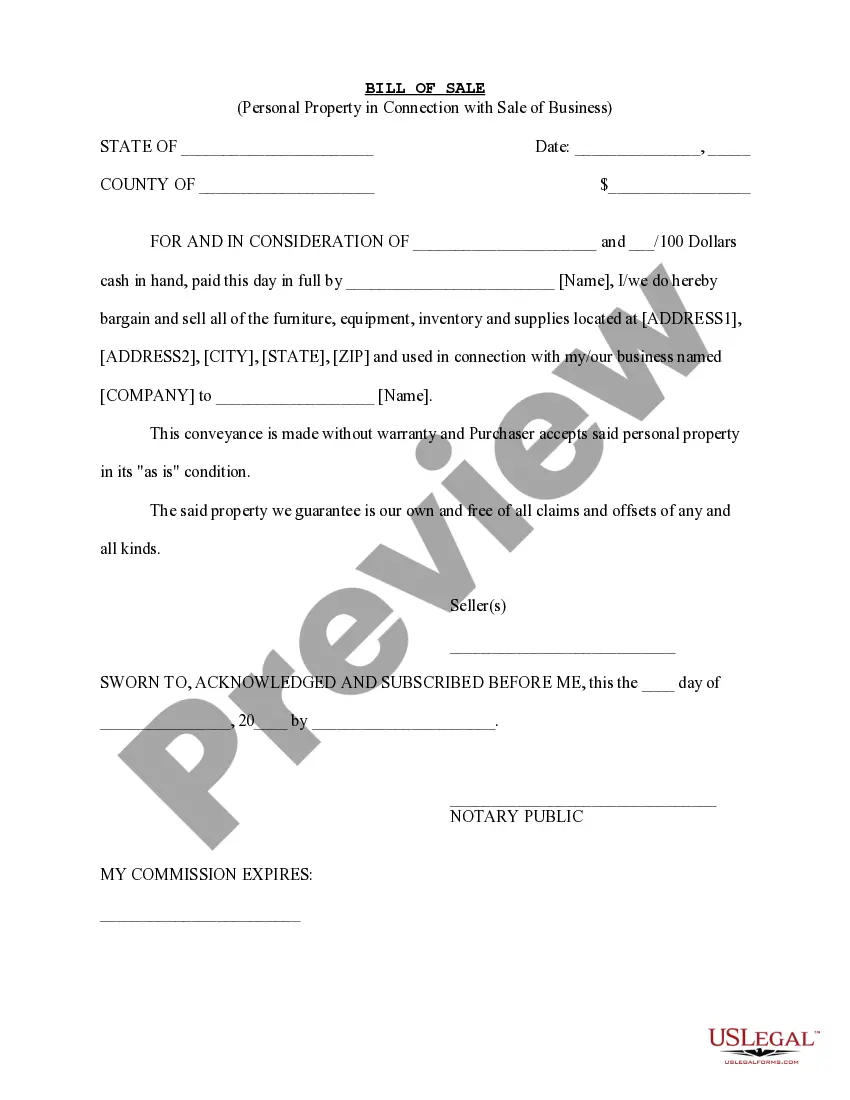

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

The key difference is that a purchase order is sent by buyers to vendors with the intention to track and control the purchasing process. On the other hand, an invoice is an official payment request sent by vendors to buyers once their order is fulfilled.

A business usually has many assets. When sold, these assets must be classified as capital assets, depreciable property used in the business, real property used in the business, or property held for sale to customers, such as inventory or stock in trade. The gain or loss on each asset is figured separately.

A sales agreement is a contract between a buyer and a seller that details the terms of an exchange. It is also known as a sales agreement contract, sale of goods agreement, sales agreement form, purchase agreement, or sales contract.

An asset sale involves the purchase of some or all of the assets owned by a company. Examples of common assets which are sold include; plant and equipment, land, buildings, machinery, stock, goodwill, contracts, records and intellectual property (including domain names and trademarks).

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...