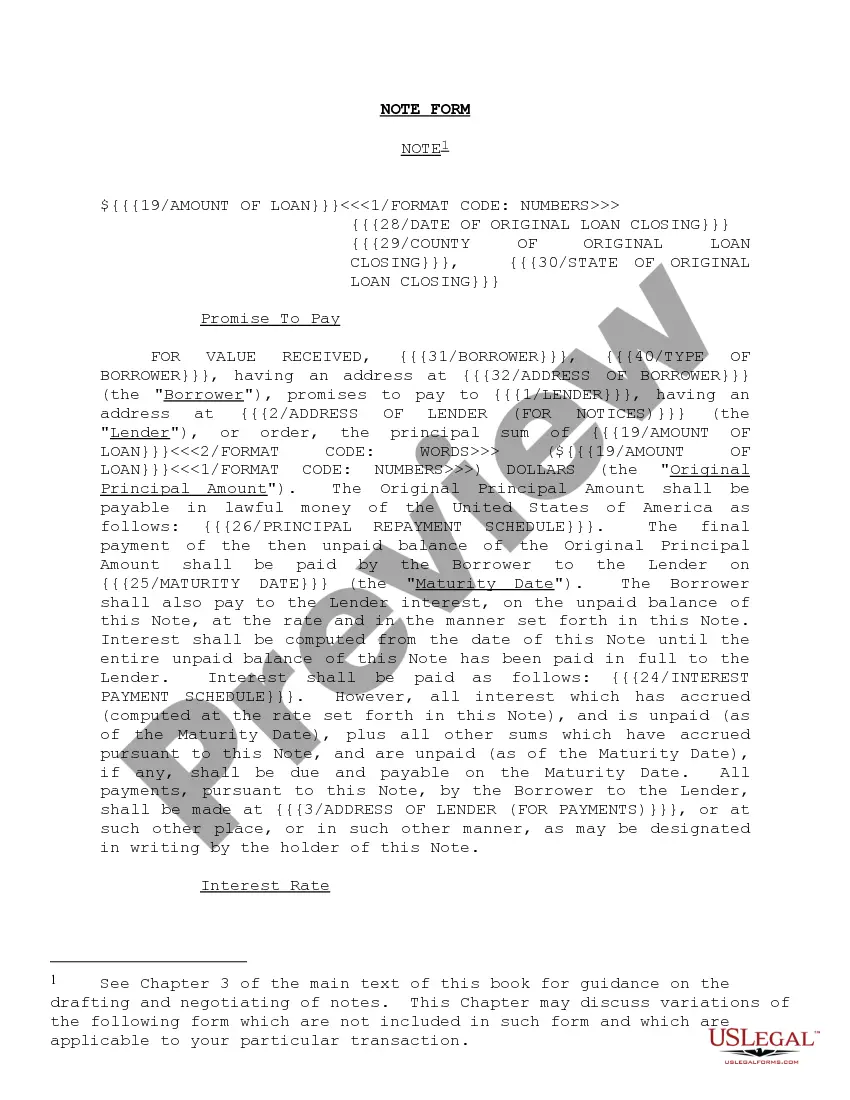

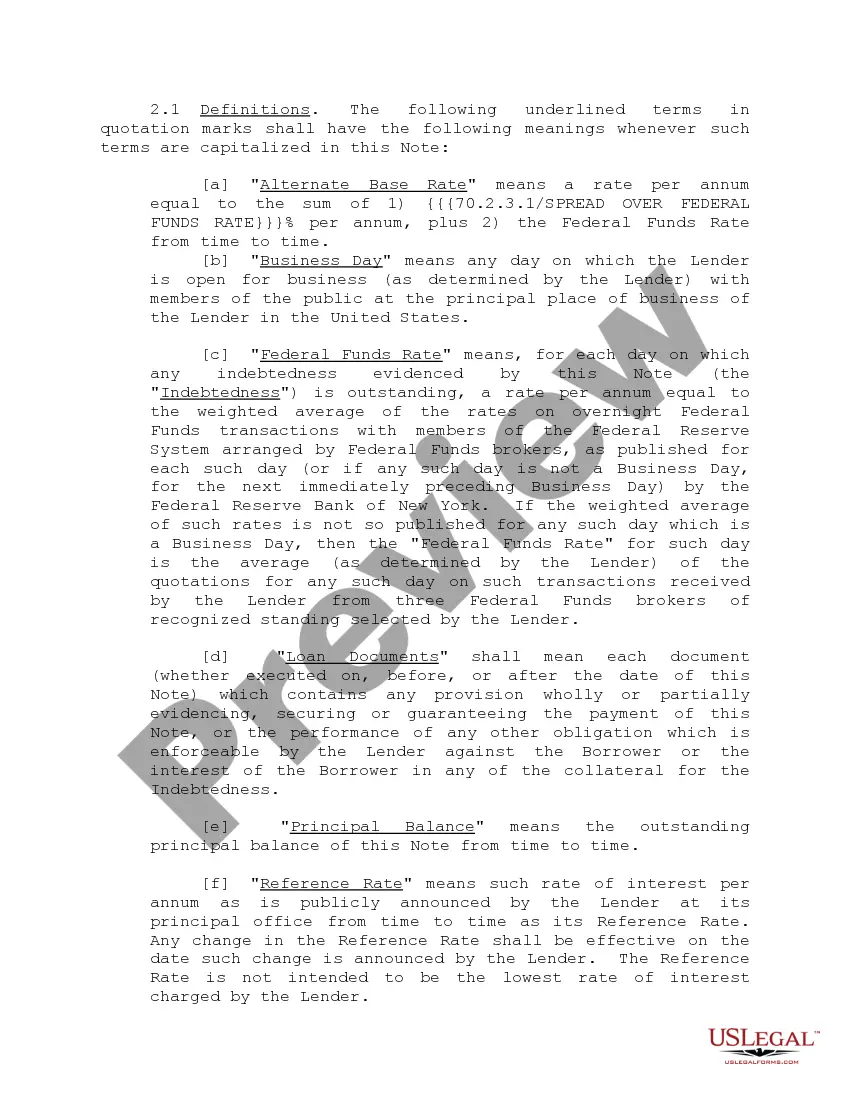

"Note Form and Variations" is a American Lawyer Media form. This form is for your note payments with different variations.

New Mexico Note Form and Variations

Description

How to fill out Note Form And Variations?

Are you inside a placement where you need to have documents for sometimes enterprise or individual purposes nearly every day? There are a lot of authorized file templates accessible on the Internet, but locating versions you can depend on isn`t easy. US Legal Forms provides a large number of kind templates, like the New Mexico Note Form and Variations, that are published in order to meet state and federal specifications.

Should you be previously knowledgeable about US Legal Forms internet site and have an account, merely log in. Afterward, you may download the New Mexico Note Form and Variations web template.

Unless you offer an account and want to begin to use US Legal Forms, abide by these steps:

- Discover the kind you need and make sure it is for your proper city/area.

- Use the Preview button to check the form.

- See the outline to actually have chosen the correct kind.

- In the event the kind isn`t what you are looking for, make use of the Lookup industry to obtain the kind that meets your requirements and specifications.

- Once you get the proper kind, click Buy now.

- Pick the costs plan you need, fill in the specified details to generate your account, and purchase an order with your PayPal or charge card.

- Pick a handy document formatting and download your duplicate.

Get all of the file templates you possess bought in the My Forms menus. You may get a additional duplicate of New Mexico Note Form and Variations whenever, if possible. Just go through the needed kind to download or printing the file web template.

Use US Legal Forms, by far the most comprehensive variety of authorized forms, to save some time and steer clear of mistakes. The services provides appropriately made authorized file templates which you can use for a selection of purposes. Create an account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

New Mexico does not require LLCs to file an annual report. New Mexico imposes a franchise tax on LLCs if they paid federal income tax. The franchise tax is filed along with the state income tax, and is due by the 15th day of the third month following the close of the tax year. The fee is $50.

EFFECTIVE July 1, 2023 The state portion of the gross receipts tax rate has been lowered from 5.000% to 4.875%, due to HB-163 from the 2022 legislative session. This change impacts all location codes across the state.

New Mexico does not have a state equivalent of the Federal Form W-4. Instead, employees should complete a copy of the Federal Form W-4 for New Mexico withholding tax purposes, writing "For New Mexico State Withholding Only" across the top in prominent letters.

The State of New Mexico requires pass-through entities (which may be a state law partnership or a limited liability company taxed as a partnership) to withhold tax at 5.9% on earnings of non-resident partners or members if the owner's distributive share of net income is over $100 in a year.

Form RPD-41083, Affidavit to Obtain Refund of New Mexico Tax Due a Deceased Taxpayer; and. A copy of the death certificate or other proof of death.

A composite return is a unique type of income tax return filed on behalf of a group of nonresident individuals by a pass-through entity. Instead of each member managing their own state income responsibilities individually, the entity takes charge of a composite filing.

How do I Estimate Gross Receipts? Add all of your transactions to get the sum of your business's expenditure, then subtract the cost of goods sold. Include sales returns and allowances when calculating this sum. This amount is your whole estimate for that month or year.

Annual statements of withholding should not be submitted to the Department, but must be submitted to the taxpayer using form RPD-41359, Annual Statement of Pass-Through Entity Withholding, or 1099-Misc.