New Mexico Statement to Add to Credit Report

Description

How to fill out Statement To Add To Credit Report?

Are you presently in a role where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but locating ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the New Mexico Statement to Add to Credit Report, designed to comply with federal and state regulations.

Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes.

The service provides well-crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Mexico Statement to Add to Credit Report template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

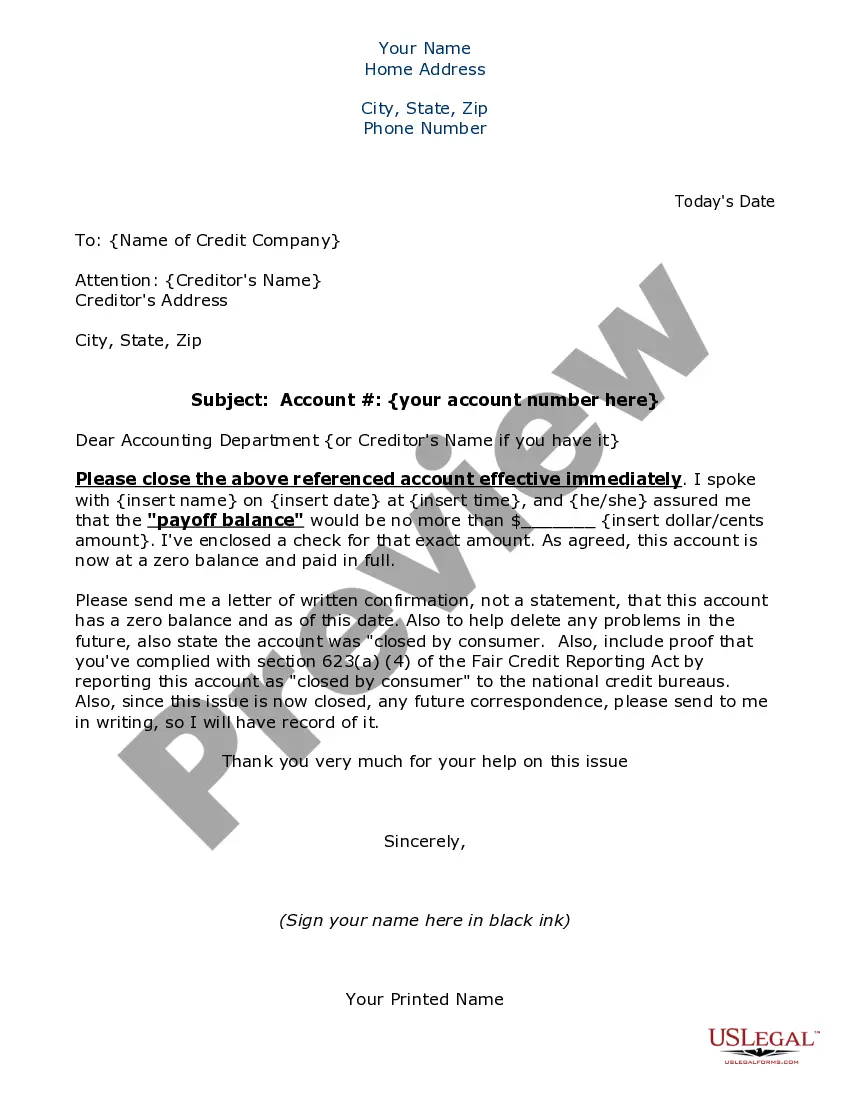

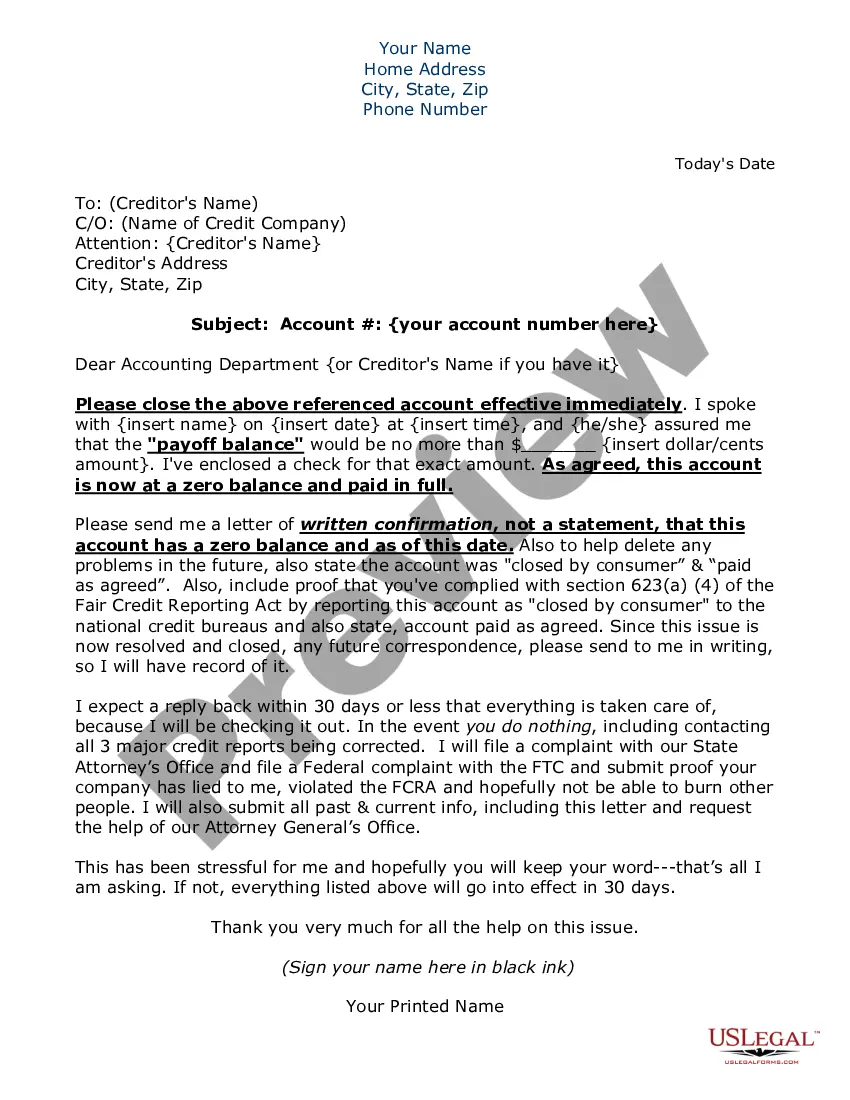

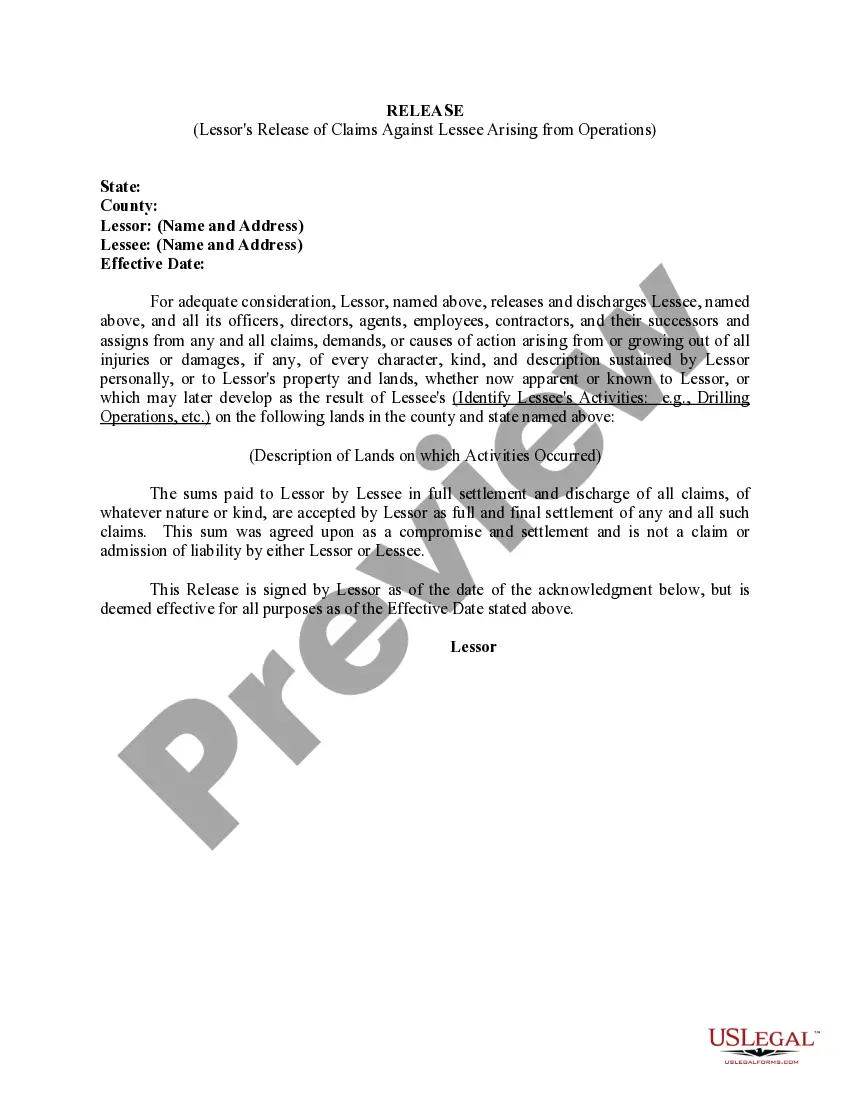

- Use the Preview button to review the document.

- Check the description to make sure you have selected the right form.

- If the form is not what you are looking for, utilize the Search bar to find the form that fits your needs.

- Once you find the correct form, click Purchase now.

- Select the pricing plan you prefer, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can download another copy of the New Mexico Statement to Add to Credit Report anytime if needed. Just select the necessary form to download or print the document template.

Form popularity

FAQ

Raising your credit score by 200 points in 30 days requires strategic actions. Focus on paying off high-interest debts to lower your credit utilization ratio. Make sure to address any inaccuracies on your credit report; the New Mexico Statement to Add to Credit Report can help you clarify any issues. Additionally, consider becoming an authorized user on a responsible person's credit card to benefit from their positive credit habits.

Adding a statement to your credit report is straightforward with the right tools. You can use the New Mexico Statement to Add to Credit Report service, which guides you through the process of crafting a statement that explains any discrepancies or unique situations. This statement is then added to your report, giving lenders context about your financial history. For assistance, platforms like uslegalforms can provide templates and guidance to ensure your statement is effective.

Achieving an 800 credit score in 45 days is challenging but possible with focused efforts. Start by paying down existing debt, especially high credit card balances. Additionally, ensure your payment history is flawless, as on-time payments significantly impact your score. Finally, consider using the New Mexico Statement to Add to Credit Report feature, which allows you to explain any negative marks, potentially improving your overall credit profile.

The GRT document in New Mexico refers to the form businesses use to report gross receipts tax. This document outlines your business's sales and the amount of tax collected. Properly managing this paperwork is vital for maintaining compliance and can directly impact your New Mexico Statement to Add to Credit Report.

To file your New Mexico state taxes online, visit the New Mexico Taxation and Revenue Department's website. They offer digital filing options that simplify the process, allowing you to submit your return quickly and efficiently. Accurate tax filing supports a positive financial profile, which is crucial for your New Mexico Statement to Add to Credit Report.

GRT stands for Gross Receipts Tax, while CRS refers to the Combined Reporting System that includes GRT. They are interconnected; businesses report GRT through the CRS. Understanding both concepts is essential for accurate tax reporting, which can affect your New Mexico Statement to Add to Credit Report.

In New Mexico, seniors may qualify for property tax exemptions starting at age 65. This exemption can significantly reduce the property tax burden for eligible individuals. Knowing about these provisions can help seniors manage their finances better and positively influence their New Mexico Statement to Add to Credit Report.

Any individual or business that earns income in New Mexico must file a tax return. This requirement includes residents, non-residents, and part-year residents. Properly filing your taxes helps maintain a clear financial history, which is beneficial when addressing your New Mexico Statement to Add to Credit Report.

To obtain a New Mexico Business Tax Identification Number (NMBTIN), you must register your business with the New Mexico Taxation and Revenue Department. This process can often be completed online, and you will need to submit basic business information. Having an NMBTIN is important as it may relate to your New Mexico Statement to Add to Credit Report.

CRS stands for Combined Reporting System in New Mexico. This system simplifies the reporting of gross receipts tax, compensating tax, and other taxes for businesses. Understanding CRS is crucial for maintaining accurate tax records and ensuring that your New Mexico Statement to Add to Credit Report reflects your financial responsibilities.