New Mexico MHA Request for Short Sale

Description

How to fill out MHA Request For Short Sale?

If you want to obtain, acquire, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site's user-friendly and efficient search feature to locate the documents you need.

A selection of templates for both business and personal use are organized by categories and states, or by keywords.

Step 4. Once you have identified the form you need, click the Buy now option. Select the payment plan that works for you and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the New Mexico MHA Request for Short Sale in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download option to acquire the New Mexico MHA Request for Short Sale.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

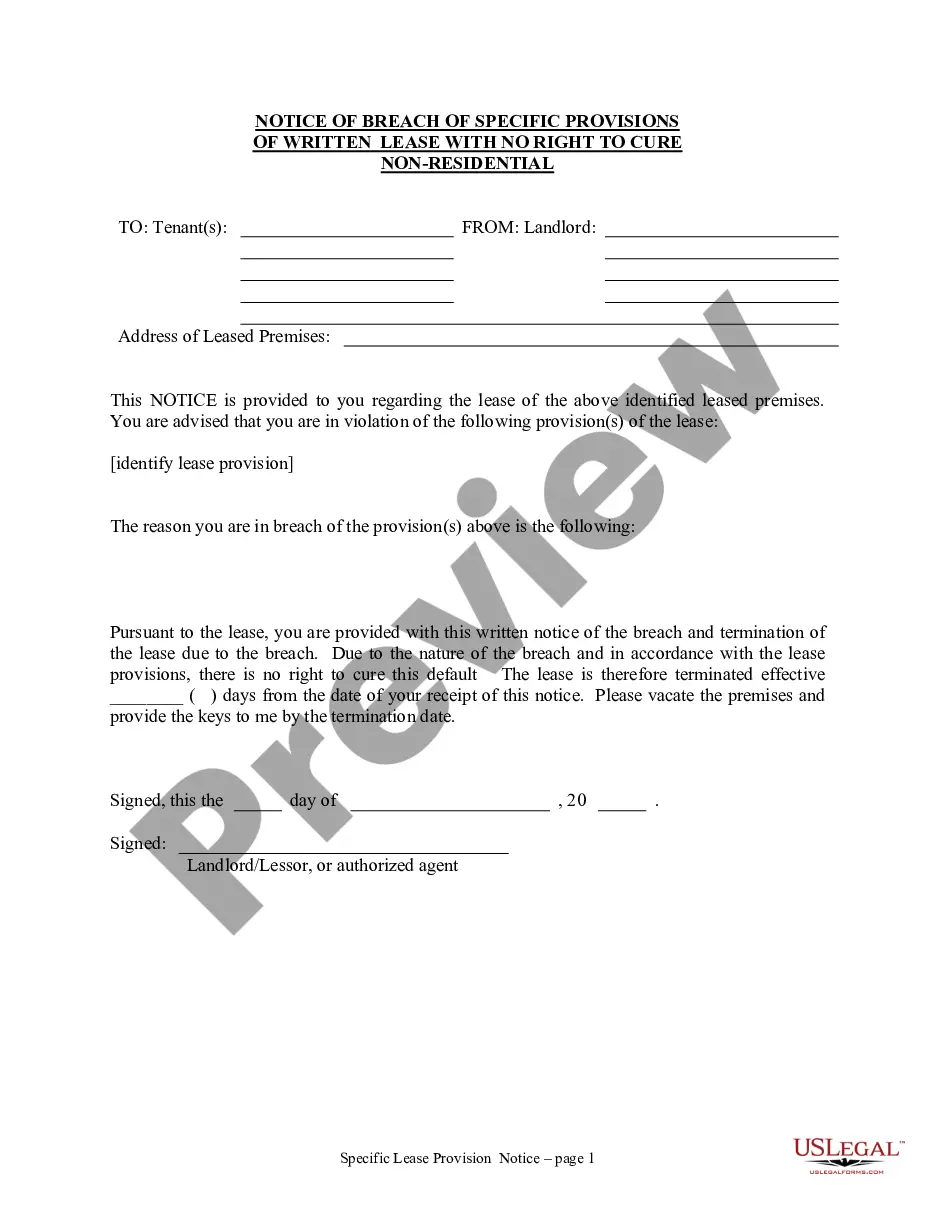

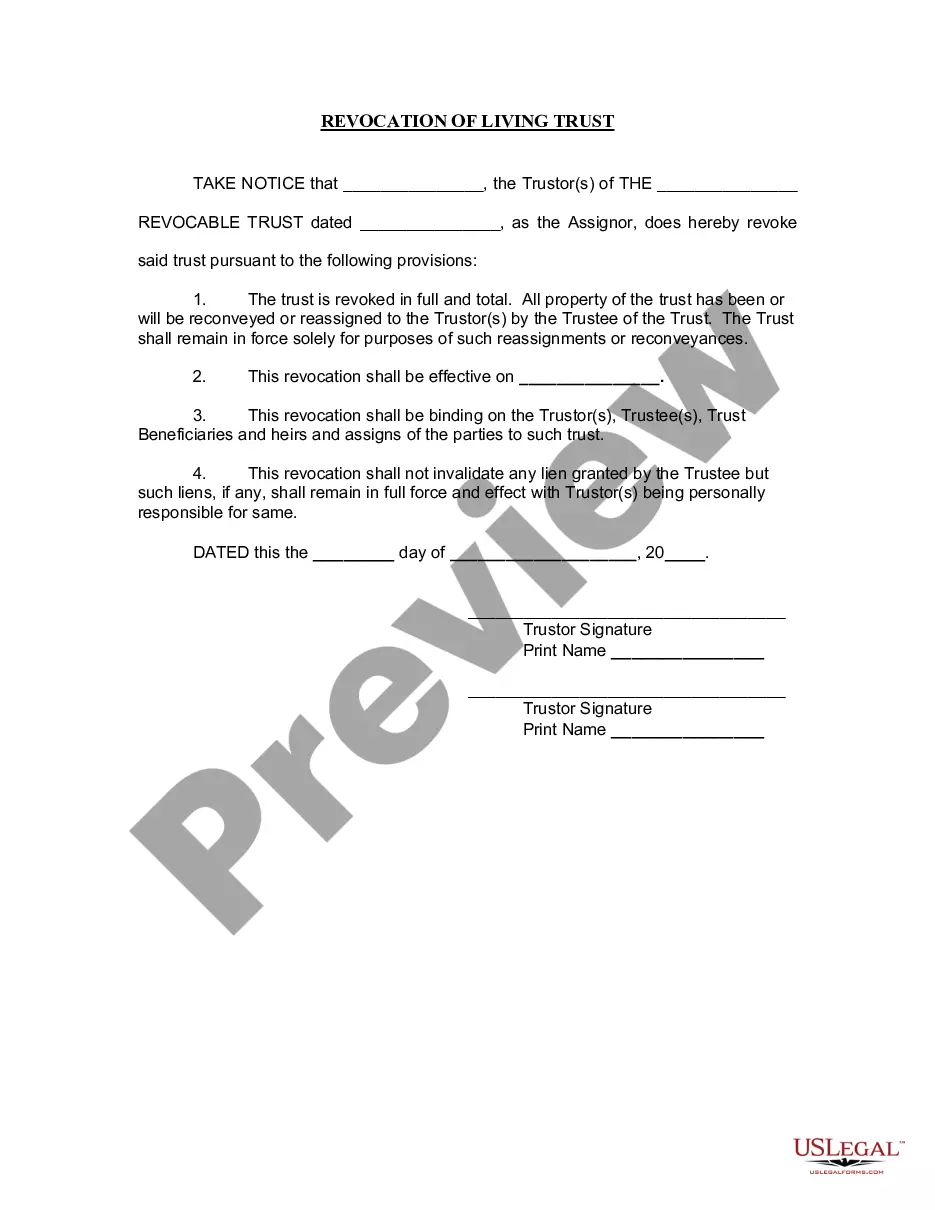

- Step 2. Use the Preview option to review the content of the form. Be sure to read through the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

The 25k grant in New Mexico is a financial assistance program aimed at homeowners. This grant supports those facing financial difficulties, specifically benefiting those who may be looking into the New Mexico MHA Request for Short Sale. By providing immediate aid, it can help cover living expenses or mortgage payments during tough times. Familiarizing yourself with this program can be essential for residents needing support.

A deed in lieu of foreclosure is a legal process in which a homeowner transfers their property title to the lender to avoid the lengthy foreclosure process. This option can simplify matters for both the homeowner and the lender, as it allows the homeowner to relinquish their mortgage liability. If you are considering this route, the New Mexico MHA Request for Short Sale can provide guidance and help you weigh your options to find the best solution.

To qualify as a first-time home buyer in New Mexico, you typically need to meet specific income criteria and be a first-time buyer or someone who has not owned a home in the past three years. Additionally, you must demonstrate readiness to manage mortgage payments and potentially complete a homebuyer education course. For those seeking to understand the process better, the New Mexico MHA Request for Short Sale can also offer insights into alternatives if you face financial difficulties.

To request a short sale, contact your lender directly and express your intention clearly. It’s beneficial to provide supporting documents, such as financial statements, income verification, and a hardship letter. Utilizing a New Mexico MHA Request for Short Sale can streamline this process and ensure that all necessary information is included. Be prepared to negotiate, as this step is key to reaching an agreement.

To ask for a short sale, start by gathering your financial documents and writing a letter to your lender. A New Mexico MHA Request for Short Sale can simplify this process and help you present a compelling case. Be clear about your financial hardship and why a short sale is necessary. This transparency can foster a positive dialogue with your lender.

Banks usually accept less than the total mortgage balance during a short sale, but the exact amount varies based on several factors, including the property's market value and condition. By leveraging a New Mexico MHA Request for Short Sale, you can negotiate better terms that align with your situation. Understanding the bank's perspective can guide you through this process effectively. Remember, the goal is to reach a mutually beneficial agreement.

In New Mexico, the redemption period for tax sales typically lasts for nine months from the date of the sale. However, the timeframe can vary depending on specific circumstances. If you're facing such a situation, a New Mexico MHA Request for Short Sale might provide an alternative route. Exploring options can help you make timely decisions regarding your property.

Yes, a short sale may impact your credit score, but it can be less damaging than a foreclosure. With a New Mexico MHA Request for Short Sale, you can negotiate terms that may minimize the damage. While you might see a drop in your credit score, the long-term consequences of avoiding foreclosure can be beneficial. It's essential to understand the process to make informed decisions.