New Mexico Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

Are you in a situation where you frequently require documents for either business or personal reasons almost every day.

There are numerous legitimate document templates available online, but finding ones you can trust is not straightforward.

US Legal Forms offers a vast array of form templates, including the New Mexico Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, designed to comply with federal and state regulations.

Once you find the appropriate form, click Acquire now.

Choose the pricing plan you want, fill in the required details to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Mexico Hardship Letter to Mortgagor or Lender to Prevent Foreclosure template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is relevant to your specific city/region.

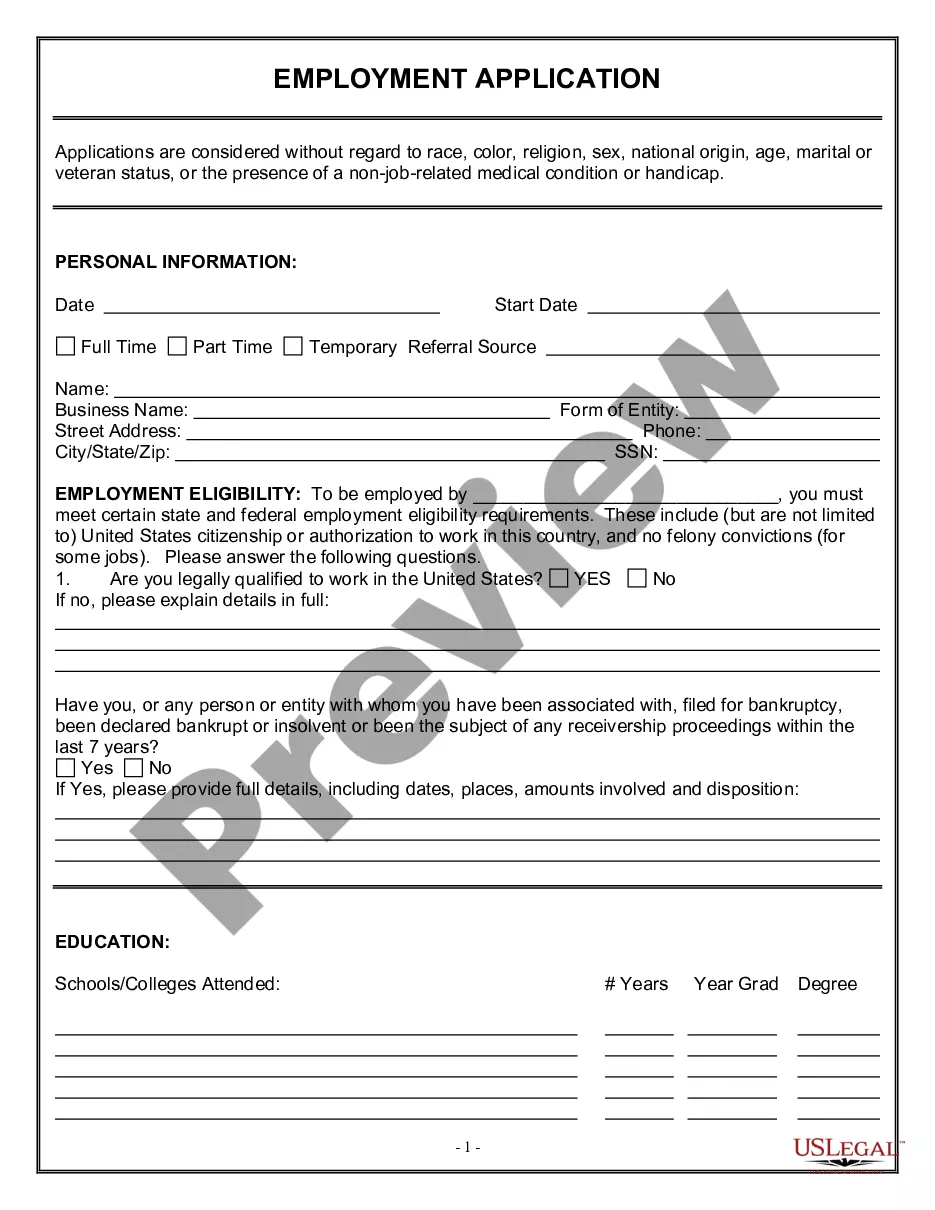

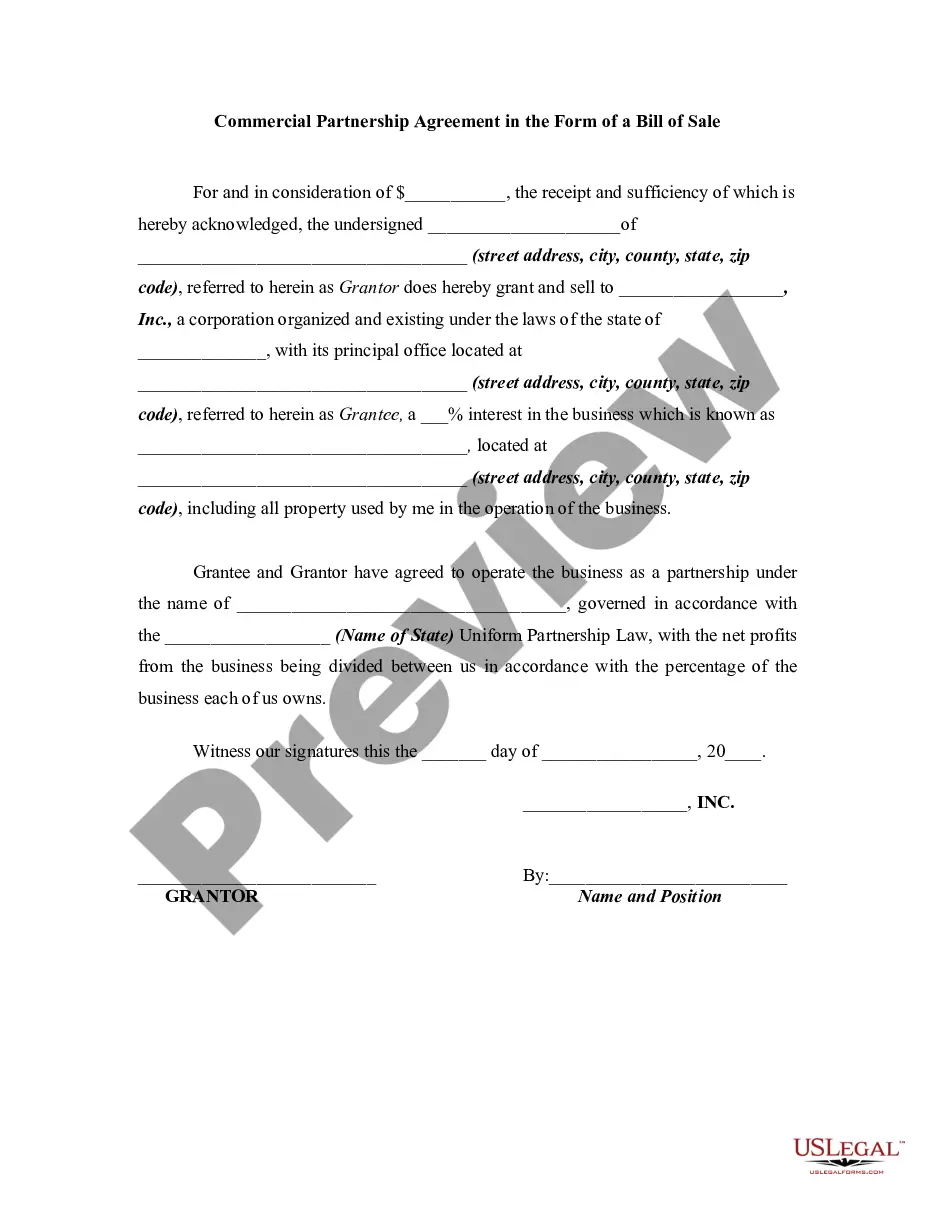

- Utilize the Preview button to review the form.

- Check the information to ensure you have selected the correct form.

- If the form does not meet your requirements, use the Search field to find the form that suits your needs and specifications.

Form popularity

FAQ

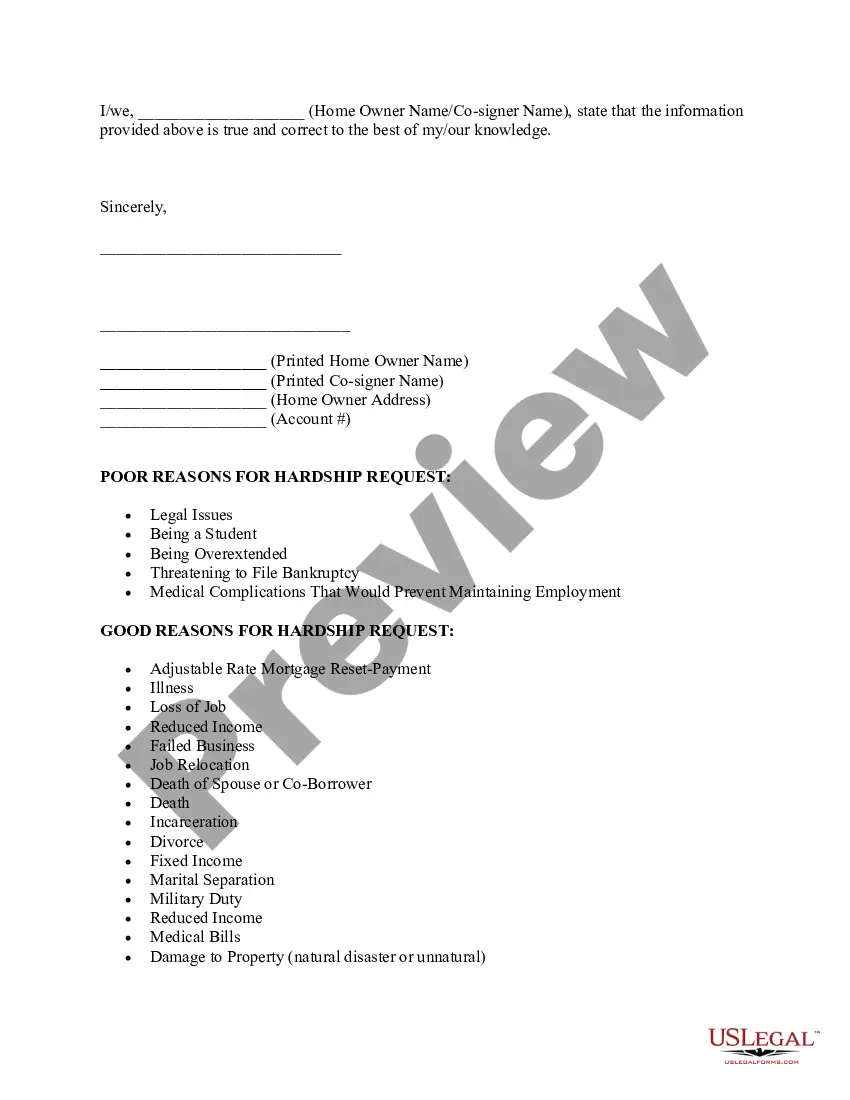

When composing your hardship letter, avoid including irrelevant personal details or excessive emotional language. Steer clear of blaming specific parties for your financial issues and focus instead on explaining your situation clearly and factually. Remember, the New Mexico Hardship Letter to Mortgagor or Lender to Prevent Foreclosure should be professional, to the point, and respectful to ensure a favorable response from your lender.

Filling out a financial hardship form involves providing accurate personal and financial information, such as income, expenses, and assets. Ensure you clearly describe your hardships in a concise manner, making it easy for the lender to understand your situation. You can use the New Mexico Hardship Letter to Mortgagor or Lender to Prevent Foreclosure as a reference, as it helps organize this information effectively.

An example of a hardship letter for a mortgage could begin by stating your name, address, and mortgage details, followed by a detailed account of your financial struggles. You may explain specific incidents like job loss or unexpected expenses that led to your current situation. By providing this context in your New Mexico Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, you help the lender understand your plight and consider possible remedies.

Writing a proof of hardship letter begins with a clear introduction stating your intention to prevent foreclosure using the New Mexico Hardship Letter to Mortgagor or Lender to Prevent Foreclosure. Be honest and specific about your financial situation, detailing the challenges you face, such as job loss or medical emergencies. Finally, conclude with a request for assistance or a solution, maintaining a respectful and formal tone throughout.

The 25k grant in New Mexico is designed to assist homeowners facing financial difficulties to prevent foreclosure. This funding can be used for mortgage payments and related housing costs, helping you maintain your home during tough times. Additionally, a New Mexico Hardship Letter to Mortgagor or Lender to Prevent Foreclosure can be a critical component in securing this aid, as it outlines your financial situation and requests assistance. Utilizing resources like US Legal Forms can help you create an effective hardship letter to navigate this process smoothly.

A hardship letter explains why a mortgage holder is defaulting on their loan and needs to sell their home for less than what they owe. Hardship may arise from unemployment, reduced income, a death in the family, divorce, military service, incarceration, or other situations.

How to Write an Effective Hardship LetterPart 1: Explain what happened and why you are applying.Part 2: Specifically illustrate the time and severity of the hardship.Part 3: Back up the reasons traditional remedies won't work.Part 4: Detail why you are stable enough to succeed with a modification.More items...?

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

A hardship letter should Start by stating the purpose of the letter whether it is a loan modification or a short sale so the lender knows what homeowners want. It should say something like I need to restructure my mortgage and obtain a lower, fixed interest rate2026, in a way that force them to find out why.

The definition of hardship is adversity, or something difficult or unpleasant that you must endure or overcome. An example of hardship is when you are too poor to afford proper food or shelter and you must try to endure the hard times and deprivation.