New Mexico Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

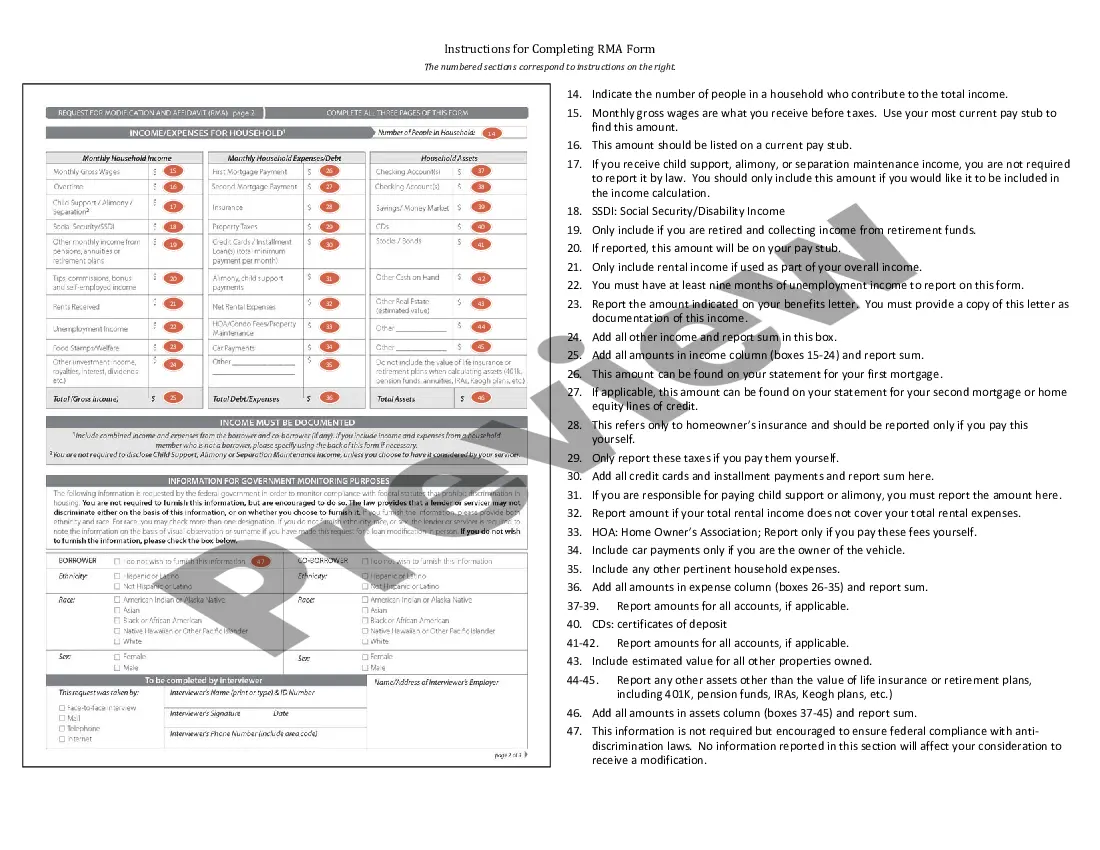

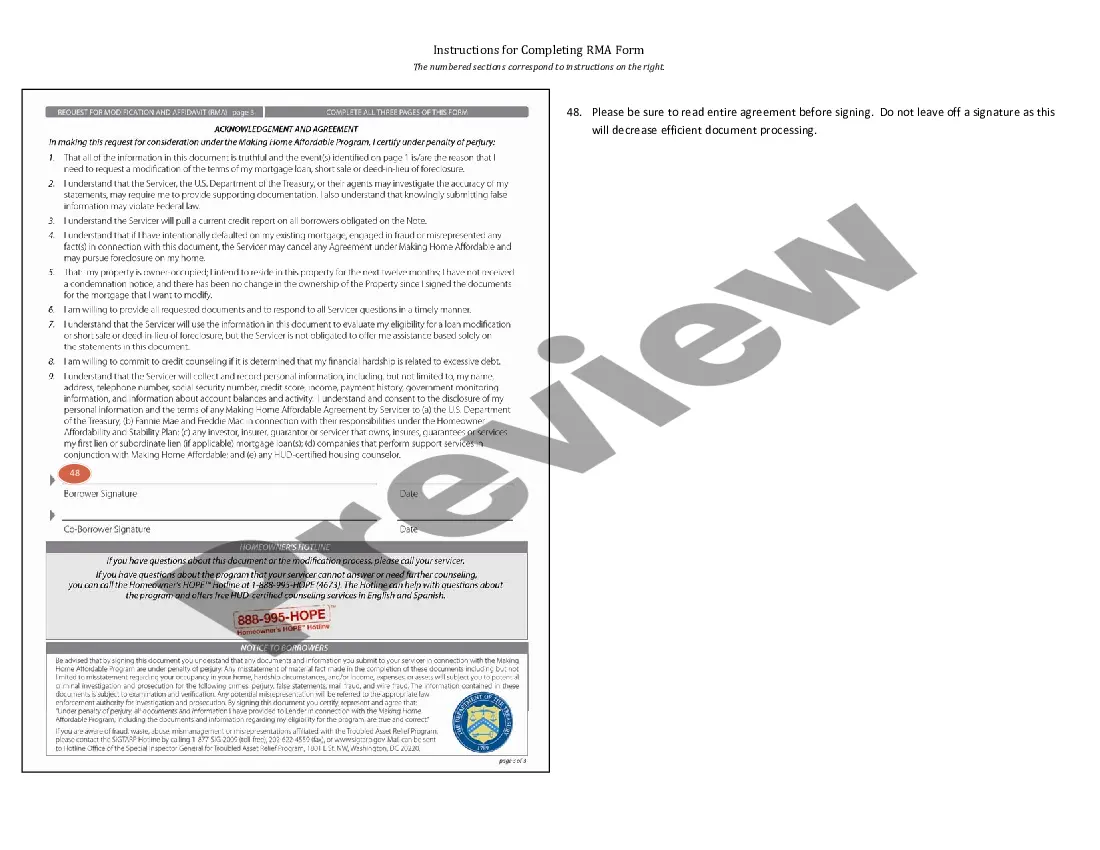

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

Locating the appropriate valid document template can be challenging. Of course, there are several designs available online, but how can you find the right version you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, such as the New Mexico Instructions for Completing Request for Loan Modification and Affidavit RMA Form, which can be employed for business and personal needs. Each of the forms is verified by professionals and complies with state and federal regulations.

If you are already registered, sign in to your account and click on the Download button to access the New Mexico Instructions for Completing Request for Loan Modification and Affidavit RMA Form. Use your account to browse the valid forms you have acquired previously. Go to the My documents section of your account and download a duplicate of the document you need.

Choose the format and download the valid document template to your device. Complete, edit, print, and sign the obtained New Mexico Instructions for Completing Request for Loan Modification and Affidavit RMA Form. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to download properly designed paperwork that adheres to state regulations.

- First, ensure you have selected the correct form for your locality/state.

- You can preview the document using the Preview feature and review the form description to confirm it is suitable for you.

- If the document does not fulfill your requirements, utilize the Search field to find the right form.

- Once you are certain that the form is accurate, click on the Order now button to obtain the form.

- Select the pricing plan you want and fill in the necessary information.

- Create your account and pay for the transaction using your PayPal account or credit card.

Form popularity

FAQ

The RMA mortgage form is a specific document that you complete when seeking assistance with your mortgage. It outlines your financial situation and requests changes to your current mortgage terms. When using the New Mexico Instructions for Completing Request for Loan Modification and Affidavit RMA Form, ensure you fill out the RMA mortgage form accurately to facilitate your request for modifications.

The full form of RMA in mortgage contexts is Request for Mortgage Assistance. This term encompasses the formal inquiry made by homeowners looking to modify their loan terms. Understanding this concept is vital when referring to the New Mexico Instructions for Completing Request for Loan Modification and Affidavit RMA Form, as it defines the process you're engaging in.

A hardship letter is a document that explains your financial difficulties to your mortgage lender. For instance, if you experienced a job loss, you would describe the situation, including how it has affected your ability to make mortgage payments. Incorporating this letter with the New Mexico Instructions for Completing Request for Loan Modification and Affidavit RMA Form can enhance your request for assistance.

In mortgage terminology, RMA refers again to Request for Mortgage Assistance. This process enables homeowners facing difficulties to seek adjustments to their mortgage terms. By following the New Mexico Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can articulate your request properly and improve your chances of obtaining the necessary financial relief.

RMA stands for Request for Mortgage Assistance in real estate contexts. This term refers to the process wherein homeowners ask for help modifying their mortgage for various reasons, such as financial hardship. When dealing with New Mexico Instructions for Completing Request for Loan Modification and Affidavit RMA Form, understanding the significance of RMA can empower you to navigate the mortgage assistance landscape effectively.

A loan modification form is a document that homeowners submit to their lenders when they seek to change the terms of their mortgage. This form includes important information about your financial situation and the desired modifications. In the context of New Mexico Instructions for Completing Request for Loan Modification and Affidavit RMA Form, it's crucial to provide accurate and complete details to increase your chances of approval.

The New Mexico Attorney General is responsible for enforcing the Home Loan Protection Act. This act aims to protect borrowers from unfair lending practices and ensures that lenders comply with state regulations. Understanding your rights under this act can be pivotal when navigating the New Mexico Instructions for Completing Request for Loan Modification and Affidavit RMA Form. By staying informed, you can better protect your interests as a borrower.

Yes, New Mexico allows for the use of a small estate affidavit. This affidavit simplifies the process for settling small estates, enabling heirs to claim property without going through probate. If you're looking for detailed guidance, the New Mexico Instructions for Completing Request for Loan Modification and Affidavit RMA Form will offer comprehensive steps to ensure you complete the process correctly. For additional support, the US Legal Forms platform provides tailored documents and resources to help you navigate local legal requirements with confidence.