New Mexico Leased Personal Property Workform

Description

How to fill out Leased Personal Property Workform?

Have you ever been in a situation where you require documents for either business or personal reasons frequently? There are numerous legal document templates available online, yet finding ones you can rely on is not simple.

US Legal Forms provides thousands of template forms, such as the New Mexico Leased Personal Property Workform, designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, just Log In. After that, you can download the New Mexico Leased Personal Property Workform template.

- Obtain the form you need and ensure it is for the correct city/region.

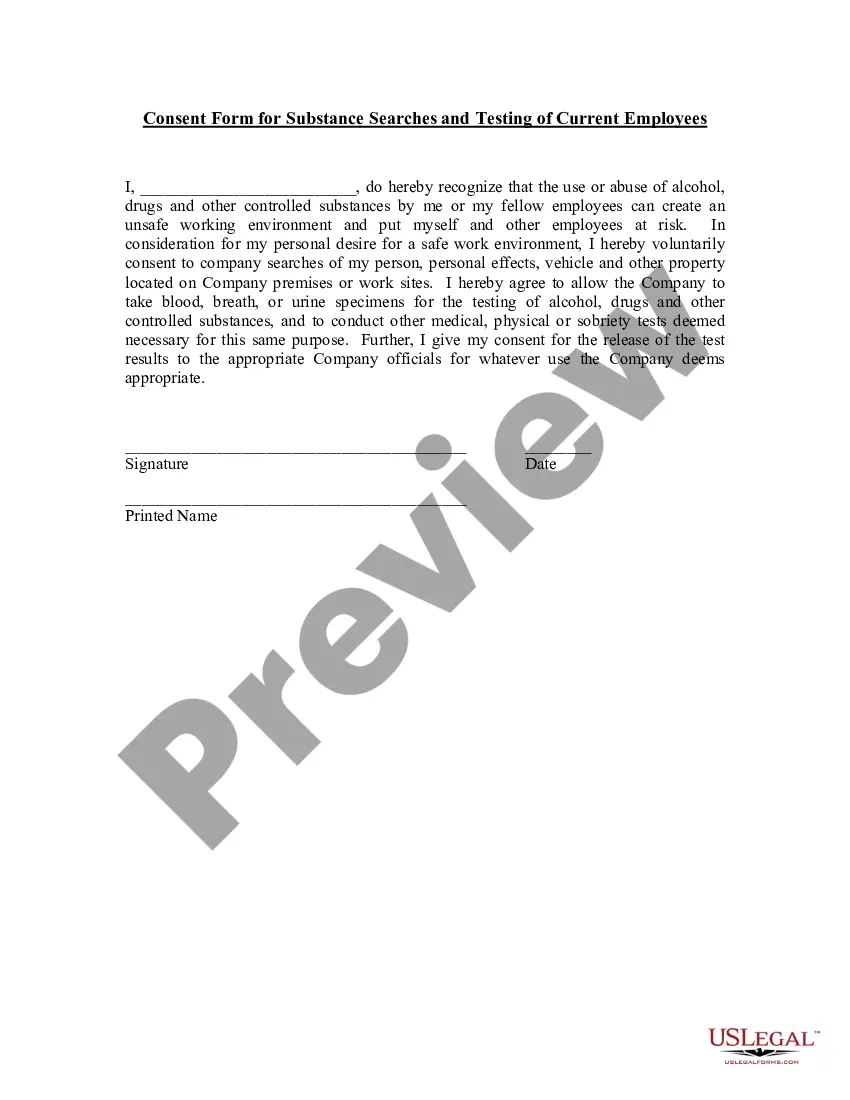

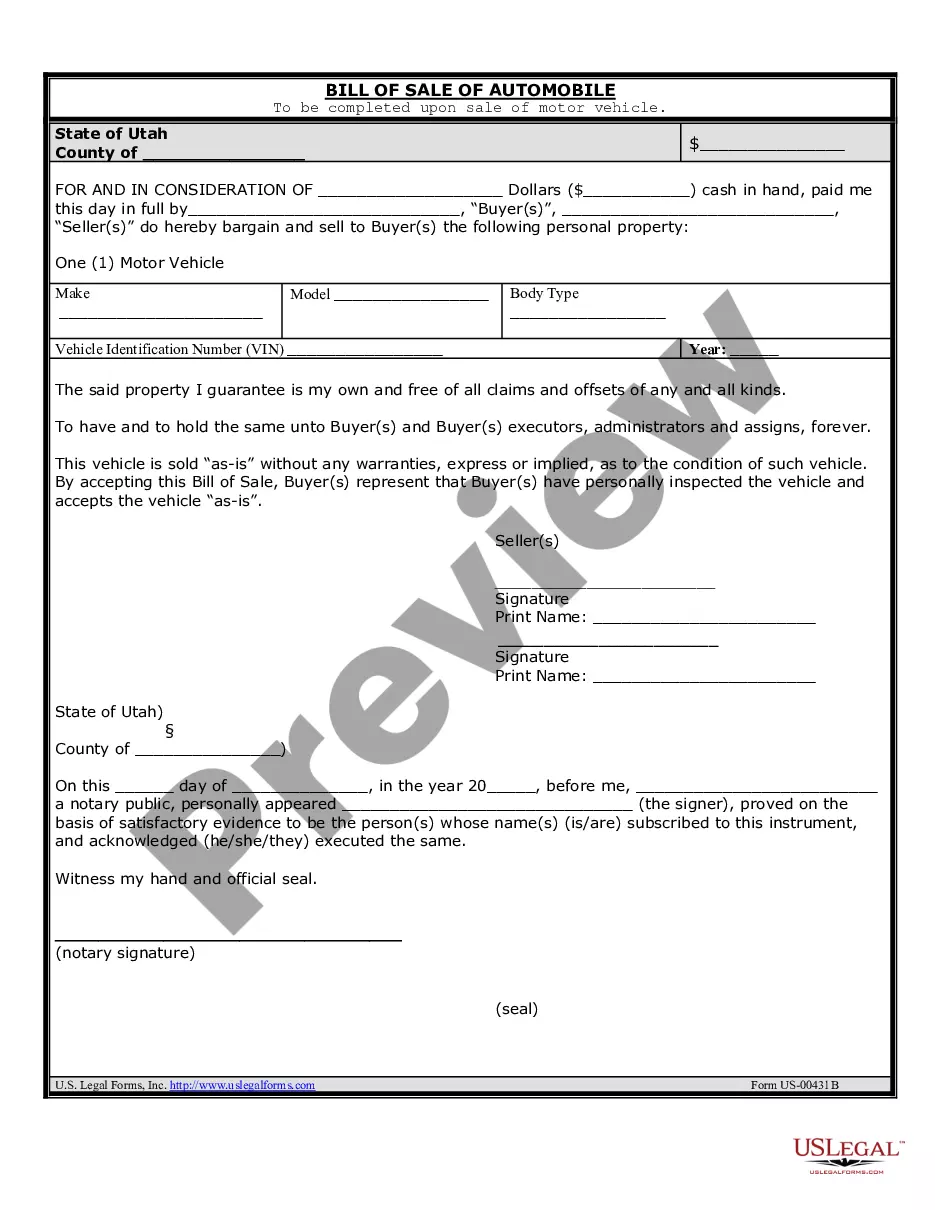

- Use the Review button to examine the form.

- Check the description to confirm you've selected the right form.

- If the form isn’t what you seek, use the Lookup field to find the form that meets your needs and requirements.

- Once you identify the correct form, click on Buy now.

- Choose the pricing plan you wish, fill out the necessary information to create your account, and pay for your order using PayPal or your credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Pass-through entity tax allows businesses to pass their income directly to owners or shareholders for tax purposes. This can be a smart strategy for managing tax liabilities and simplifying the filing process. If your business is considering this option, it’s crucial to evaluate how it would apply to your New Mexico Leased Personal Property Workform. Consulting with tax experts on our platform can provide insights tailored to your business situation, ensuring you make the best choice.

Tangible personal property in New Mexico includes physical items you can touch and move, such as furniture, machinery, and vehicles. This type of property is subject to taxation, which is why understanding it relates back to the New Mexico Leased Personal Property Workform. Accurate identification of these items ensures you report them correctly and adhere to state tax laws. Our platform provides helpful resources to guide you through the classification and reporting process.

PIT stands for Personal Income Tax, a crucial term for New Mexico residents. It refers to the tax levied on income earned by individuals and businesses, which includes income generated from leased personal property. Understanding PIT is essential for properly completing your New Mexico Leased Personal Property Workform, as it impacts your overall tax liability. By staying informed about PIT regulations, you can better manage your financial obligations and optimize your tax filing.

Schedule 1 of the New Mexico Leased Personal Property Workform should be completed by individuals or entities that handle leased personal property. This includes businesses that lease equipment, vehicles, or other tangible assets in New Mexico. By filling out this schedule accurately, you ensure clear reporting of your leased items and maintain compliance with New Mexico tax regulations. Using our platform can simplify this process greatly, guiding you through each necessary section.

Yes, New Mexico does impose a personal property tax on certain types of property, including leased personal property. It is essential for business owners to report their leased assets accurately using the New Mexico Leased Personal Property Workform. This form not only helps in tax calculation but also ensures compliance with state regulations. You can find detailed guidance and templates on uslegalforms to assist you with your tax planning.

The NYS-1 form is primarily used for reporting New York State withholding tax, not directly related to New Mexico transactions. However, if you operate in multiple states, understanding various tax forms, including the New Mexico Leased Personal Property Workform, is crucial for accurate reporting. For businesses handling personal property across state lines, compliance is simplified through comprehensive resources on platforms like uslegalforms. Familiarizing yourself with different forms helps streamline your tax responsibilities.

To apply for a New Mexico CRS number, you can submit an application online through the New Mexico Taxation and Revenue Department's website. This number is vital for businesses engaging in lease transactions, including those related to leased personal property. The process is straightforward, and uslegalforms offers resources to help you navigate the requirements. Ensure you have your business details ready for a smooth application experience.

Individuals and businesses that earn income in New Mexico must file a tax return. If you receive income from leased personal property, you will need to report it using the New Mexico Leased Personal Property Workform. Filing is essential to meet state tax obligations and avoid penalties. You can find guidance and support through uslegalforms to ensure compliance.

New Mexico does not tax Social Security benefits, which can be beneficial for retirees. However, pensions may be subject to state income tax depending on the source of the pension. To navigate these tax nuances, utilizing the New Mexico Leased Personal Property Workform alongside other resources can provide you with clarity and guidance.

In New Mexico, seniors may qualify for property tax exemptions based on their age and income level. Typically, residents aged 65 or older can apply for a low-income property tax exemption. If you are concerned about property taxes, exploring the New Mexico Leased Personal Property Workform can provide additional insights into your tax obligations.