A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes using a document designed to falsely imply that it issued from a state or federal source or creates a false impression as to its source, authorization or approval.

New Mexico Notice to Debt Collector - Falsely Representing a Document's Authority

Description

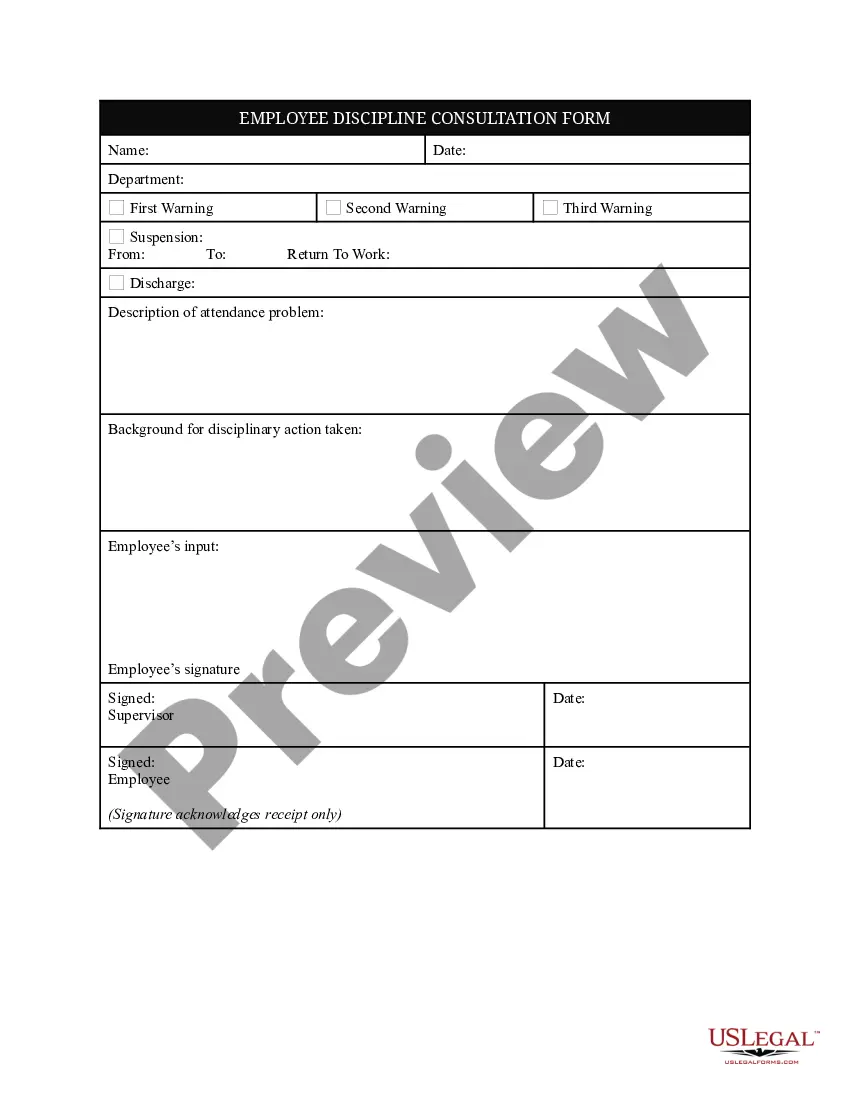

How to fill out Notice To Debt Collector - Falsely Representing A Document's Authority?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal document templates that you can download or print.

On the website, you'll discover thousands of templates for business and personal use, organized by categories, states, or keywords.

You can find the most recent versions of forms such as the New Mexico Notice to Debt Collector - Falsely Representing a Document's Authority in just moments.

Review the form description to confirm that you have chosen the right document.

If the form doesn't meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you already have a subscription, Log In to download New Mexico Notice to Debt Collector - Falsely Representing a Document's Authority from the US Legal Forms collection.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are some basic steps to help you begin.

- Ensure that you’ve selected the correct form for your city/state.

- Click on the Preview option to review the content of the form.

Form popularity

FAQ

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

If a collection account is incorrect or outdated, you can dispute the account with each credit bureau that's reporting the inaccurate information. Under the FCRA, when you submit a dispute the credit bureaus will have to investigate your claim.

If you believe any account information is incorrect, you should dispute the information to have it either removed or corrected. If, for example, you have a collection or multiple collections appearing on your credit reports and those debts do not belong to you, you can dispute them and have them removed.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

By law, a consumer must receive written notice (known as a debt validation letter) within five days of the collector's initial attempt to contact you. That notice must include the amount of the debt, the original creditor to whom the debt is owed and a statement of your right to dispute the debt.

If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

If you dispute the debt, the debt collector cannot report it to a credit reporting agency unless and until it verifies the debt. If the debt collector has already reported the debt (before it received your dispute letter), it must notify the credit reporting agencies that the debt is disputed.

A debt dispute letter demands that the collection agency demonstrate that you do indeed owe the debt and can provide detailed information and documents to prove the amount owed. Federal law says that after receiving written notice of a debt, consumers have a 30-day window to respond with a debt dispute letter.

If you do have a legitimate issue with a debt collection that shows up on your credit report, you can dispute it through the collector or the credit bureaus. To contact the collector directly, be sure you file a letter in writing within 30 days of first receiving communication about the debt.