Massachusetts Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc.

Description

How to fill out Long Term Performance And Restricted Stock Incentive Plan Of Ipalco Enterprises, Inc.?

Choosing the right lawful file format can be a have a problem. Needless to say, there are plenty of layouts available on the Internet, but how will you find the lawful develop you need? Make use of the US Legal Forms web site. The support offers a huge number of layouts, including the Massachusetts Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc., that can be used for organization and personal needs. Every one of the varieties are inspected by experts and meet federal and state needs.

Should you be already signed up, log in for your profile and then click the Down load button to have the Massachusetts Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc.. Utilize your profile to appear through the lawful varieties you possess ordered in the past. Proceed to the My Forms tab of your profile and have one more duplicate of the file you need.

Should you be a new end user of US Legal Forms, allow me to share basic instructions that you should comply with:

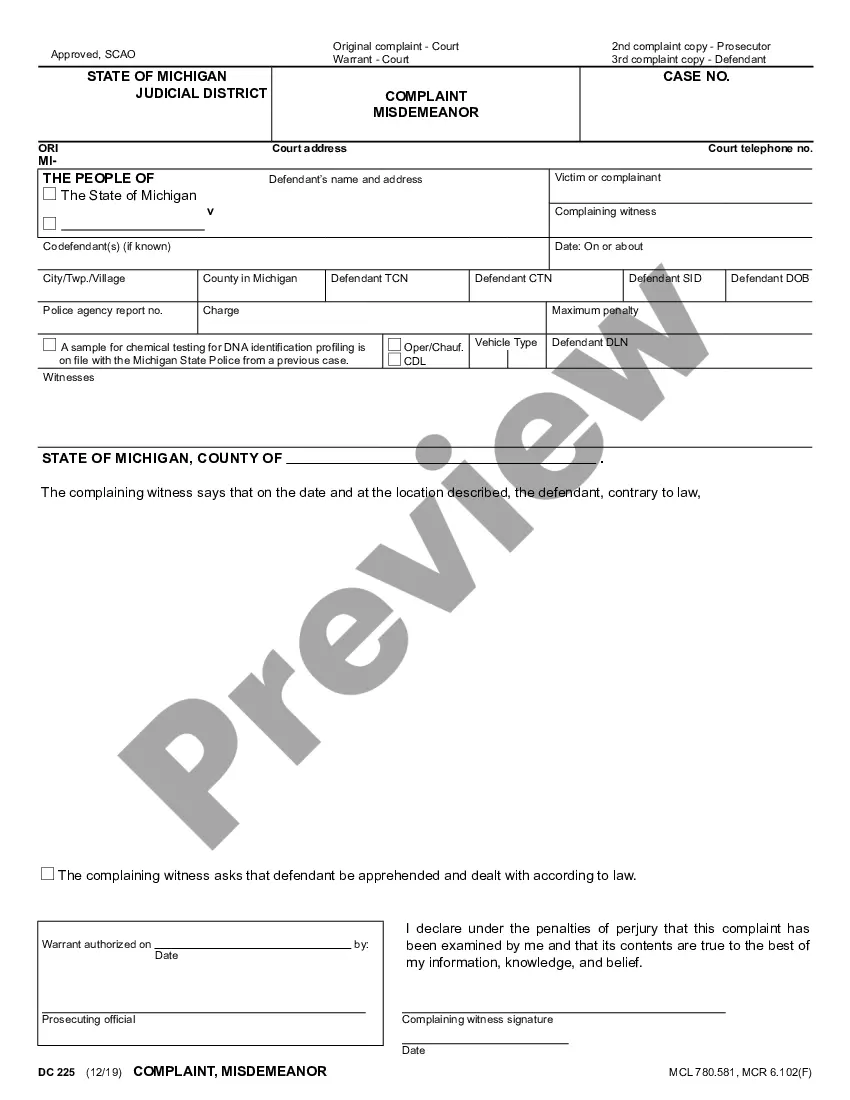

- First, ensure you have selected the appropriate develop for your personal city/state. You are able to look over the shape while using Review button and browse the shape information to guarantee it will be the best for you.

- If the develop does not meet your requirements, take advantage of the Seach industry to get the proper develop.

- When you are certain that the shape is proper, select the Acquire now button to have the develop.

- Pick the rates plan you want and enter in the necessary information and facts. Design your profile and pay money for the order making use of your PayPal profile or credit card.

- Select the document formatting and download the lawful file format for your product.

- Comprehensive, change and printing and indicator the obtained Massachusetts Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc..

US Legal Forms may be the greatest library of lawful varieties that you can see different file layouts. Make use of the service to download professionally-made paperwork that comply with condition needs.

Form popularity

FAQ

To summarize: RSU tax at vesting date is: The # of shares vesting x price of shares = Income taxed in the current year. If held beyond the vesting date, the RSU tax when shares are sold is: (Sales price ? price at vesting) x # of shares = Capital gain (or loss)

term incentive plan (LTIP or LTI plan) is a deferred compensation strategy to attract, reward and motivate your employees, while also helping your company to retain valued talent and grow.

RSUs are a type of restricted stock (which may also be known as ?letter stock? or ?restricted securities?). Restricted stock is company stock that cannot be fully transferable until certain restrictions have been met. These can be performance or timing restrictions, similar to restrictions for options.

term incentive plan (LTIP or LTI plan) is a deferred compensation strategy to attract, reward and motivate your employees, while also helping your company to retain valued talent and grow.

In a standard LTIP, the employee, who is normally a senior executive, is required to meet a number of criteria to receive the incentive. This incentive is paid out on top of the executive's base salary and can often come in the form of a cash incentive.

Here's an example. Say you've been granted 1,500 RSUs and the vesting schedule is 20% after one year of service, and then equal quarterly installments thereafter for the next three years. This would mean that after staying with your company for a year, 300 shares would vest and become yours.

An example of a long-term incentive could be a cash plan, equity plan or share plan. A long-term incentive plan can typically run between three years and five years before the full benefit of the incentive is received by the employee.

There isn't a prescribed form your LTIP has to take, but usually, the employee needs to hit targets or achieve pre-agreed upon goals to earn their bonus. In essence, if your management team increases the value of your shares, an LTIP recompenses them, usually after three to five trading years.