Maine Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company

Description

How to fill out Pooling And Servicing Agreement Contemplating The Sale Of Mortgage Loans To Trustee For Inclusion In The Trust Fund By The Company?

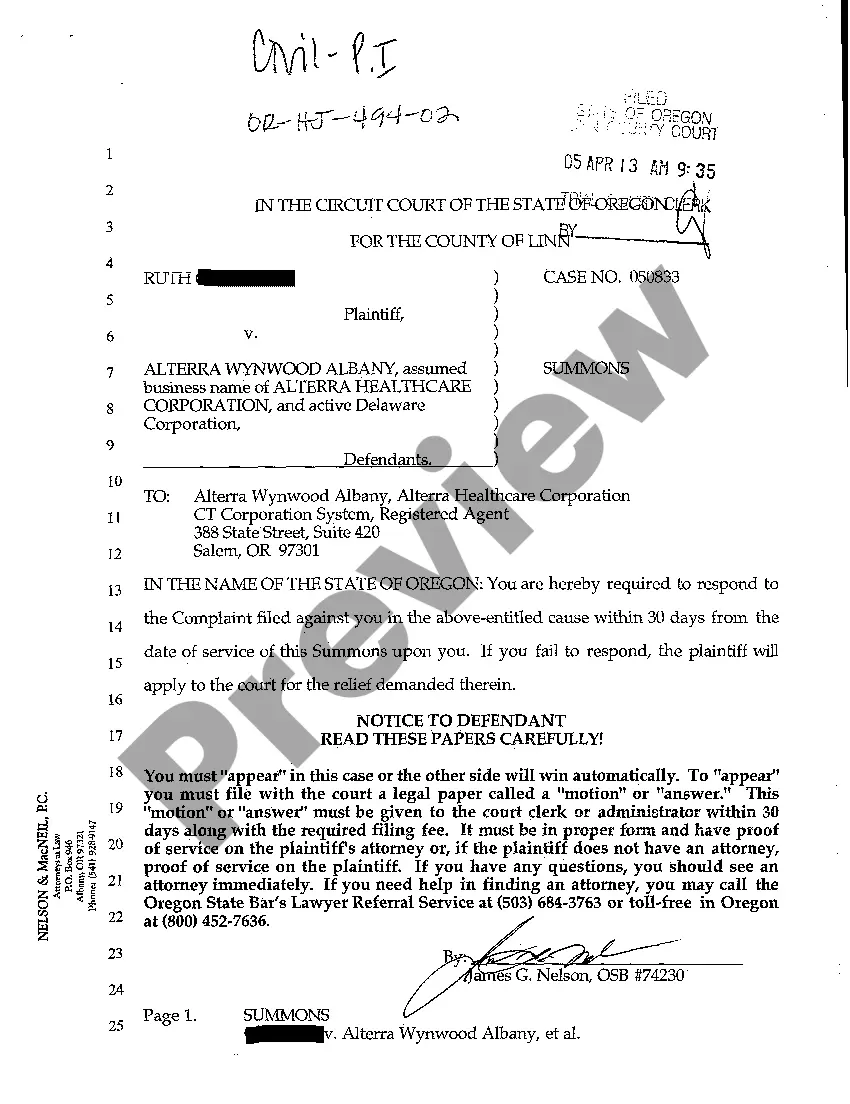

You are able to spend several hours on the web looking for the authorized record format that meets the federal and state specifications you need. US Legal Forms provides thousands of authorized forms that are evaluated by pros. You can easily acquire or print the Maine Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company from your services.

If you already possess a US Legal Forms bank account, you can log in and click the Acquire switch. Next, you can complete, modify, print, or sign the Maine Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company. Each authorized record format you purchase is your own property permanently. To get yet another duplicate of the obtained form, go to the My Forms tab and click the related switch.

Should you use the US Legal Forms web site for the first time, follow the straightforward guidelines under:

- Initially, make certain you have selected the proper record format to the county/area of your liking. Browse the form outline to ensure you have picked out the proper form. If offered, utilize the Review switch to search from the record format too.

- If you would like find yet another version from the form, utilize the Lookup industry to discover the format that fits your needs and specifications.

- After you have discovered the format you need, simply click Buy now to continue.

- Find the costs prepare you need, key in your references, and sign up for your account on US Legal Forms.

- Comprehensive the deal. You can use your Visa or Mastercard or PayPal bank account to purchase the authorized form.

- Find the structure from the record and acquire it to the gadget.

- Make adjustments to the record if needed. You are able to complete, modify and sign and print Maine Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company.

Acquire and print thousands of record web templates utilizing the US Legal Forms site, that provides the largest collection of authorized forms. Use professional and status-specific web templates to tackle your business or individual needs.

Form popularity

FAQ

A mortgage pool is a group of mortgages held in trust as collateral for the issuance of a mortgage-backed security. Some mortgage-backed securities issued by Fannie Mae, Freddie Mac, and Ginnie Mae are known as "pools" themselves.

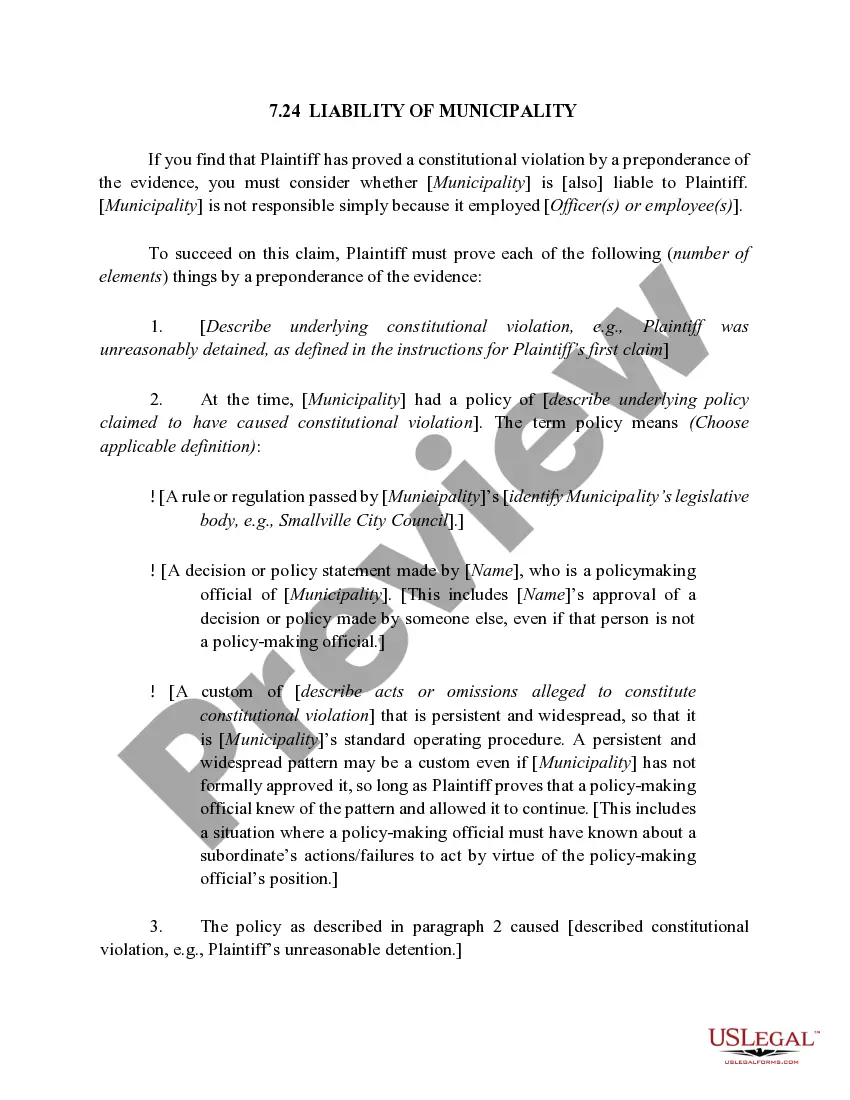

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

Mortgage servicers collect homeowners' mortgage payments and pass on those payments to investors, tax authorities, and insurers, often through escrow accounts. Servicers also work to protect investors' interests in mortgaged properties, for example, by ensuring homeowners maintain proper insurance coverage.

A mortgage pool is a form of alternative investment that provides mortgages to those who may not be approved through usual methods. Essentially, a group of investors pool their money together and invest in projects that range from commercial to residential property.

Securitization. Act of pooling mortgages and then selling them as mortgage-backed securities. - Mortgage loans purchased from the primary mortgage market are assembled into pools by a government/quasi-governmental entity or a private investor who operates in the secondary mortgage market.

Opens in a new tab. opens in a new tab. Servicing Agreements. Introduction. A Servicing Agreement (or Loan Servicing Agreement) is a document entered into in connection with a facility established for the securitization of various types of assets, most often loans, receivables or leases.

More complicated mortgage-backed securities, known as collateralized mortgage obligations (CMOs) or real estate mortgage investment conduits (REMICs), consist of multiple classes of securities designed to appeal to investors with different investment objectives and risk tolerances.

A collateralized mortgage obligation (CMO) is a fixed-income security with a pool of mortgage loans that are similar in a variety of ways, like credit score or loan amount, and are combined and resold as a single packaged investment to investors called a security.