Massachusetts Executive Employee Stock Incentive Plan

Description

How to fill out Executive Employee Stock Incentive Plan?

You can spend hours online trying to locate the legal document format that meets the local and federal requirements you need.

US Legal Forms offers thousands of legal templates that have been reviewed by professionals.

It is easy to access or create the Massachusetts Executive Employee Stock Incentive Plan from their service.

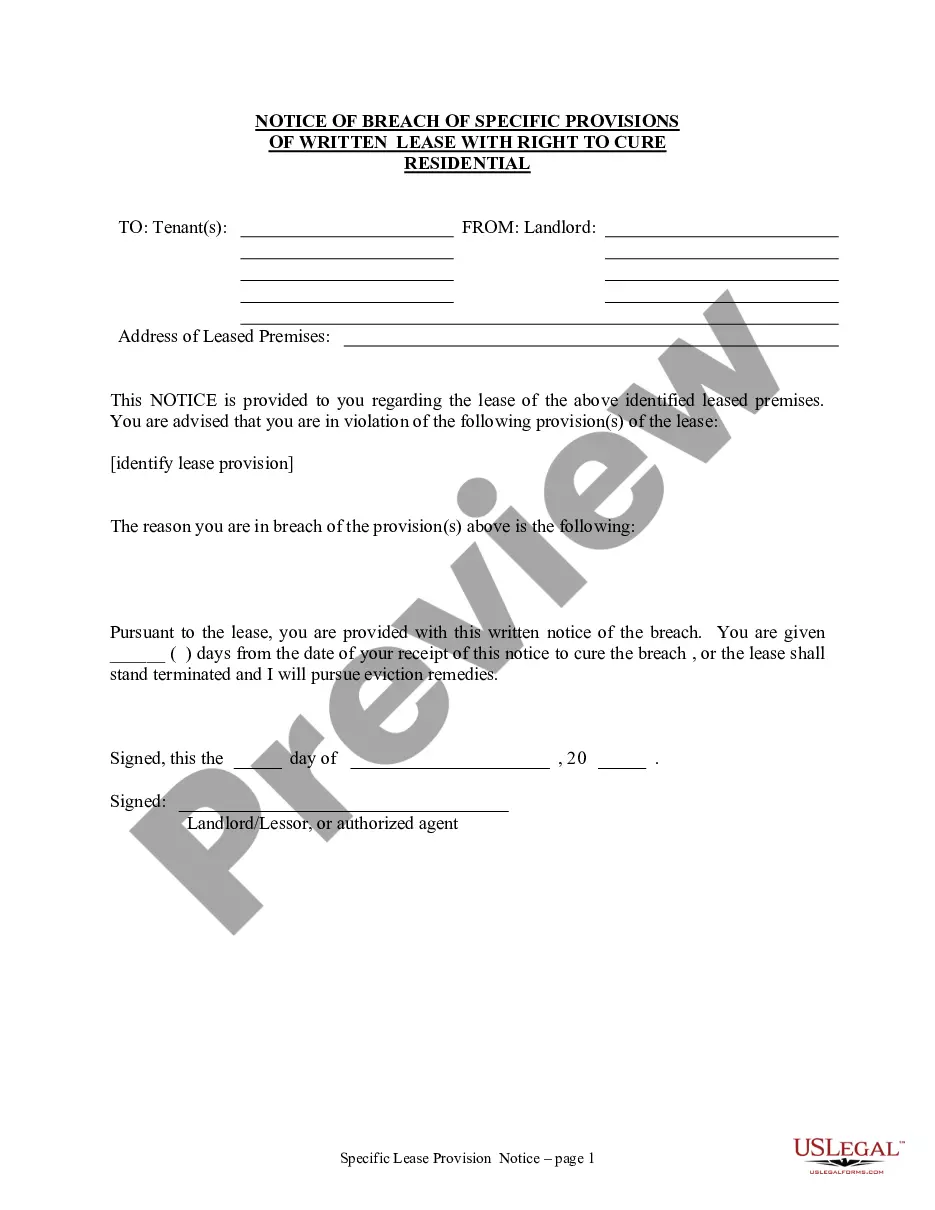

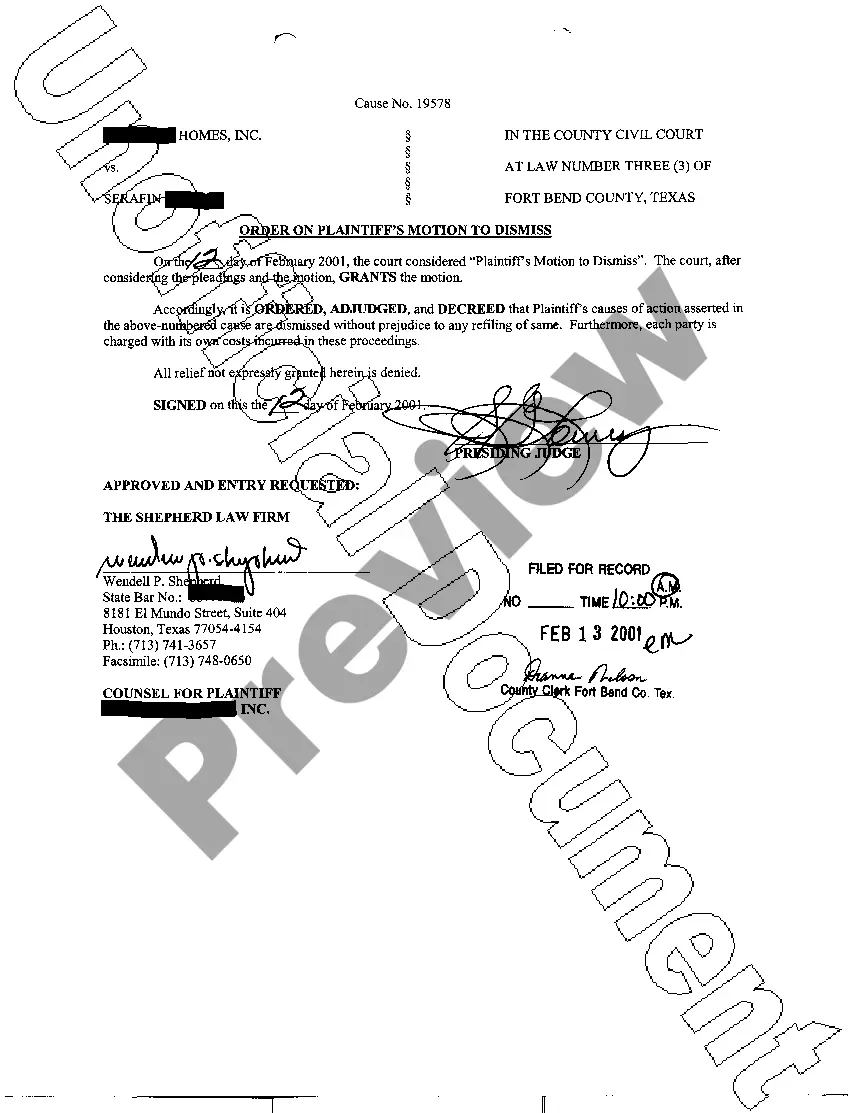

If available, utilize the Preview button to examine the document format as well.

- If you already possess a US Legal Forms account, you can Log In and hit the Download button.

- After that, you can complete, modify, create, or sign the Massachusetts Executive Employee Stock Incentive Plan.

- Every legal document format you obtain is yours indefinitely.

- To retrieve another copy of any acquired form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document format for the area/city of your choice.

- Review the form outline to verify you have chosen the correct form.

Form popularity

FAQ

Incentive stock options (ISOs) are generally not taxed at the time of exercise, but the amount may trigger the Alternative Minimum Tax. If you sell the shares after meeting specific holding periods, you may qualify for favorable capital gains tax rates. Understanding the tax implications of the Massachusetts Executive Employee Stock Incentive Plan is essential, as it can provide significant tax benefits if managed correctly.

When stock options are exercised, the income is reported on Form 1099-MISC if you have received nonqualified options and earned income from exercising them. This form documents the amount you made from the transaction and is crucial when filing your tax return. If you are part of a Massachusetts Executive Employee Stock Incentive Plan, it's important to understand these reporting requirements and how they affect your overall tax situation.

To report incentive stock options on your tax return, you typically need to complete Form 8949 for any sales, indicating whether the sale resulted in a gain or a loss. Additionally, if you exercised the options and held the stock, you must consider the implications for the Alternative Minimum Tax. The Massachusetts Executive Employee Stock Incentive Plan may provide unique considerations for reporting, so it’s wise to seek professional guidance to navigate your tax obligations effectively.

When you exercise stock options, the income from the exercise usually appears on your W-2 in Box 1 as part of your taxable income. However, nonqualified stock options (NQSOs) might have a different reporting approach, so it is important to clarify your options with your employer. If you belong to a Massachusetts Executive Employee Stock Incentive Plan, this could influence your W-2 reporting, making it essential to verify your individual circumstances.

Filing an Employee Stock Ownership Plan (ESOP) involves several steps that can be streamlined through platforms like UsLegalForms. Begin by drafting a plan document that describes the ESOP structure and operation, ensuring compliance with IRS regulations. After the plan is established, you must file Form 5500 annually, which reports financial information about the plan. The Massachusetts Executive Employee Stock Incentive Plan could be a beneficial structure to explore in the context of an ESOP.

To report incentive stock options (ISOs) on your taxes, start by determining whether you sold the stock in the same year you exercised the options. If you did, you will report the sale on Schedule D and Form 8949. For those who hold the stock, keep track of the fair market value at exercise, as it will impact your Alternative Minimum Tax. The Massachusetts Executive Employee Stock Incentive Plan may include specific reporting obligations, so consult a tax professional for your unique situation.

The employee stock incentive program offers a way for companies to reward employees through equity ownership. This program helps align employee interests with those of the company. By participating in the Massachusetts Executive Employee Stock Incentive Plan, employees gain a sense of ownership that can drive productivity and loyalty. Moreover, this program can enhance recruitment and retention efforts.

To qualify for incentive stock options, individuals must be employees of the company and meet specific criteria established in the Massachusetts Executive Employee Stock Incentive Plan. Typically, this includes full-time status and sometimes performance benchmarks. Properly defining eligibility ensures that the plan is targeted and effective in rewarding the right talent.

Restricted stock units (RSUs) are taxed as ordinary income upon vesting in Massachusetts. The fair market value of the shares at the time of vesting is considered taxable income. Understanding the tax implications of RSUs is vital for both the employee and employer to ensure compliance and proper financial planning within the Massachusetts Executive Employee Stock Incentive Plan.

Eligibility for incentive stock options under the Massachusetts Executive Employee Stock Incentive Plan is typically limited to employees of the issuing company. This includes those who meet certain employment duration or position criteria. It is essential to establish clear guidelines to maximize the effectiveness of the plan and foster employee loyalty.