New Mexico Log of Records Retention Requirements

Description

How to fill out Log Of Records Retention Requirements?

Are you currently in a scenario where you require documents for both business or personal purposes almost every day.

There are numerous official document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of form templates, such as the New Mexico Log of Records Retention Requirements, which can be downloaded to comply with state and federal regulations.

When you find the right form, click Buy now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the New Mexico Log of Records Retention Requirements template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the right area/state.

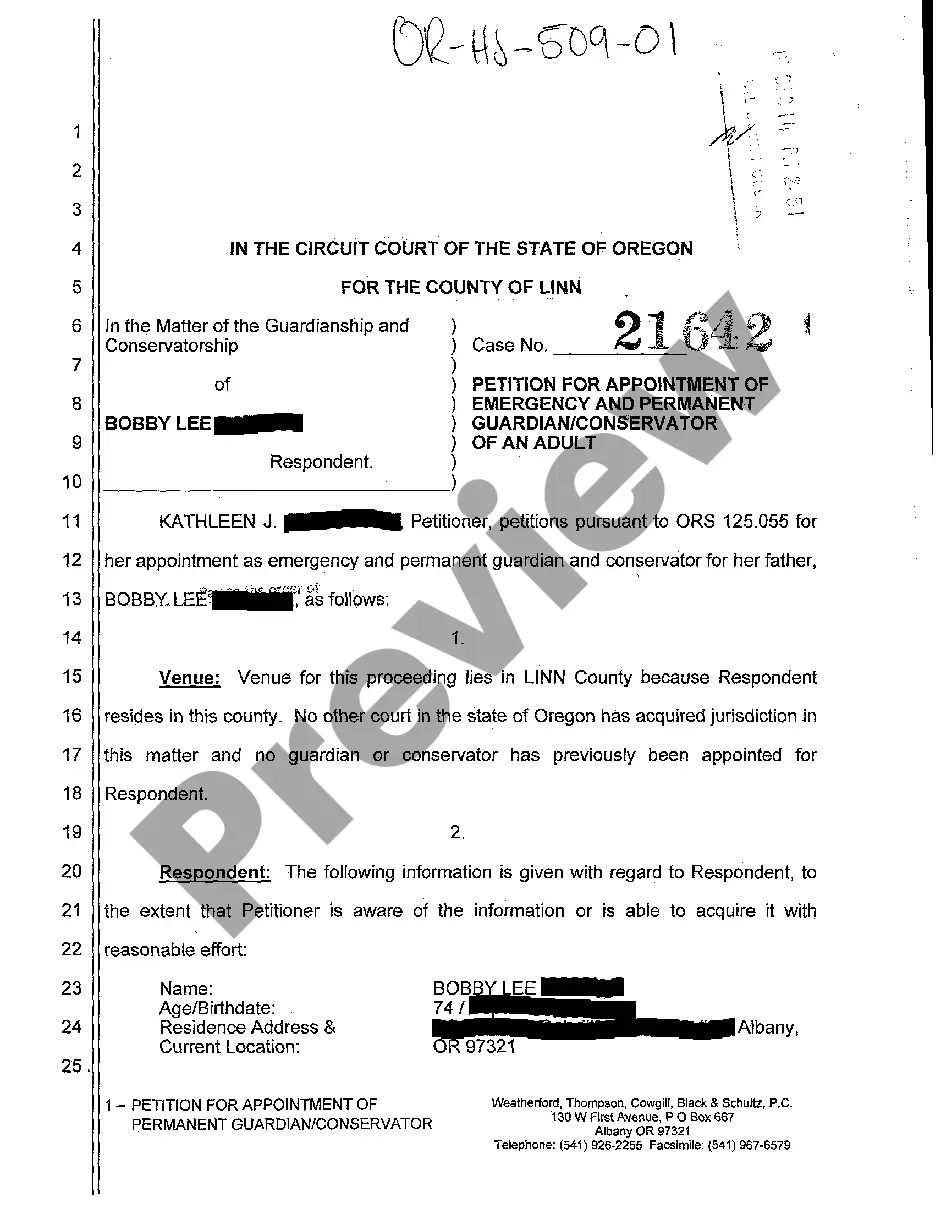

- Utilize the Preview button to view the form.

- Review the description to confirm that you have selected the correct document.

- If the form is not what you are looking for, use the Search field to locate the form that meets your needs and requirements.

Form popularity

FAQ

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

Under Fair Labor Standards Act (FLSA) recordkeeping requirements applicable to the EPA, employers must keep payroll records for at least three years.

Books, accounts, records and other documents pertaining to a mortgage lender, broker and loan originator's business must be kept for at least 3 years after making the final entry on any application or loan. 6 years Mortgage loan companies and brokers must maintain records for six years. N.M. Stat. § 5821-11.

New Mexico statute requires that medical records for Medicaid patients must be kept for at least six years from the date of creation of the record. NMSA 1978 § 27-11-4 A. (2016). Hospital records, regardless of the insurer, must be retained for ten years.

Section 1026.25(c)(2)(i) requires a creditor to maintain records sufficient to evidence all compensation it pays to a loan originator, as well as the compensation agreements that govern those payments, for three years after the date of the payments.

As a general rule of thumb, tax returns, financial statements and accounting records should be retained for a minimum of six years.

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.

Mortgage retention is when a lender refuses to release the entire mortgage funds to a customer straight away. They retain some of the capital until certain works have been carried out.

Different records are kept for different lengths of time. Most records are destroyed after a certain period of time. Generally most health and care records are kept for eight years after your last treatment.

After a loan is liquidated, the servicer must keep the individual loan records for at least four years, unless the local jurisdiction requires longer retention or Fannie Mae specifies that the records must be retained for a longer period.