New Mexico Startup Package

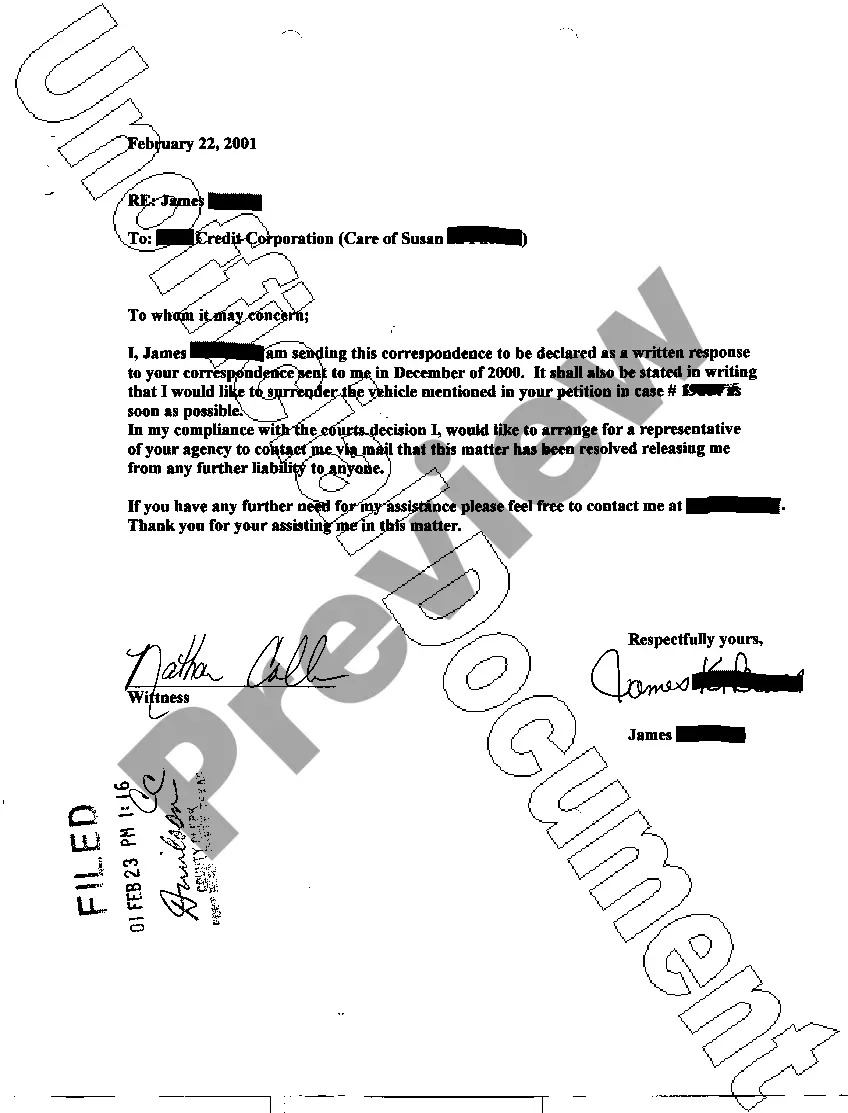

Description

How to fill out Startup Package?

You can devote hrs on-line attempting to find the lawful record web template that suits the state and federal demands you need. US Legal Forms gives thousands of lawful types which can be reviewed by specialists. You can easily download or print out the New Mexico Startup Package from the assistance.

If you currently have a US Legal Forms accounts, you are able to log in and then click the Acquire option. After that, you are able to total, change, print out, or sign the New Mexico Startup Package. Every lawful record web template you purchase is yours for a long time. To acquire another backup of any obtained kind, proceed to the My Forms tab and then click the related option.

If you work with the US Legal Forms web site for the first time, adhere to the straightforward recommendations under:

- First, ensure that you have selected the best record web template for the county/city that you pick. See the kind information to make sure you have picked the appropriate kind. If accessible, use the Review option to look through the record web template at the same time.

- If you wish to locate another variation from the kind, use the Search field to get the web template that fits your needs and demands.

- When you have identified the web template you would like, click Acquire now to carry on.

- Select the prices prepare you would like, key in your references, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can use your Visa or Mastercard or PayPal accounts to pay for the lawful kind.

- Select the file format from the record and download it for your device.

- Make modifications for your record if possible. You can total, change and sign and print out New Mexico Startup Package.

Acquire and print out thousands of record layouts while using US Legal Forms web site, that offers the most important selection of lawful types. Use expert and condition-certain layouts to handle your small business or specific needs.

Form popularity

FAQ

Obtain Tax ID Numbers In order to obtain an EIN or a FEIN, visit the IRS Application for Employer Identification Number. Register with the New Mexico Secretary of the State Business Services. You may register online at the New Mexico Taxation & Revenue Department website for your CRS registration.

Name your New Mexico LLC. ... Create a business plan. ... Get an employer identification number (EIN) ... File New Mexico LLC Articles of Organization. ... Choose a registered agent in New Mexico. ... Obtain a business license and permits. ... Understand New Mexico state tax requirements. ... Prepare an operating agreement.

If you file your LLC by mail, it will be approved in 15-20 business days. But if you file online, your LLC will be approved in 1-3 business days. Please see How long does it take to get an LLC in New Mexico to check for any delays.

New Mexico LLC Formation Filing Fee: $50 The fee to file your New Mexico LLC's Articles of Organization is $50. You must file with the New Mexico Secretary of State through the online Business Services Division portal.

New Mexico State Income Tax If your New Mexico LLC is taxed as a C-corp, each member will need to pay the corporate income tax of 4.8% on sales of $500,000 and below, or 5.9% on any sales above that. Each member will file Form CIT-1.

Name your New Mexico LLC. ... Create a business plan. ... Get an employer identification number (EIN) ... File New Mexico LLC Articles of Organization. ... Choose a registered agent in New Mexico. ... Obtain a business license and permits. ... Understand New Mexico state tax requirements. ... Prepare an operating agreement.