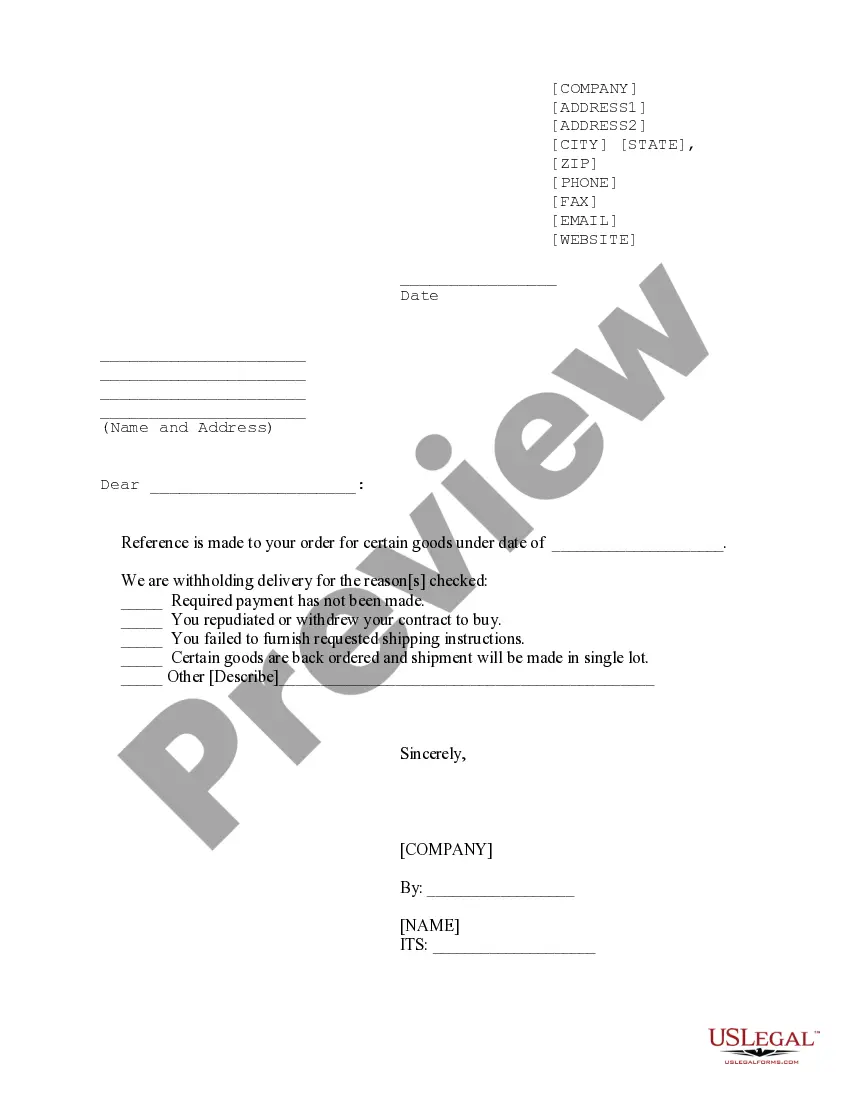

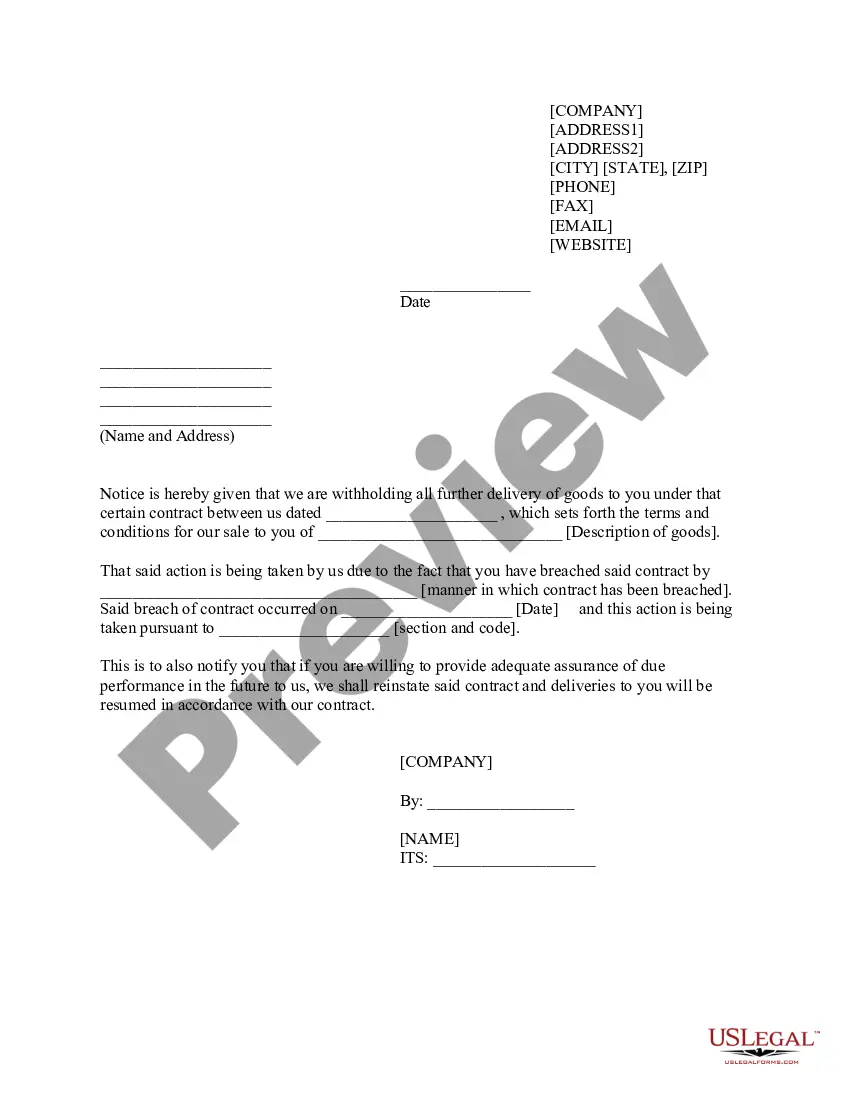

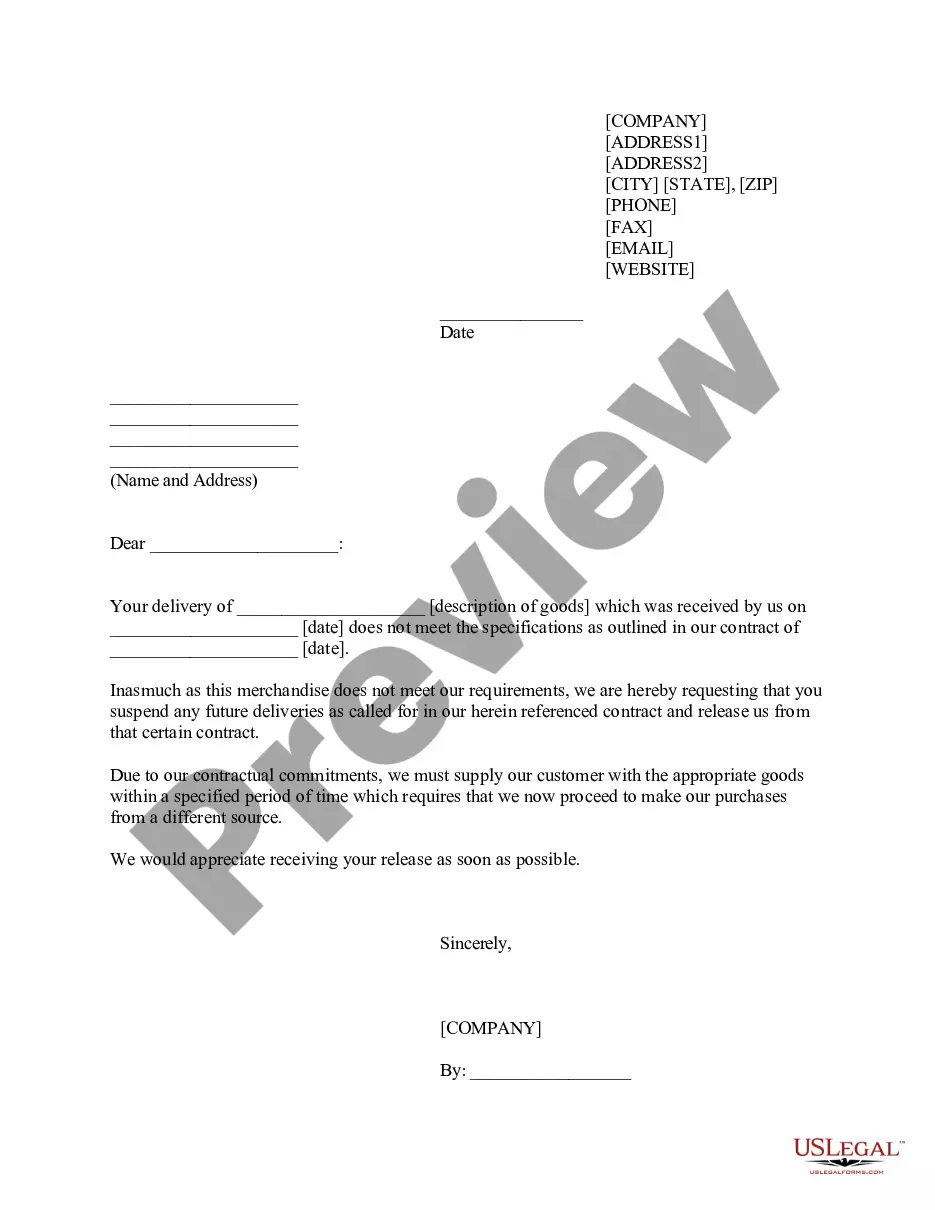

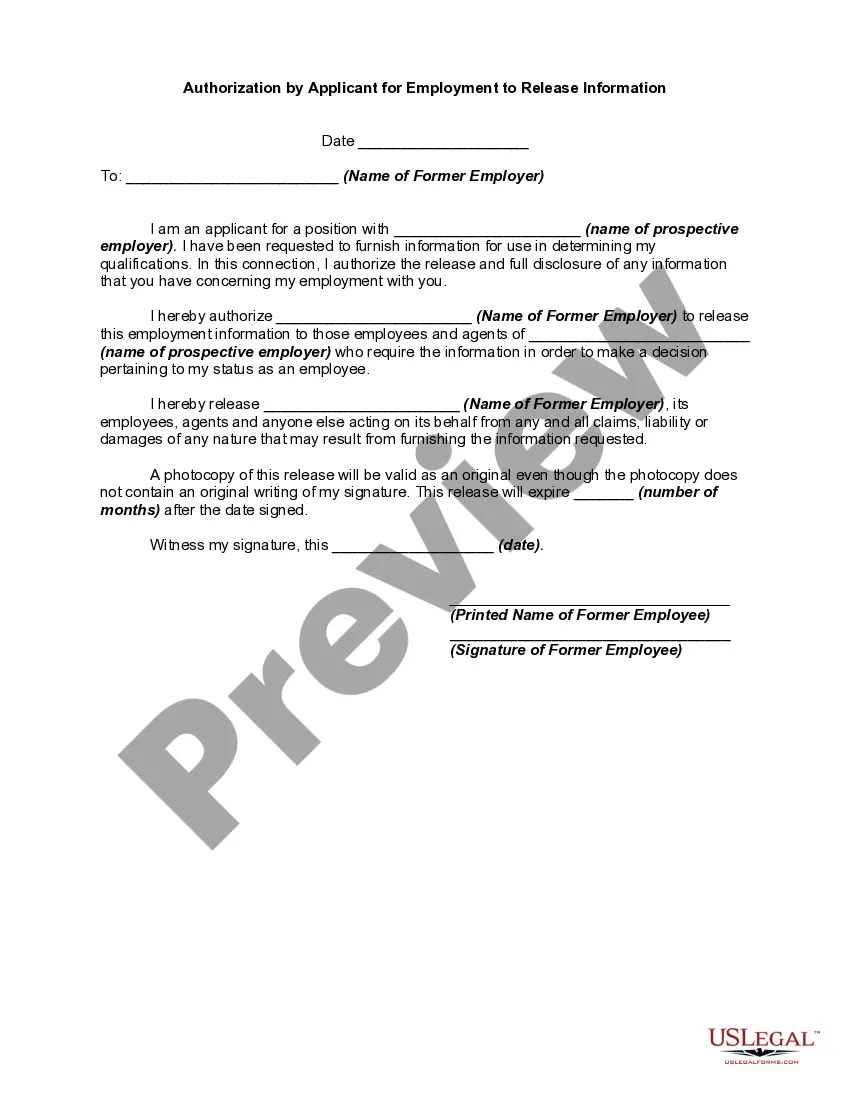

New Mexico Withheld Delivery Notice

Description

How to fill out Withheld Delivery Notice?

If you wish to complete, obtain, or generate official document formats, utilize US Legal Forms, the largest assortment of official templates available online.

Make use of the site's straightforward and convenient search feature to find the documents you need.

A selection of formats for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the purchase. You may use your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of the official document and download it to your device. Step 7. Complete, modify, and print or sign the New Mexico Withheld Delivery Notice. Every official document template you obtain is yours indefinitely. You can access each document you downloaded in your account. Click the My documents section and choose a document to print or download again. Finish and download, and print the New Mexico Withheld Delivery Notice with US Legal Forms. There are numerous professional and state-specific templates you can use for your business or personal requirements.

- Utilize US Legal Forms to locate the New Mexico Withheld Delivery Notice with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire option to download the New Mexico Withheld Delivery Notice.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Remember to read the instructions.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other types of the official form template.

- Step 4. Once you find the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your information to register for the account.

Form popularity

FAQ

New Mexico bases its withholding tax on an estimate of an employee's State income tax liability. The State credits taxes withheld against the employee's actual income tax liability on the New Mexico personal income tax return. State withholding tax is like federal withholding tax.

Apply online at the NM Taxpayer Access Point portal to receive the ID number in 2 days. This number is also used for NM Worker's Compensation payments and filing.Find an existing CRS ID Number: On Form CRS-1, Combined Report System. By contacting the Dept. of Taxation and Revenue.

New Mexico Withholding: What you need to know The New Mexico income tax withholding law requires employers in the state to withhold the New Mexico tax from wages paid to all employees for service performed within the state and from wages of New Mexico residents for performing services outside the state.

Notify the Taxation and Revenue Department of your close-of-business date by logging in to your administrator account online profile in the TAP system. Click more account options under the BTIN you wish to close. Under the Manage my account cube, click close account.

The W-4 is a form that you complete and give to your employer (not the IRS) for federal tax and the equivalent form for state tax withholding. The W-4 communicates to your employer(s) how much federal and/or state tax you - and your spouse if s/he works - wish to have withheld from each paycheck in a pay period.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund.

New Mexico does not have a form equivalent to the federal Form W-Q. For New Mexico withholding tax you should use a federal W-4 and write across the top of that form: For New Mexico Withholding Tax Only.

The following states opted to create their own state W-4 forms: Delaware, Idaho, Nebraska, Oregon, South Carolina, and Wisconsin whereas Colorado, New Mexico, North Dakota, and Utah will adopt the new inputs that the 2020 Federal W-4 put forth.

Have New Employees Complete a Federal Tax Form All new employees for your business must complete both a federal Form W-4. Unlike some other states, New Mexico does not have a separate state equivalent to Form W-4, but instead relies on the federal form. You can download blank Forms W-4 from irs.gov.