Have you been in the placement the place you need to have files for both business or personal reasons virtually every day time? There are a variety of legal record templates available on the Internet, but getting ones you can rely is not easy. US Legal Forms offers a huge number of form templates, like the New Mexico Complaint for Wrongful Repossession of Automobile and Impairment of Credit, which can be composed to fulfill state and federal needs.

Should you be already acquainted with US Legal Forms website and also have a merchant account, simply log in. Afterward, it is possible to down load the New Mexico Complaint for Wrongful Repossession of Automobile and Impairment of Credit web template.

Unless you offer an account and need to begin to use US Legal Forms, adopt these measures:

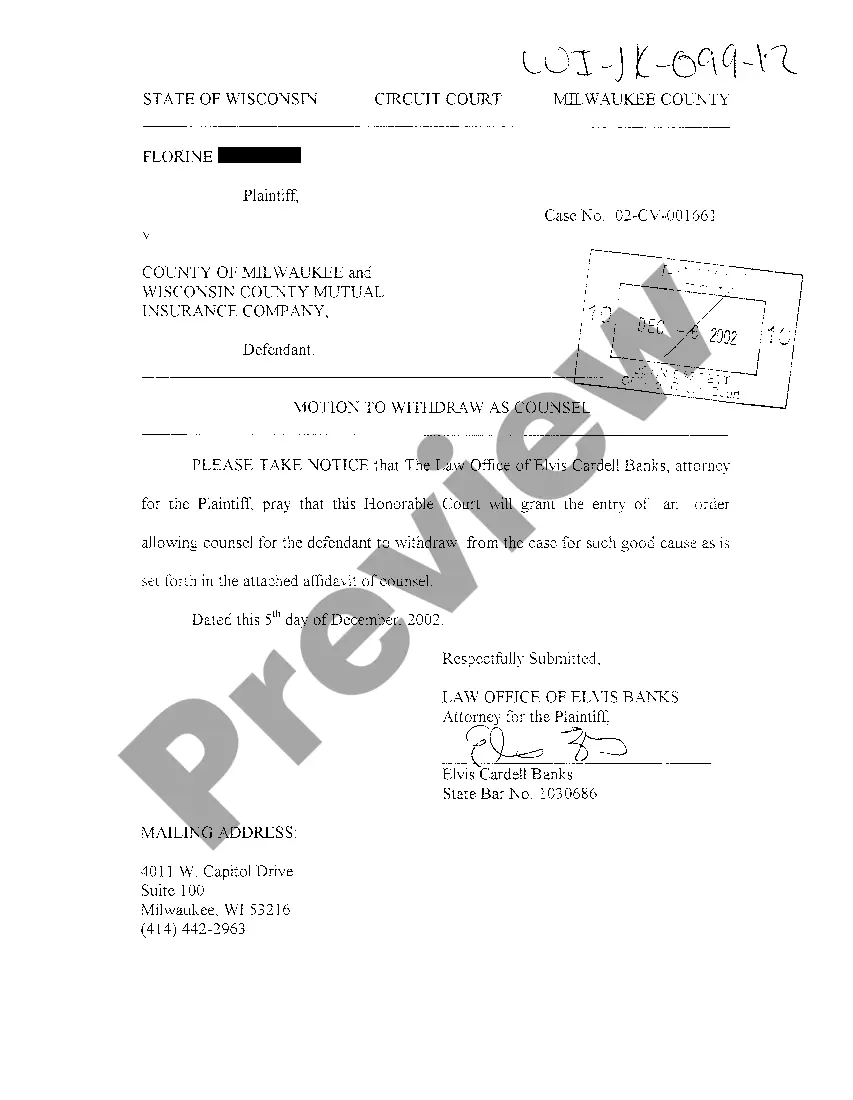

- Get the form you require and make sure it is for the proper city/county.

- Take advantage of the Preview button to review the form.

- Look at the information to actually have chosen the correct form.

- In case the form is not what you`re looking for, make use of the Search industry to discover the form that fits your needs and needs.

- If you get the proper form, click Acquire now.

- Select the pricing program you would like, fill in the specified info to create your account, and pay for your order utilizing your PayPal or credit card.

- Choose a practical file structure and down load your version.

Discover each of the record templates you possess bought in the My Forms menu. You can obtain a additional version of New Mexico Complaint for Wrongful Repossession of Automobile and Impairment of Credit anytime, if possible. Just go through the required form to down load or print the record web template.

Use US Legal Forms, the most extensive collection of legal kinds, to save time as well as avoid errors. The support offers skillfully manufactured legal record templates which you can use for a selection of reasons. Produce a merchant account on US Legal Forms and begin creating your lifestyle a little easier.