Artwork in tangible form is personal property. Transfer of title can therefore be made by a Bill of Sale. A Bill of Sale also constitutes a record of the transaction for both the artist and the person buying the artwork. It can provide the seller with a record of what has been sold, to whom, when, and for what price. The following form anticipates that the seller is the artist and therefore reserves copyright and reproduction rights.

New Mexico Bill of Sale for Artwork or Work of Art or Painting

Description

How to fill out Bill Of Sale For Artwork Or Work Of Art Or Painting?

If you want to be thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms accessible online.

Employ the site’s straightforward and user-friendly search to find the documents you need. Various templates for business and personal purposes are categorized by type and region, or keywords.

Use US Legal Forms to access the New Mexico Bill of Sale for Artwork or Work of Art or Painting with just a few clicks.

Every legal document format you acquire is yours indefinitely. You will have access to each form you purchased in your account. Go to the My documents section and select a form to print or download again.

Complete and download, and print the New Mexico Bill of Sale for Artwork or Work of Art or Painting with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to obtain the New Mexico Bill of Sale for Artwork or Work of Art or Painting.

- You can also find forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have chosen the form for your correct city/state.

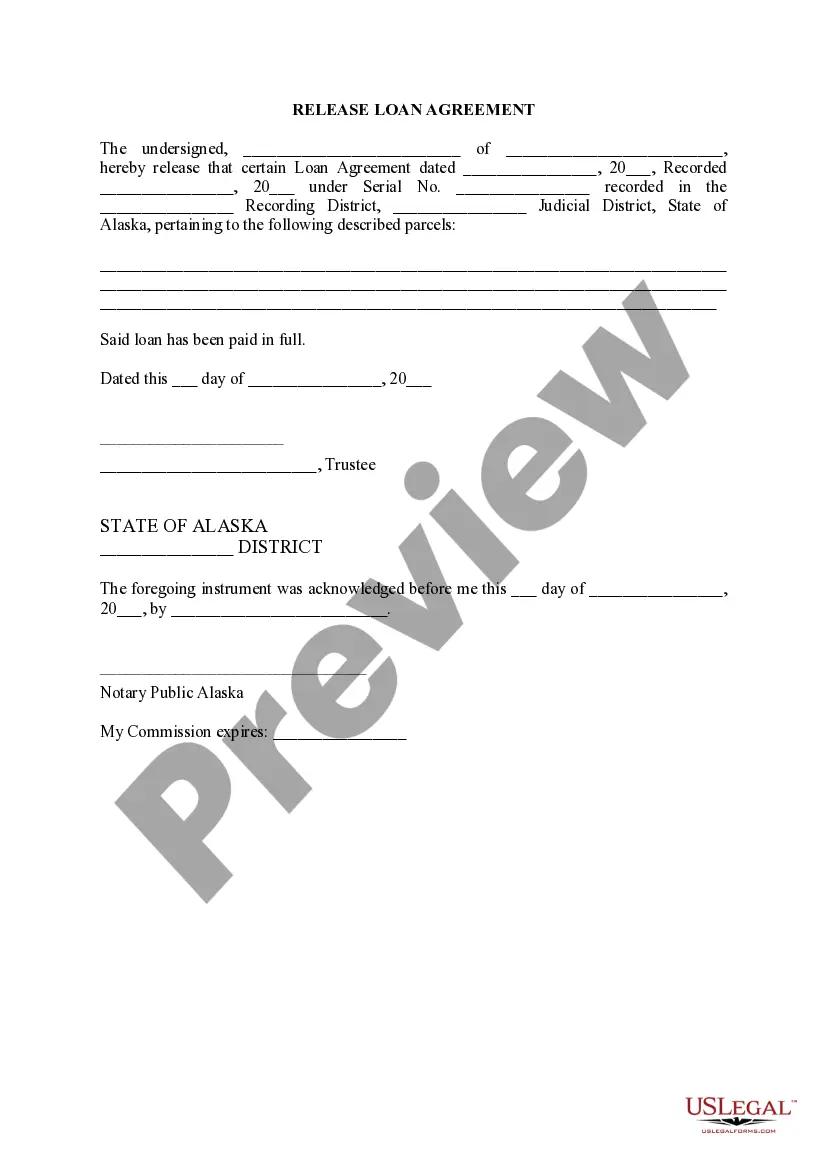

- Step 2. Use the Preview option to review the form’s content. Be sure to read the details.

- Step 3. If you are not satisfied with the type, use the Search box at the top of the screen to find other forms of your legal document type.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Process the transaction. You may use your Visa or MasterCard or PayPal account to complete the purchase.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, edit, print, or sign the New Mexico Bill of Sale for Artwork or Work of Art or Painting.

Form popularity

FAQ

You can claim artwork as a tax deduction if it qualifies as a charitable contribution. If you donate a work of art to a qualified organization, you may use the value of the artwork as a tax deduction. It is advisable to have a New Mexico Bill of Sale for Artwork or Work of Art or Painting for documentation purposes. Consulting a tax advisor can further clarify your eligibility for deductions based on your specific circumstances.

The sale of artwork in the United States, including New Mexico, may be subject to sales tax. This tax applies when you sell an artwork or a work of art and it is important to include a New Mexico Bill of Sale for Artwork or Work of Art or Painting in your transaction documentation. This ensures both the seller and buyer comply with the relevant tax laws. Always consult a tax professional to understand the exact implications for your situation.

To keep track of art sales effectively, create a dedicated record-keeping system. This could be a simple spreadsheet or a specialized software tool. Ensure you include details such as the artwork's title, sale date, buyer's information, and any associated New Mexico Bill of Sale for Artwork or Work of Art or Painting, as this will help you monitor your sales accurately.

Reporting art sales requires you to declare the income earned from these transactions on your tax return. Make sure to retain any documentation, such as the New Mexico Bill of Sale for Artwork or Work of Art or Painting, as proof of your sales. Consulting a tax professional can provide guidance tailored to your specific situation and ensure compliance.

Recording art sales involves keeping detailed documentation of each transaction. This can include maintaining copies of receipts, invoices, and a New Mexico Bill of Sale for Artwork or Work of Art or Painting. Organizing this information will help you monitor your sales, streamline your accounting, and fulfill tax obligations.

Filling out a New Mexico Bill of Sale for Artwork or Work of Art or Painting is straightforward. Start by providing detailed information about the artwork, including its title, medium, and any unique identifiers. Include the seller's and buyer's details, along with the sale date and total amount. This document will serve as a crucial record for both parties.

Artists typically earn a percentage of sales from their artwork, but this amount can differ widely. On average, artists receive around 10% to 25% in royalties from sales. If you're selling your work, consider creating a New Mexico Bill of Sale for Artwork or Work of Art or Painting to formalize the transaction and help you track your earnings.

The tax treatment for the sale of artwork can vary depending on several factors. Generally, if you sell artwork for a profit, you may need to report this income on your tax return. It's important to keep accurate records of your transactions, including any New Mexico Bill of Sale for Artwork or Work of Art or Painting, to ensure proper reporting.

To sell a piece of art, first determine its value and choose a marketing strategy, which might include online platforms or local art shows. Highlight its unique qualities in your listing, and consider professional photography to showcase it effectively. When a buyer is interested, prepare a New Mexico Bill of Sale for Artwork or Work of Art or Painting to complete the transaction smoothly.

The 1/3 rule in art suggests that a compelling composition divides the artwork into three equal sections, guiding viewer's eyes. While this rule helps in creating visually appealing pieces, it's not a strict requirement. Understanding such principles can improve your artwork, which may enhance its marketability when using a New Mexico Bill of Sale for Artwork or Work of Art or Painting.