Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

New Mexico Sample Letter for Change of Venue and Request for Homestead Exemption

Description

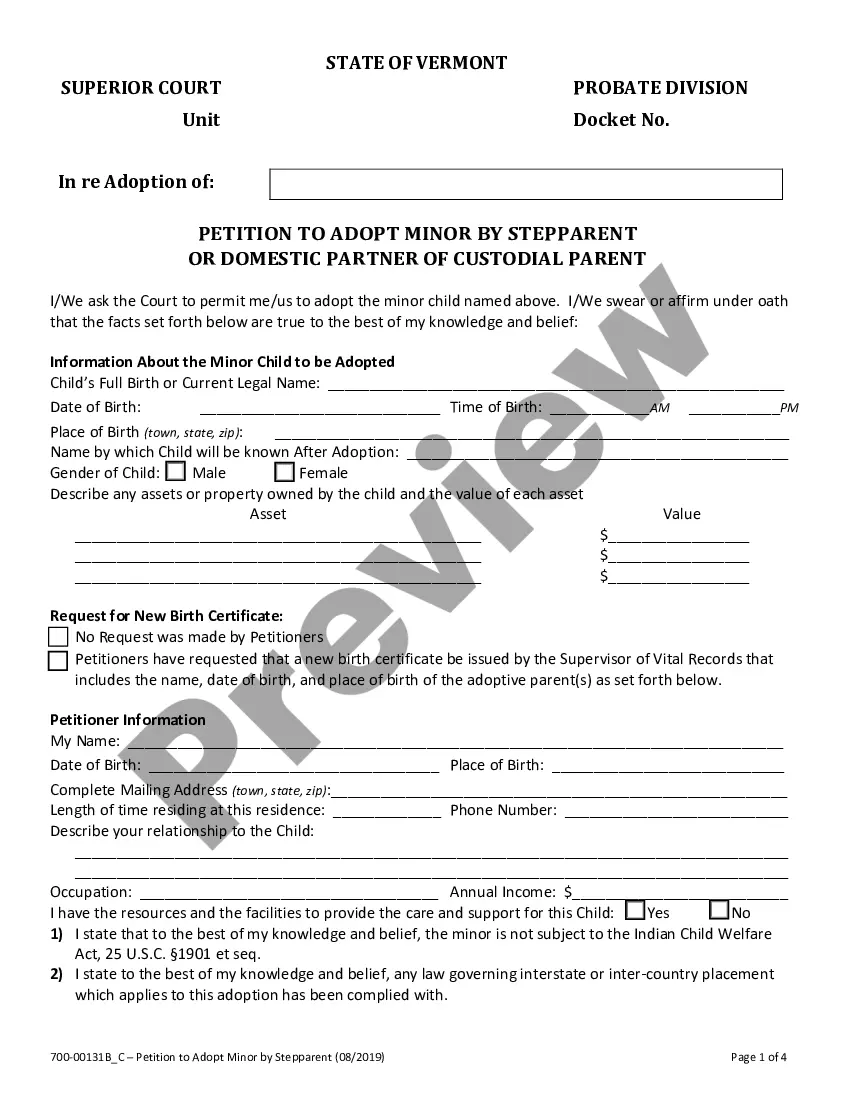

How to fill out Sample Letter For Change Of Venue And Request For Homestead Exemption?

Finding the right lawful document web template can be quite a have difficulties. Obviously, there are a lot of templates available on the Internet, but how would you find the lawful develop you require? Utilize the US Legal Forms internet site. The support gives a huge number of templates, like the New Mexico Sample Letter for Change of Venue and Request for Homestead Exemption, that can be used for company and private requirements. All the kinds are examined by experts and satisfy federal and state specifications.

Should you be previously signed up, log in in your bank account and click the Acquire key to find the New Mexico Sample Letter for Change of Venue and Request for Homestead Exemption. Utilize your bank account to check throughout the lawful kinds you might have bought earlier. Check out the My Forms tab of your own bank account and have another version from the document you require.

Should you be a fresh end user of US Legal Forms, here are easy guidelines so that you can adhere to:

- Initial, be sure you have selected the proper develop for the metropolis/county. It is possible to check out the shape utilizing the Preview key and browse the shape information to ensure it will be the right one for you.

- When the develop fails to satisfy your preferences, use the Seach field to find the appropriate develop.

- When you are positive that the shape would work, click the Get now key to find the develop.

- Pick the pricing program you would like and enter in the required information. Make your bank account and purchase an order making use of your PayPal bank account or bank card.

- Select the file format and download the lawful document web template in your system.

- Full, revise and printing and indication the attained New Mexico Sample Letter for Change of Venue and Request for Homestead Exemption.

US Legal Forms may be the largest local library of lawful kinds for which you will find various document templates. Utilize the company to download skillfully-manufactured files that adhere to condition specifications.

Form popularity

FAQ

By around April 1 of each year, County Assessors mail Notices of Valuation as required by Section 7-38-20 NMSA 1978. The notice informs homeowners of the full value and net taxable value of their property for that year.

Qualifying Exemptions Veteran Exemption. Head of Household Exemption. 65 yrs or Older or Disabled Low-Income Value Freeze.

Disabled Veteran Property Tax Exemption Any veteran who has been rated 100 percent ?Permanent & Total? disabled by the U.S. Department of Veterans Affairs (VA), , and is a legal resident of New Mexico, qualifies for a complete property tax waiver on their primary residence.

Exemptions are available for qualifying homeowners. If a homeowner disagrees with a property valuation, remedies are available as described under Section 7-38-21 NMSA 1978. View more information about Property Tax Division. Click on the link to locate contact information for your County Official.

This exemption is a two thousand dollars ($2,000) reduction of the taxable value of residential property subject to the tax if the property is owned by the head of family who is a New Mexico resident.

All New Mexico seniors at least 65 years old may claim a special exemption. See the instructions for PIT-ADJ.