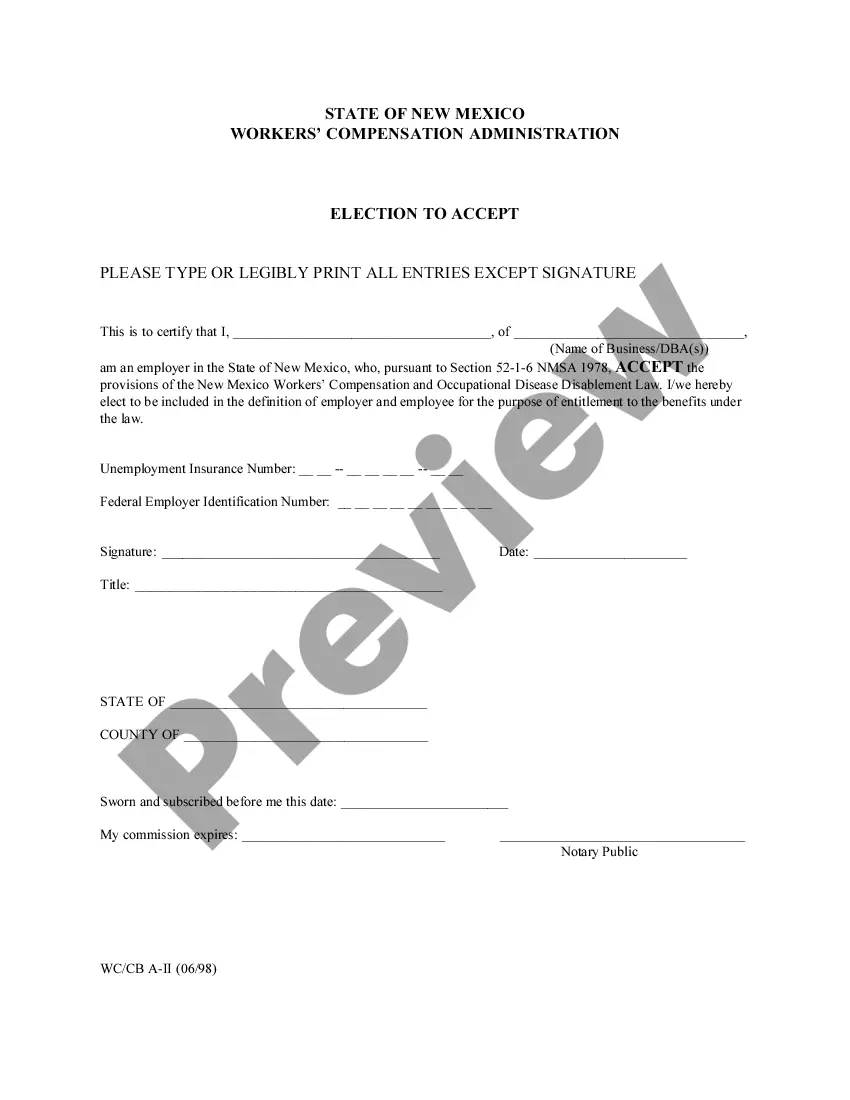

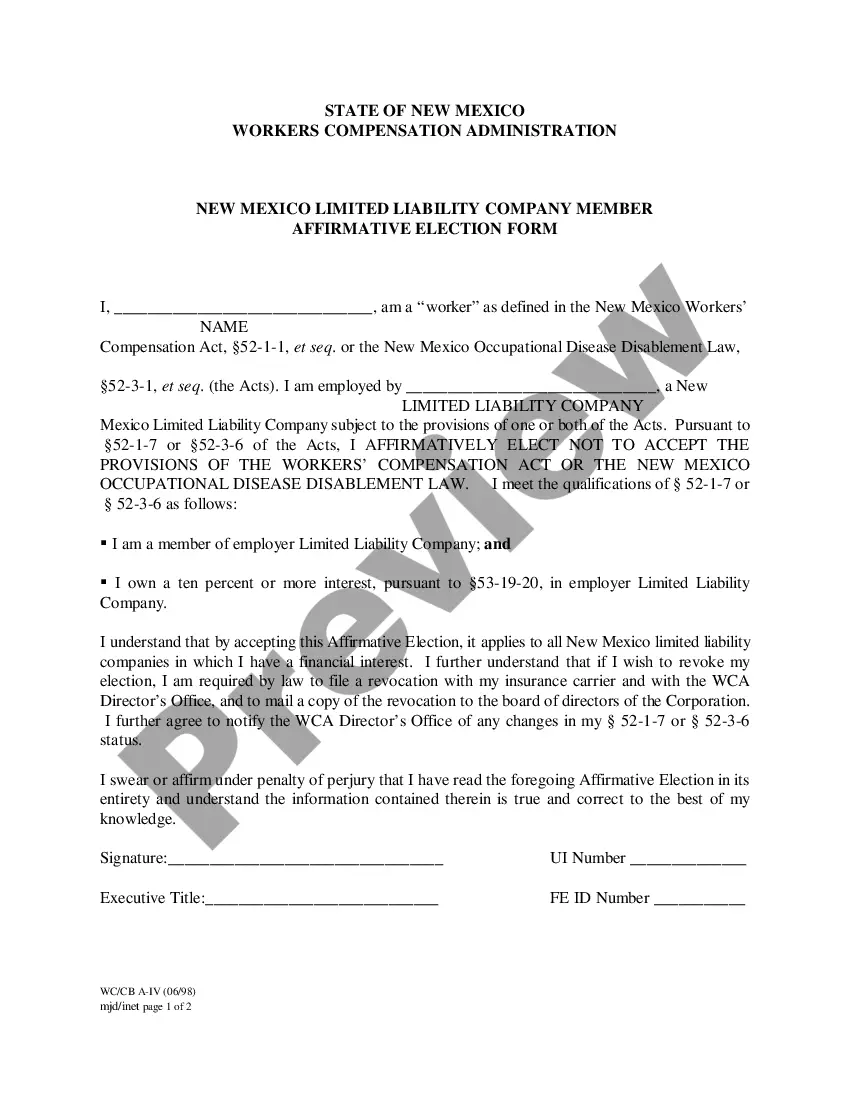

New Mexico Workers Compensation Sole Proprietor Affirmative Election Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Mexico Workers Compensation Sole Proprietor Affirmative Election Form?

US Legal Forms is really a unique system where you can find any legal or tax document for filling out, including New Mexico Workers Compensation Sole Proprietor Affirmative Election Form. If you’re sick and tired of wasting time searching for appropriate examples and spending money on record preparation/lawyer charges, then US Legal Forms is exactly what you’re seeking.

To reap all the service’s advantages, you don't need to install any software but just pick a subscription plan and create your account. If you have one, just log in and look for the right template, save it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need to have New Mexico Workers Compensation Sole Proprietor Affirmative Election Form, check out the guidelines listed below:

- make sure that the form you’re checking out is valid in the state you need it in.

- Preview the form and look at its description.

- Click Buy Now to reach the register webpage.

- Choose a pricing plan and continue registering by entering some info.

- Decide on a payment method to complete the sign up.

- Download the document by selecting your preferred file format (.docx or .pdf)

Now, complete the document online or print it. If you feel unsure about your New Mexico Workers Compensation Sole Proprietor Affirmative Election Form form, speak to a legal professional to examine it before you send out or file it. Begin without hassles!

Form popularity

FAQ

Sole proprietors with no employees typically are not required to purchase workers' compensation insurance. However, if you're injured on the job, a sole proprietor workers' comp policy can help pay for medical expenses and replacement wages while you recover.

If you're a business owner, you're not automatically covered by workers' compensation benefitsonly your workers are. Don't worry though, optional personal coverage is available to you. Business owners with or without workers.

Be factual with the information you provide. Be concise with the information you provide. Keep descriptions simple and to the point. Be sure to monitor your audit results.

In closing, workers' compensation does not pay your full salary, but you are entitled to part of your salary. If you've been injured on the job and need assistance throughout the sometimes confusing process, be sure to consult an attorney for their expertise.

Payroll journal and summary. Your check book (if it's your only means of keeping records. Federal Tax Report- 941's that cover the period. State Unemployment Tax reports or individual earnings records. All overtime payroll records (charged at reduced rates)

New Mexico workers' compensation insurance covers wage replacement and medical bills for employees who are injured on the job. It pays for medical care resulting from a work-related illness or injury, as well as wage replacement if the worker is unable to work as a result of the injury or illness.

Every employer required to be covered by the Workers' Compensation Act, or who elects to do so, and every employee covered by the Act, must pay a quarterly fee called the workers' compensation assessment fee. The fee is similar to a tax, and is $4.30 per employee per calendar quarter.

If you've been injured as a result of your work, you should be able to collect workers compensation benefits.Your employer or its workers' comp insurance company does not have to agree to settle your claim, and you do not have to agree with a settlement offer proposed by your employer or its insurance company.

Your workers' comp policy requires audits to verify your estimated payroll. These audits help make sure you're paying the right amount for the right coverage. Depending on your state, workers' compensation audits can also be a legal requirement.