New Mexico Limited Liability Company Member Affirmative Election Form

Description

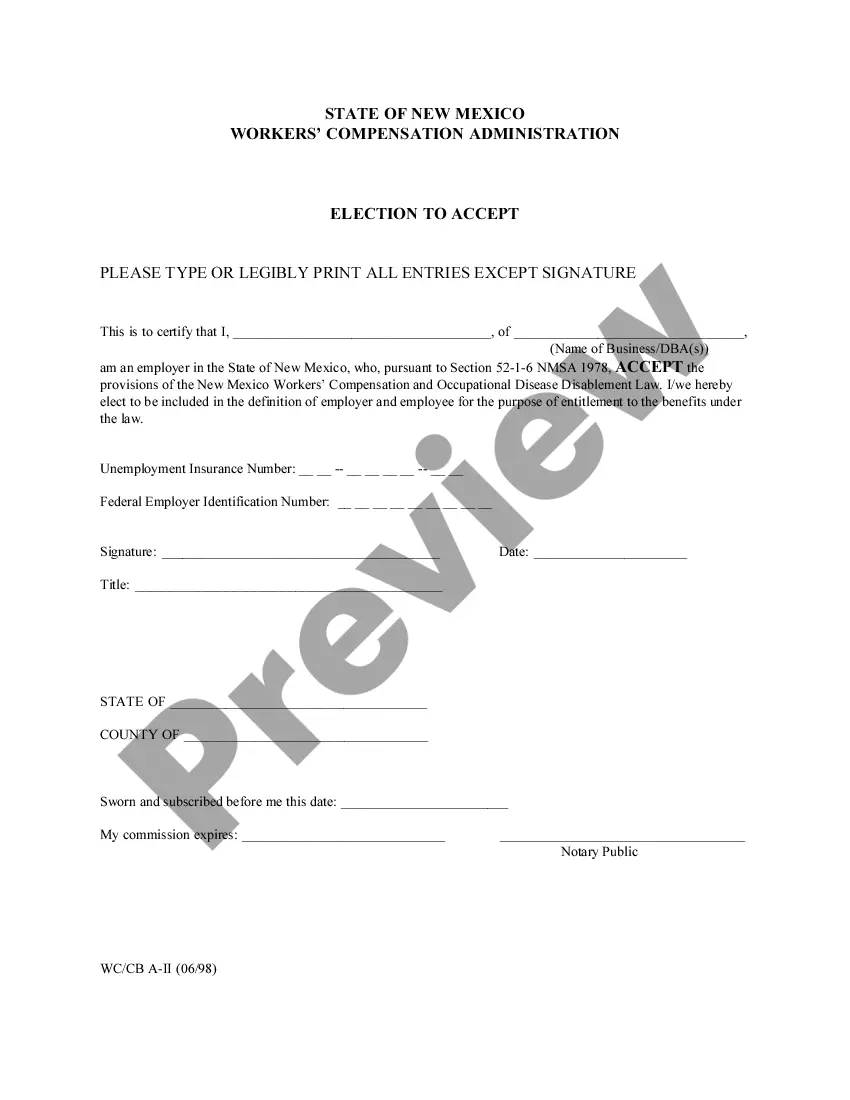

How to fill out New Mexico Limited Liability Company Member Affirmative Election Form?

US Legal Forms is actually a special system to find any legal or tax form for completing, such as New Mexico Limited Liability Company Member Affirmative Election Form. If you’re sick and tired of wasting time searching for perfect examples and spending money on record preparation/legal professional service fees, then US Legal Forms is precisely what you’re trying to find.

To reap all of the service’s benefits, you don't have to install any application but simply select a subscription plan and sign up your account. If you already have one, just log in and get the right sample, save it, and fill it out. Downloaded documents are kept in the My Forms folder.

If you don't have a subscription but need New Mexico Limited Liability Company Member Affirmative Election Form, check out the recommendations below:

- Double-check that the form you’re considering applies in the state you need it in.

- Preview the example its description.

- Click on Buy Now button to reach the register page.

- Choose a pricing plan and keep on signing up by providing some information.

- Choose a payment method to complete the registration.

- Download the file by choosing your preferred file format (.docx or .pdf)

Now, fill out the document online or print it. If you are unsure concerning your New Mexico Limited Liability Company Member Affirmative Election Form form, contact a lawyer to examine it before you decide to send out or file it. Begin without hassles!

Form popularity

FAQ

An LLC's primary legal obligation is to pay and otherwise fulfill the debts and contractual obligations it incurs. As a business entity, an LLC has the power to take many of the actions an individual can, like borrowing money, owning real estate, signing contracts, hiring employees, and engaging contractors.

Personally guarantees a business loan. It is not unusual for a lender to ask owners of a new venture to sign a personal loan guarantee for an unproven business. Signs a contract individually. Breaks the law. Incurs a negligence or malpractice claim. Pierces the corporate veil.

If you set up an LLC for yourself and conduct all your business through it, the LLC will be liable in a lawsuit but you won't.Conducting your personal business through an LLC provides no protection against a tort verdict, the type of liability that most people are worried about.

The term "LLC" means that the company holding that title formed as an LLC entity under relevant state law.An LLC is easy to form and provides members with limited liability. An Ltd, whether formed as a C or an S corporation, has more formal requirements but provides limited liability and has shareholders.

The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

A limited liability company (LLC) offers protection from personal liability for business debts, just like a corporation. While setting up an LLC is more difficult than creating a partnership or sole proprietorship, running one is significantly easier than running a corporation.

Generally, the members of an LLC, even a one man LLC, are not responsible personally for corporate debts. Some taxes such as sales taxes and payroll taxes are the usual exception and personal liability for these corporate debts can...

Costs to setting up a New Mexico LLC Setting up a New Mexico LLC costs $50. This is the state filing fee for a document called the Articles of Organization. The Articles of Organization is filed with the New Mexico Secretary of State and once approved, this is what creates your LLC. The $50 fee is a one-time fee.

Profits subject to social security and medicare taxes. In some circumstances, owners of an LLC may end up paying more taxes than owners of a corporation. Salaries and profits of an LLC are subject to self-employment taxes, currently equal to a combined 15.3%.