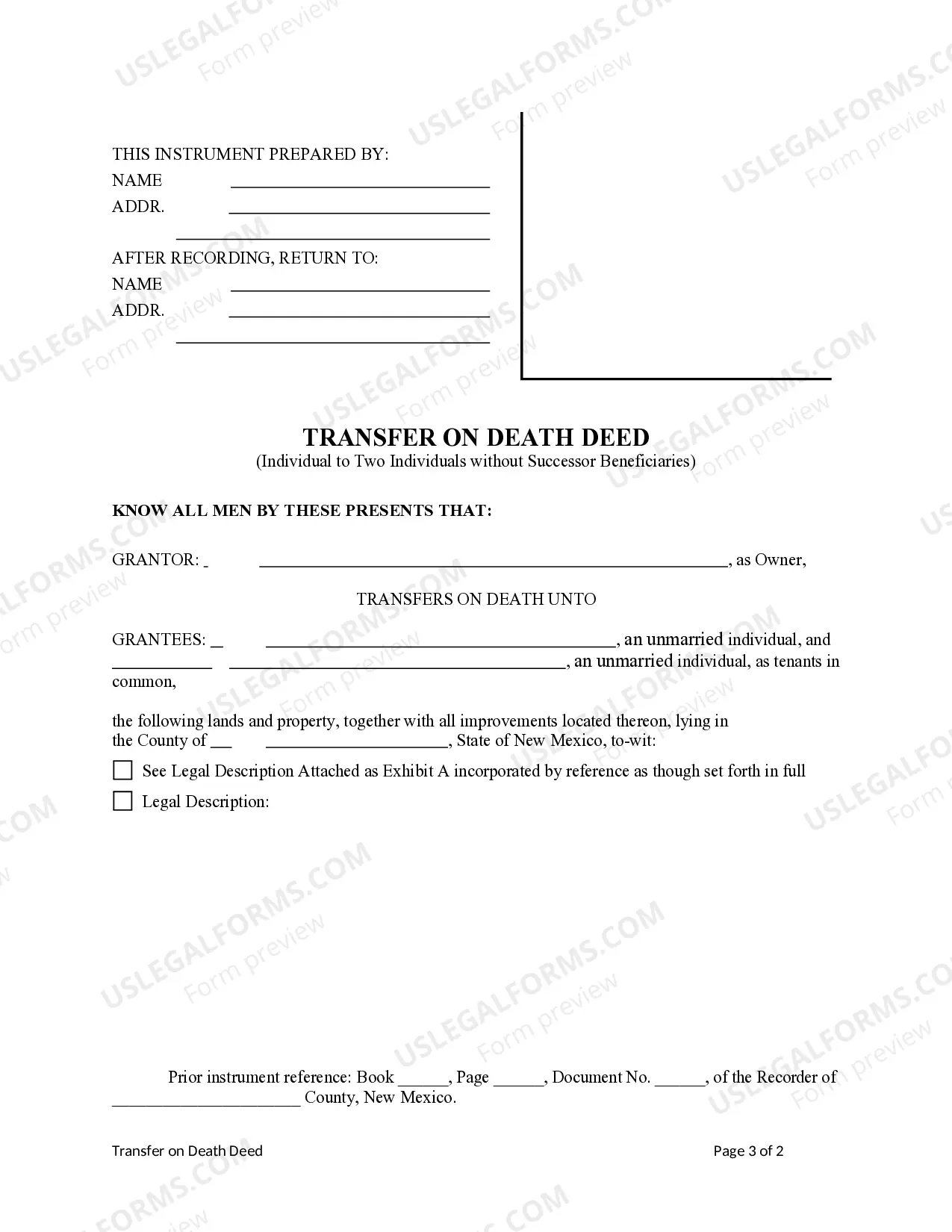

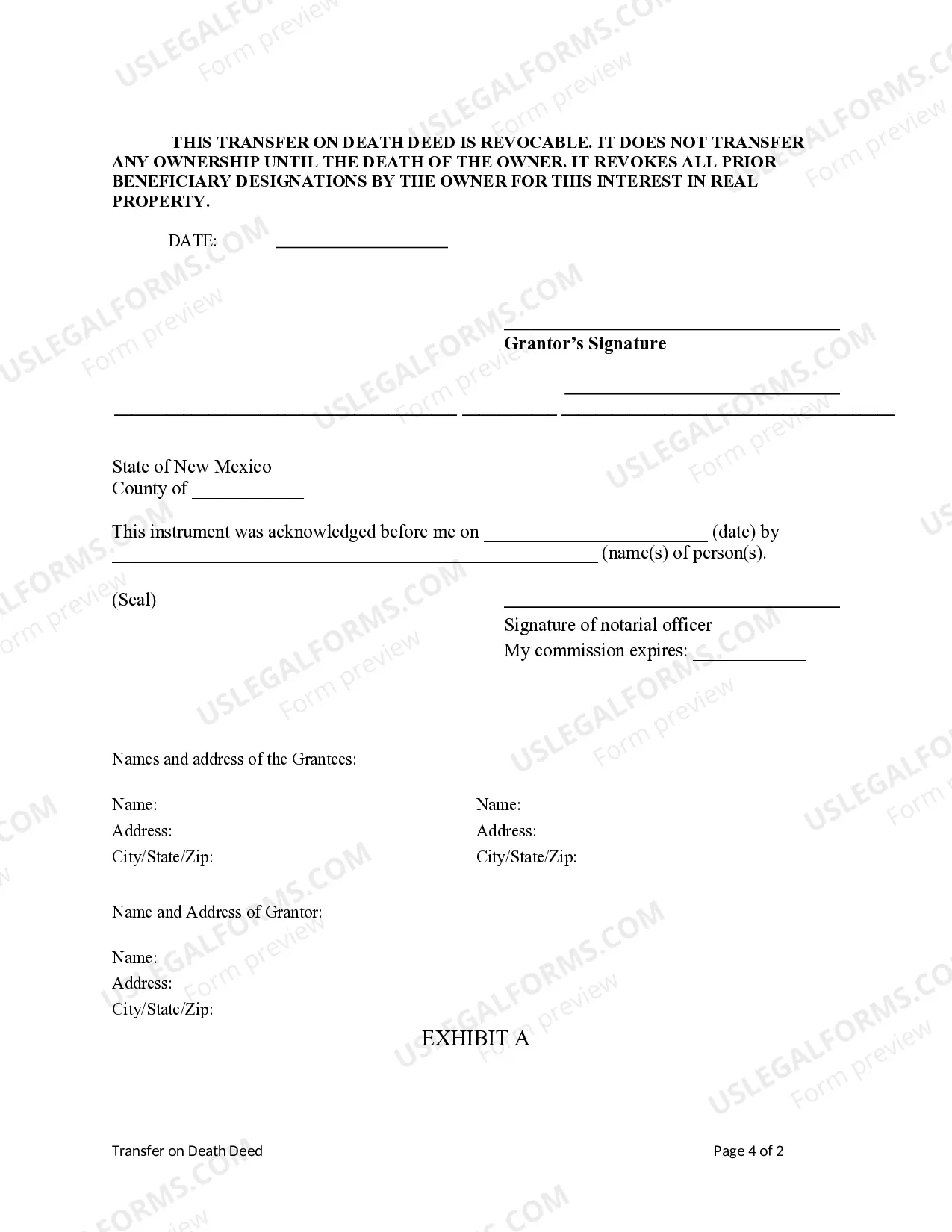

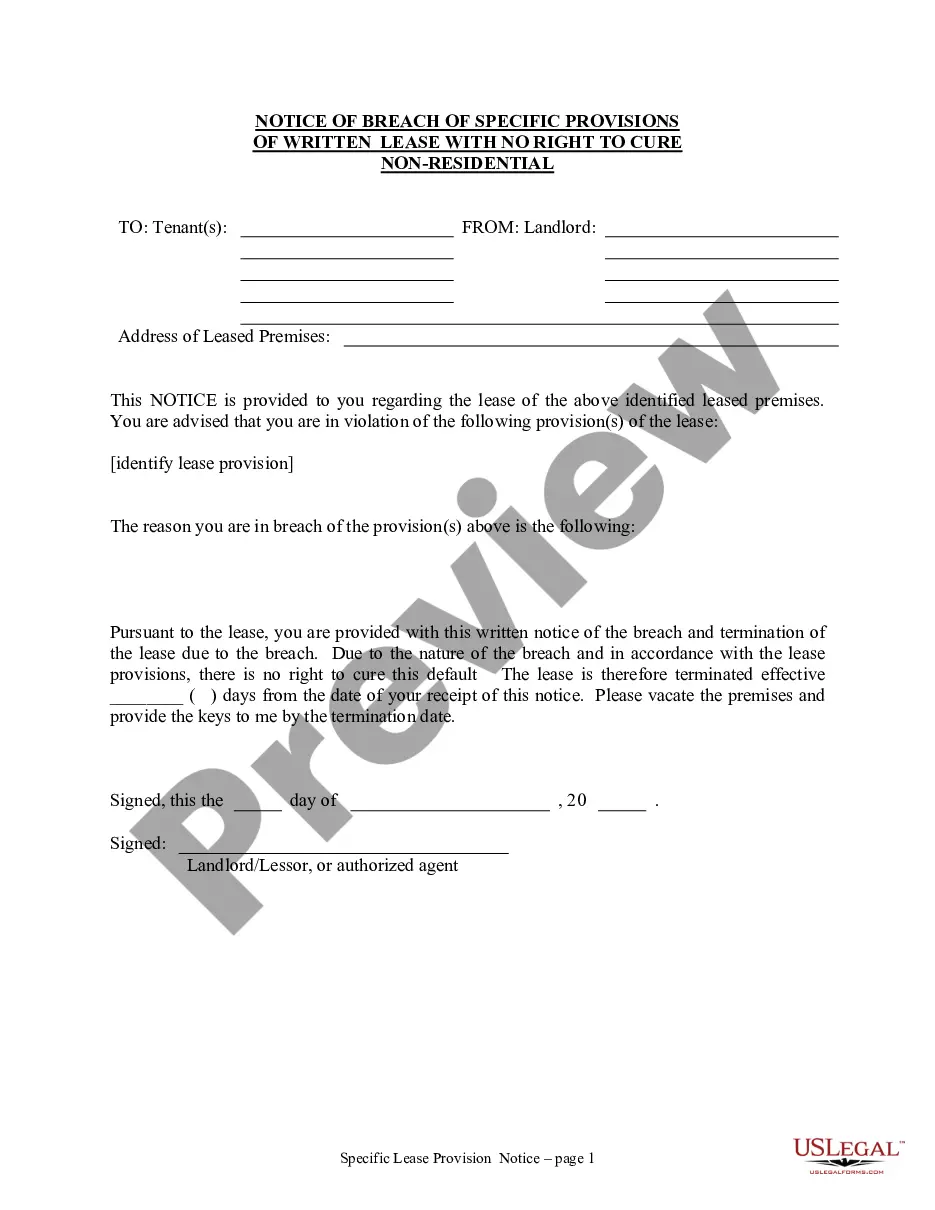

This form is a Beneficiary Deed where the Grantor is an individual and there are two Grantee Beneficiaries. There are NO named Successor Grantee Beneficiaries. Grantor conveys and transfers, upon Grantor's death, to the Grantee Beneficiaries as tenants in common. This Deed is not effective unless recorded prior to Grantor's death. This deed complies with all state statutory laws.

New Mexico Transfer on Death Deed - Individual to Two Individuals Without Successor Beneficiaries

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Mexico Transfer On Death Deed - Individual To Two Individuals Without Successor Beneficiaries?

US Legal Forms is actually a unique system to find any legal or tax template for submitting, such as New Mexico Transfer on Death Deed - Individual to Two Individuals Without Successor Beneficiaries. If you’re tired of wasting time seeking ideal samples and paying money on file preparation/legal professional service fees, then US Legal Forms is exactly what you’re searching for.

To enjoy all of the service’s advantages, you don't need to install any software but simply pick a subscription plan and sign up your account. If you already have one, just log in and get the right sample, download it, and fill it out. Saved documents are saved in the My Forms folder.

If you don't have a subscription but need New Mexico Transfer on Death Deed - Individual to Two Individuals Without Successor Beneficiaries, check out the guidelines below:

- check out the form you’re taking a look at is valid in the state you need it in.

- Preview the sample and look at its description.

- Click Buy Now to access the sign up page.

- Pick a pricing plan and keep on signing up by entering some info.

- Decide on a payment method to complete the sign up.

- Download the document by choosing your preferred format (.docx or .pdf)

Now, complete the document online or print out it. If you feel unsure regarding your New Mexico Transfer on Death Deed - Individual to Two Individuals Without Successor Beneficiaries template, contact a lawyer to check it before you send out or file it. Begin hassle-free!

Form popularity

FAQ

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

States that allow TOD deeds are Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia, Washington, West Virginia,

Your deed won't be effective unless you recorded (filed) it in the local public records before your death. To get that done, take the signed deed to the land records office for the county in which the real estate is located. This office is commonly called the county recorder, land registry, or registrar of deeds.