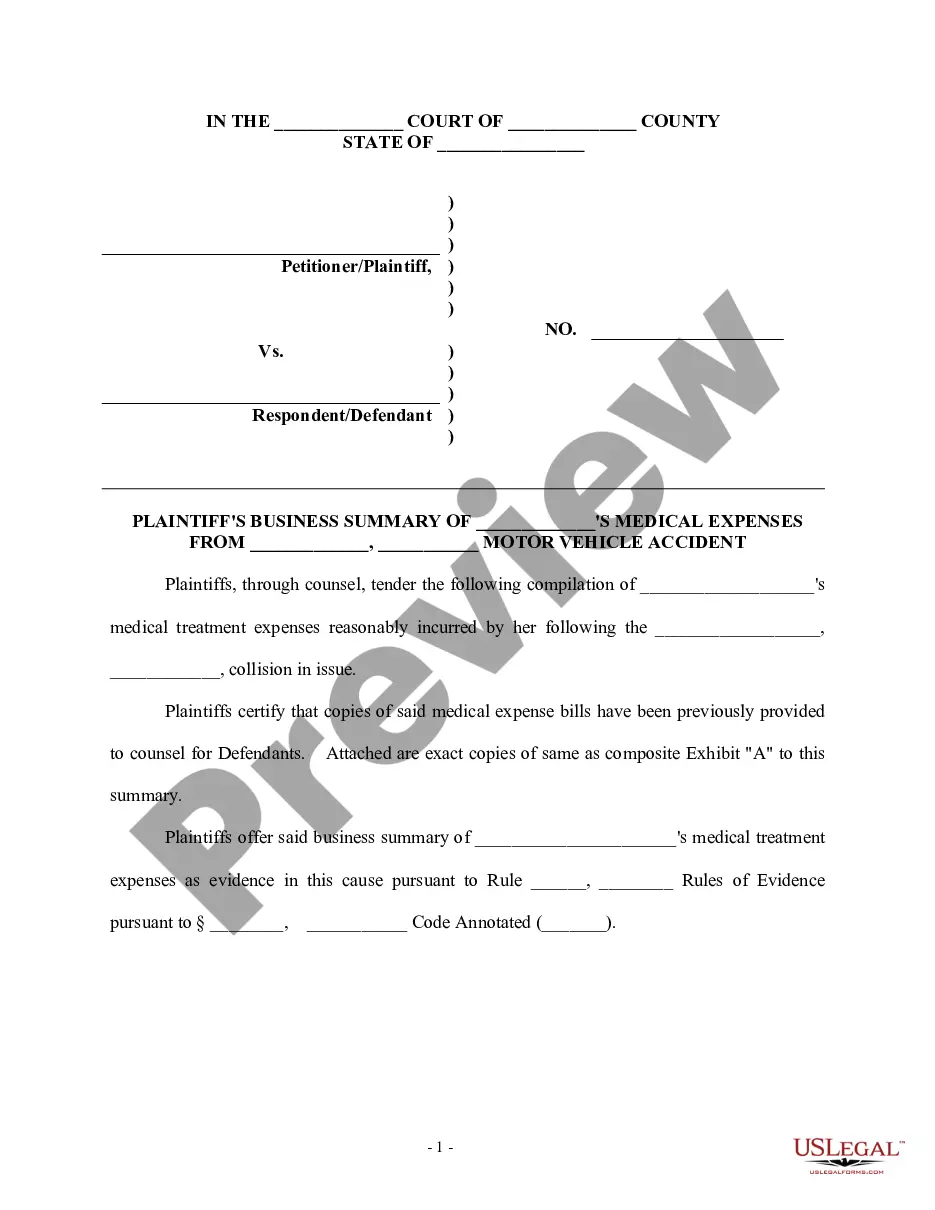

New Jersey Plaintiff's Business Summary of Medical Expenses

Description

How to fill out Plaintiff's Business Summary Of Medical Expenses?

If you wish to complete, down load, or print legal document layouts, use US Legal Forms, the biggest variety of legal kinds, that can be found on-line. Make use of the site`s simple and easy hassle-free research to find the documents you will need. Different layouts for company and specific reasons are categorized by types and says, or search phrases. Use US Legal Forms to find the New Jersey Plaintiff's Business Summary of Medical Expenses within a few mouse clicks.

Should you be currently a US Legal Forms consumer, log in to the profile and click on the Acquire switch to have the New Jersey Plaintiff's Business Summary of Medical Expenses. Also you can entry kinds you in the past delivered electronically in the My Forms tab of your profile.

If you work with US Legal Forms initially, follow the instructions listed below:

- Step 1. Ensure you have selected the shape for that proper town/country.

- Step 2. Use the Preview option to look over the form`s information. Don`t forget to learn the outline.

- Step 3. Should you be not happy together with the develop, take advantage of the Lookup field at the top of the monitor to find other types from the legal develop template.

- Step 4. When you have discovered the shape you will need, click the Get now switch. Select the pricing strategy you favor and include your accreditations to sign up on an profile.

- Step 5. Method the transaction. You may use your credit card or PayPal profile to finish the transaction.

- Step 6. Pick the structure from the legal develop and down load it on the system.

- Step 7. Complete, change and print or indication the New Jersey Plaintiff's Business Summary of Medical Expenses.

Each legal document template you purchase is the one you have for a long time. You have acces to each develop you delivered electronically with your acccount. Go through the My Forms segment and pick a develop to print or down load once more.

Compete and down load, and print the New Jersey Plaintiff's Business Summary of Medical Expenses with US Legal Forms. There are many professional and condition-distinct kinds you may use for your company or specific requirements.

Form popularity

FAQ

The medical expense tax credit is a non-refundable tax credit that you can use to reduce the tax that you paid or may have to pay. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your tax return.

Employer contributions to HSAs are included in NJ income and employee contributions are not deductible on the NJ individual tax return. But withdrawals from HSAs for medical purposes are deductible on the NJ tax return (subject to a 2% exclusion) as medical expenses.

Medical Expenses Only expenses that exceed 2% of your income can be deducted. Some examples of allowable medical expenses are: payments for doctor's visits, dental care, hospital care, eye examinations, eyeglasses, medicine, and x-rays or other diagnostic services directed by your physician or dentist.

Claiming medical expenses on your return If the expenses are for you and your spouse, common-law partner or dependent child under 18 years of age, you can make the claim on line 33099 of your return. If they are for any other dependent, they can be claimed on line 33199.

Medical travel rates 2021 Province or territoryMedical travel rate 2021Nunavut60.5Ontario57.5Prince Edward Island53.0Quebec55.09 more rows ?

This threshold amount for the federal part of your tax return (Schedule 1) is either 3% of your net income as reported on your tax return, or $2,479 in 2022 ($2,635 in 2023), whichever is lower. For example, if your net income on your tax return is $40,000, you can deduct expenses in excess of $1,200.