New Jersey Assignment of Overriding Royalty Interest Out of Working Interest with Multiple Leases and Limited Warranty - Long Form

Description

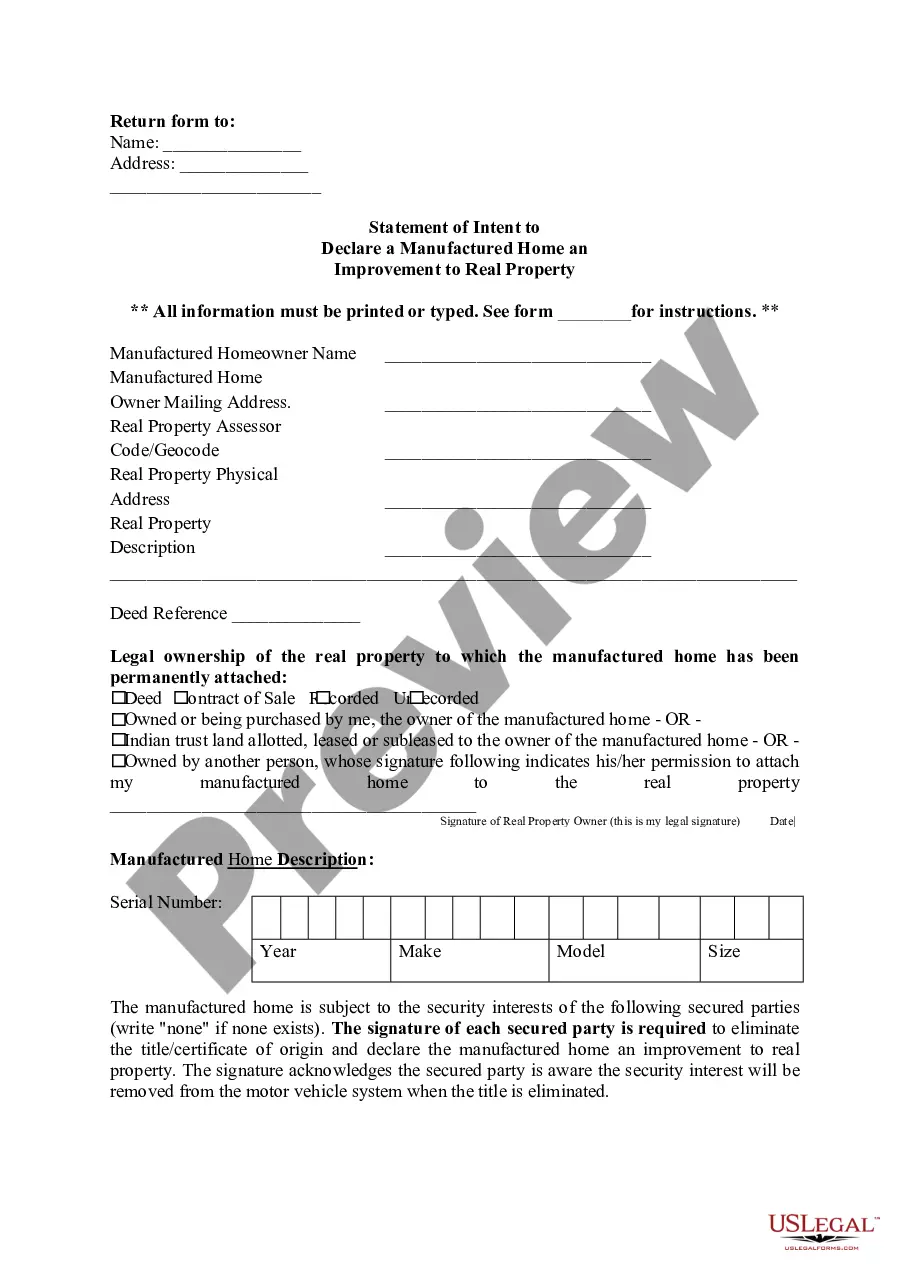

How to fill out Assignment Of Overriding Royalty Interest Out Of Working Interest With Multiple Leases And Limited Warranty - Long Form?

If you wish to comprehensive, download, or produce lawful record templates, use US Legal Forms, the biggest assortment of lawful kinds, which can be found on-line. Take advantage of the site`s simple and practical lookup to get the paperwork you need. Different templates for company and individual reasons are sorted by categories and states, or keywords. Use US Legal Forms to get the New Jersey Assignment of Overriding Royalty Interest Out of Working Interest with Multiple Leases and Limited Warranty - Long Form in just a handful of clicks.

If you are currently a US Legal Forms consumer, log in in your bank account and click the Acquire option to find the New Jersey Assignment of Overriding Royalty Interest Out of Working Interest with Multiple Leases and Limited Warranty - Long Form. You can also accessibility kinds you in the past delivered electronically within the My Forms tab of your own bank account.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for that correct area/country.

- Step 2. Use the Review option to look through the form`s information. Do not neglect to read the outline.

- Step 3. If you are unhappy with the kind, take advantage of the Look for area near the top of the monitor to locate other models of the lawful kind web template.

- Step 4. When you have discovered the shape you need, select the Acquire now option. Choose the costs strategy you prefer and include your accreditations to register on an bank account.

- Step 5. Procedure the deal. You may use your bank card or PayPal bank account to accomplish the deal.

- Step 6. Find the formatting of the lawful kind and download it on the gadget.

- Step 7. Full, edit and produce or signal the New Jersey Assignment of Overriding Royalty Interest Out of Working Interest with Multiple Leases and Limited Warranty - Long Form.

Every lawful record web template you get is your own property for a long time. You possess acces to every kind you delivered electronically within your acccount. Click the My Forms section and choose a kind to produce or download yet again.

Be competitive and download, and produce the New Jersey Assignment of Overriding Royalty Interest Out of Working Interest with Multiple Leases and Limited Warranty - Long Form with US Legal Forms. There are thousands of professional and state-particular kinds you can use for your personal company or individual requires.

Form popularity

FAQ

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

If there is more than one mineral owner, multiply the net revenue by the fractional interest of each owner to determine their respective royalty interest. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres. Net Royalty Acres Defined - Oil and Gas Lawyer Blog oilandgaslawyerblog.com ? net-royalty-acre... oilandgaslawyerblog.com ? net-royalty-acre...

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document. Overriding Royalty Interest Explained - Landgate landgate.com ? news ? overriding-royalty-in... landgate.com ? news ? overriding-royalty-in...

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well. Overriding Royalty Interest (ORRI) (US) - Westlaw Westlaw ? PracticalLaw Westlaw ? PracticalLaw