New Jersey Coaching Services Contract - Self-Employed

Description

How to fill out Coaching Services Contract - Self-Employed?

Are you presently in the location where you need documentation for both organization or particular tasks almost every time.

There are numerous legal document templates accessible online, but discovering forms you can trust isn't simple.

US Legal Forms offers a vast array of form templates, such as the New Jersey Coaching Services Contract - Self-Employed, designed to meet state and federal criteria.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service offers expertly crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the New Jersey Coaching Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct region.

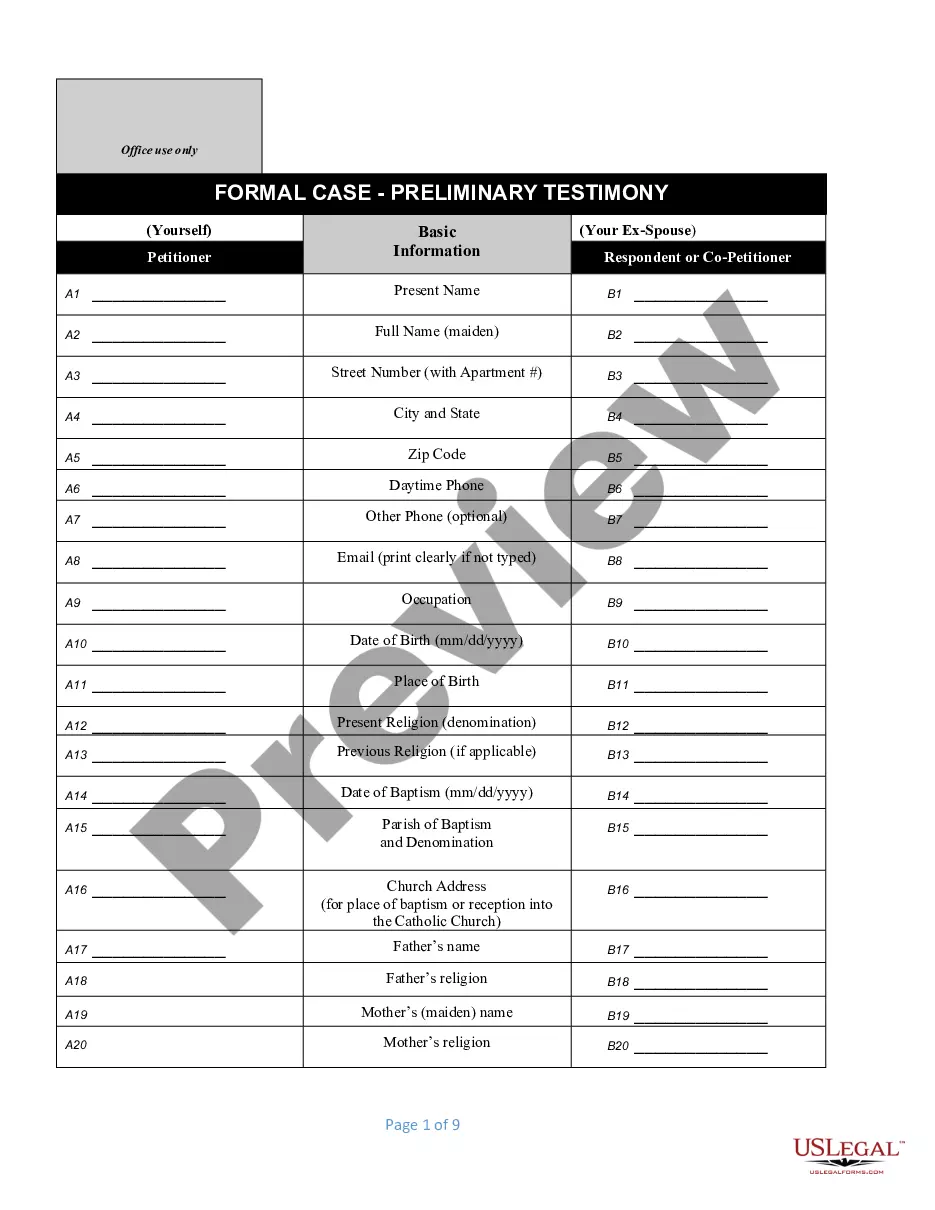

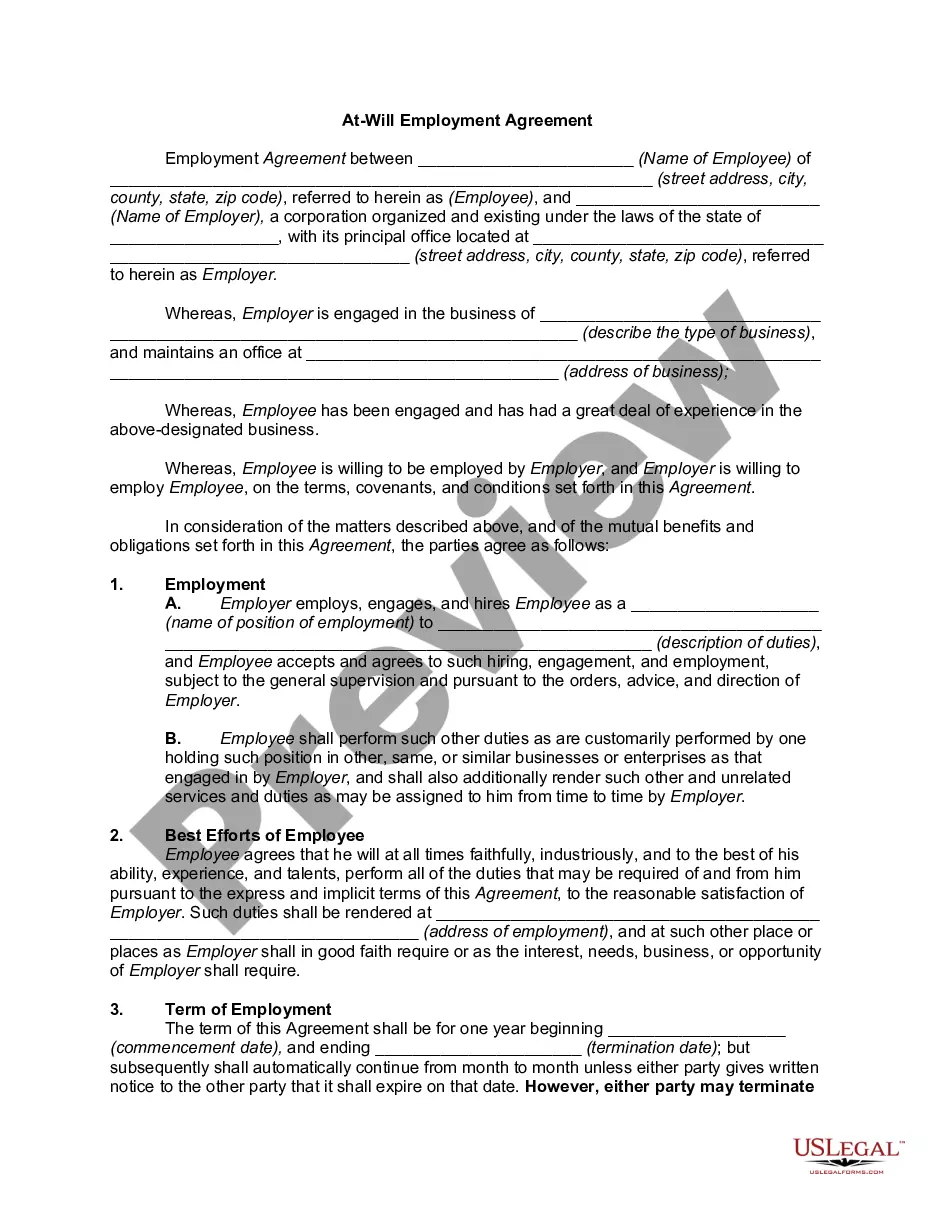

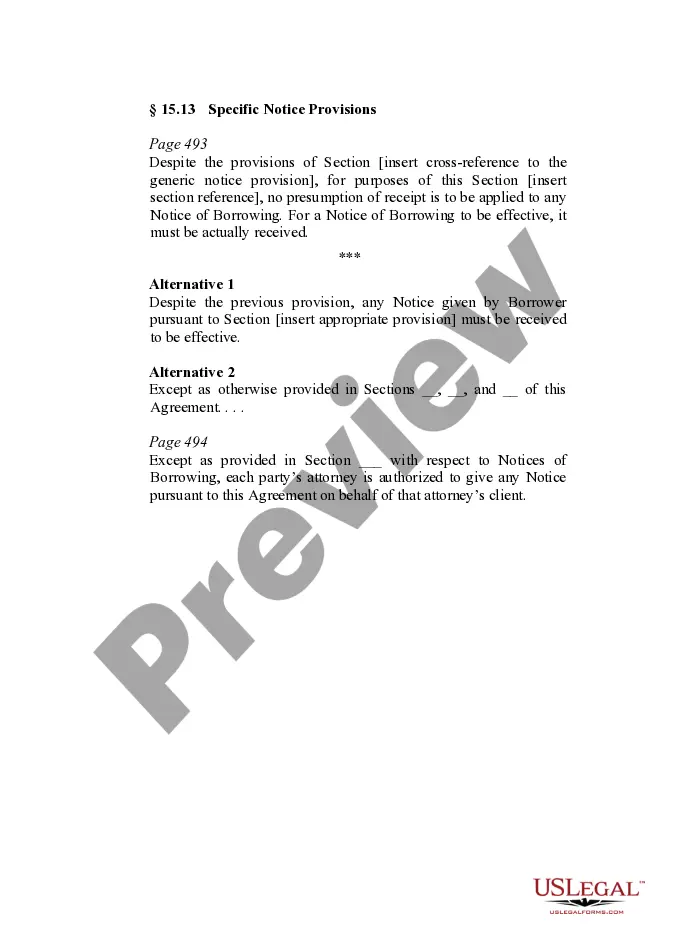

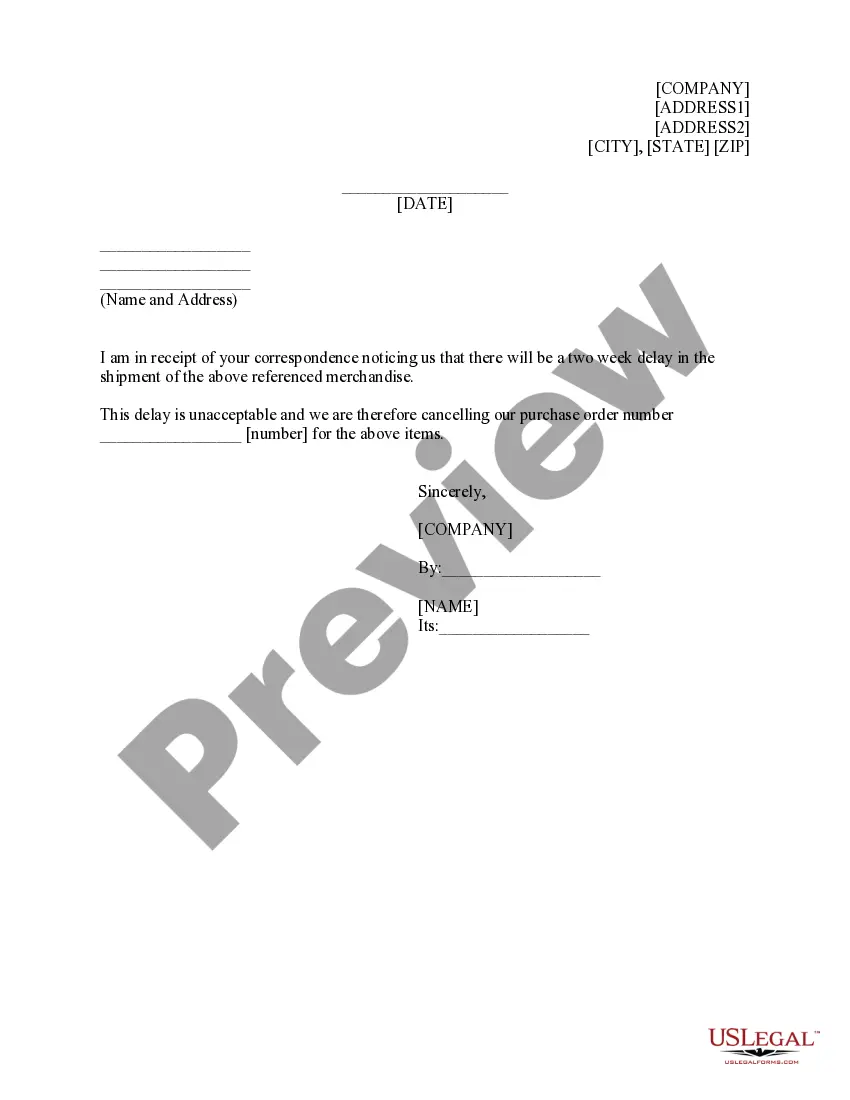

- Use the Review option to inspect the form.

- Read the description to confirm that you have selected the right form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your needs and requirements.

- If you find the appropriate form, click Purchase now.

- Choose the pricing plan you want, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Find all of the document templates you have purchased in the My documents menu.

- You can download another copy of the New Jersey Coaching Services Contract - Self-Employed anytime, if needed.

- Just select the necessary form to download or print the document template.

Form popularity

FAQ

New Jersey exempts various services from sales tax, including services related to health, education, and certain consulting activities. To determine if your particular service qualifies for exemption, review your New Jersey Coaching Services Contract - Self-Employed carefully. This will ensure you remain compliant with state regulations.

Consulting itself is generally not considered a taxable service in New Jersey. However, if consulting includes tangible products or specific professional services, taxation rules can differ. Your New Jersey Coaching Services Contract - Self-Employed can assist you in understanding what aspects may be taxable.

In general, consulting services in New Jersey are not subject to state sales tax. However, if your services involve selling goods or taxable services, different rules may apply. Always refer to your New Jersey Coaching Services Contract - Self-Employed to clarify which services are taxable.

Independent contractors in New Jersey are subject to both federal and state tax rates. Your income would be taxed based on your total earnings after deductions. The specifics of your New Jersey Coaching Services Contract - Self-Employed can provide insights into structuring your income for optimal tax outcomes.

Writing an independent contractor agreement requires stating the nature of the work, payment terms, and duration of the contract. Ensure that both parties understand their rights and responsibilities to prevent misunderstandings. For your New Jersey Coaching Services Contract - Self-Employed, uslegalforms offers templates that simplify this process.

The 3 C's of coaching are Clarity, Consistency, and Commitment. These principles encourage a strong foundation for both coach and client to succeed. Addressing these concepts in your New Jersey Coaching Services Contract - Self-Employed can foster a productive coaching relationship.

To write an effective coaching contract, start by outlining the roles and responsibilities of both parties. Include terms for confidentiality, compensation, and methods for resolving disputes. Using specialized resources like uslegalforms can help you include all necessary components in your New Jersey Coaching Services Contract - Self-Employed.

The 7 P's of coaching include Purpose, Process, Participants, Presence, Performance, Progress, and Partnership. These concepts enhance the effectiveness of coaching and provide clear frameworks for success. Understanding these elements can greatly improve your New Jersey Coaching Services Contract - Self-Employed.

Setting up a coaching contract in New Jersey involves defining the scope of services clearly. Both parties should agree on expectations, compensation, and duration. You can find detailed templates and guidance on platforms like uslegalforms to help streamline the process.

It's wise to consider forming an LLC as a personal trainer to protect your personal assets. An LLC provides a shield against personal liability from business-related issues. Furthermore, having a New Jersey Coaching Services Contract - Self-Employed can help establish a clear agreement with your clients, enhancing their trust in your services.