New Jersey Employment Services Agreement - Self-Employed Independent Contractor

Description

How to fill out Employment Services Agreement - Self-Employed Independent Contractor?

It is possible to spend hrs on the web attempting to find the lawful papers web template that fits the federal and state requirements you will need. US Legal Forms gives thousands of lawful forms that happen to be examined by specialists. You can easily download or print the New Jersey Employment Services Agreement - Self-Employed Independent Contractor from your services.

If you have a US Legal Forms account, you are able to log in and click on the Download switch. Following that, you are able to complete, edit, print, or indication the New Jersey Employment Services Agreement - Self-Employed Independent Contractor. Every lawful papers web template you purchase is the one you have for a long time. To acquire yet another backup for any bought kind, visit the My Forms tab and click on the related switch.

If you are using the US Legal Forms site the first time, adhere to the basic instructions under:

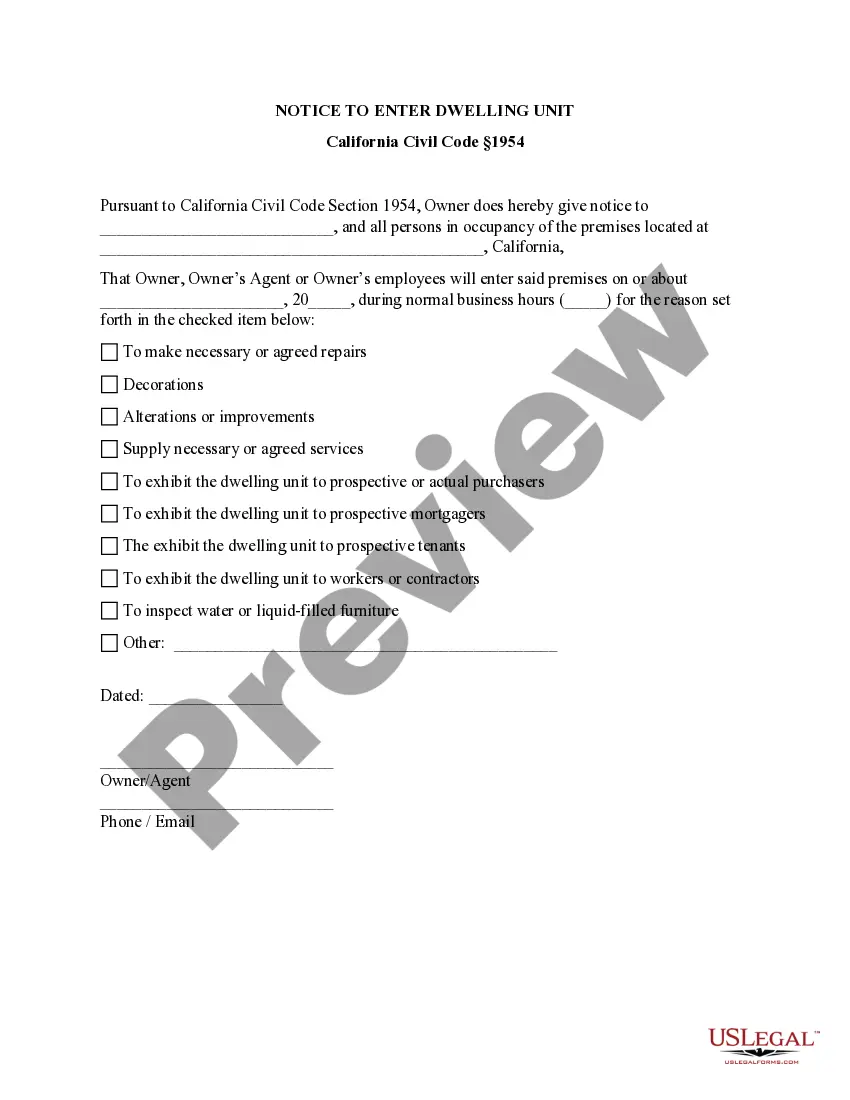

- First, make sure that you have chosen the proper papers web template for the county/city of your choice. Browse the kind description to make sure you have selected the right kind. If offered, use the Review switch to look through the papers web template as well.

- If you want to get yet another edition of the kind, use the Search field to get the web template that fits your needs and requirements.

- After you have identified the web template you desire, just click Acquire now to move forward.

- Find the pricing plan you desire, key in your accreditations, and register for a free account on US Legal Forms.

- Comprehensive the transaction. You may use your Visa or Mastercard or PayPal account to cover the lawful kind.

- Find the file format of the papers and download it for your system.

- Make adjustments for your papers if needed. It is possible to complete, edit and indication and print New Jersey Employment Services Agreement - Self-Employed Independent Contractor.

Download and print thousands of papers web templates utilizing the US Legal Forms site, that offers the greatest collection of lawful forms. Use professional and express-certain web templates to take on your organization or individual demands.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Self-employed, independent contractors, and gig workers:Workers who have been properly classified as independent contractors are not eligible for traditional unemployment insurance benefits.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

The Labour Relations Act applies to all employers, workers, trade unions and employers' organisations.

The individual is customarily engaged in an independently established trade, occupation, profession or business.

The other contract (Independent contractor) is a Contract for Service, and is usually a contract where the contractor undertakes to perform a specific service or task, and upon completion of the agreed service or task, or upon production of the result agreed upon, the contractor will be paid.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

If you are classified as an "independent contractor," you may be paid with a 1099 with no deductions made for taxes, unemployment, or other contributions that an employee pays.