New Jersey Chef Services Contract - Self-Employed

Description

How to fill out Chef Services Contract - Self-Employed?

Locating the correct authorized document template can be a challenge.

It goes without saying, there are numerous designs accessible online, but how will you obtain the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, such as the New Jersey Chef Services Contract - Self-Employed, which can be utilized for business and personal purposes. All of the documents are verified by professionals and comply with federal and state regulations.

If the form does not fit your needs, use the Search field to find the appropriate form. Once you are certain that the form is suitable, click on the Get now button to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete your purchase using your PayPal account or Visa or Mastercard. Select the document format and download the legal document template to your device. Complete, edit, print, and sign the obtained New Jersey Chef Services Contract - Self-Employed. US Legal Forms is the largest repository of legal documents where you can find a variety of document templates. Utilize the service to obtain professionally crafted files that comply with state requirements.

- If you are already registered, Log In to your account and click the Download button to access the New Jersey Chef Services Contract - Self-Employed.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents section of your account and retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions that you should follow.

- First, ensure you have selected the correct form for your region/state.

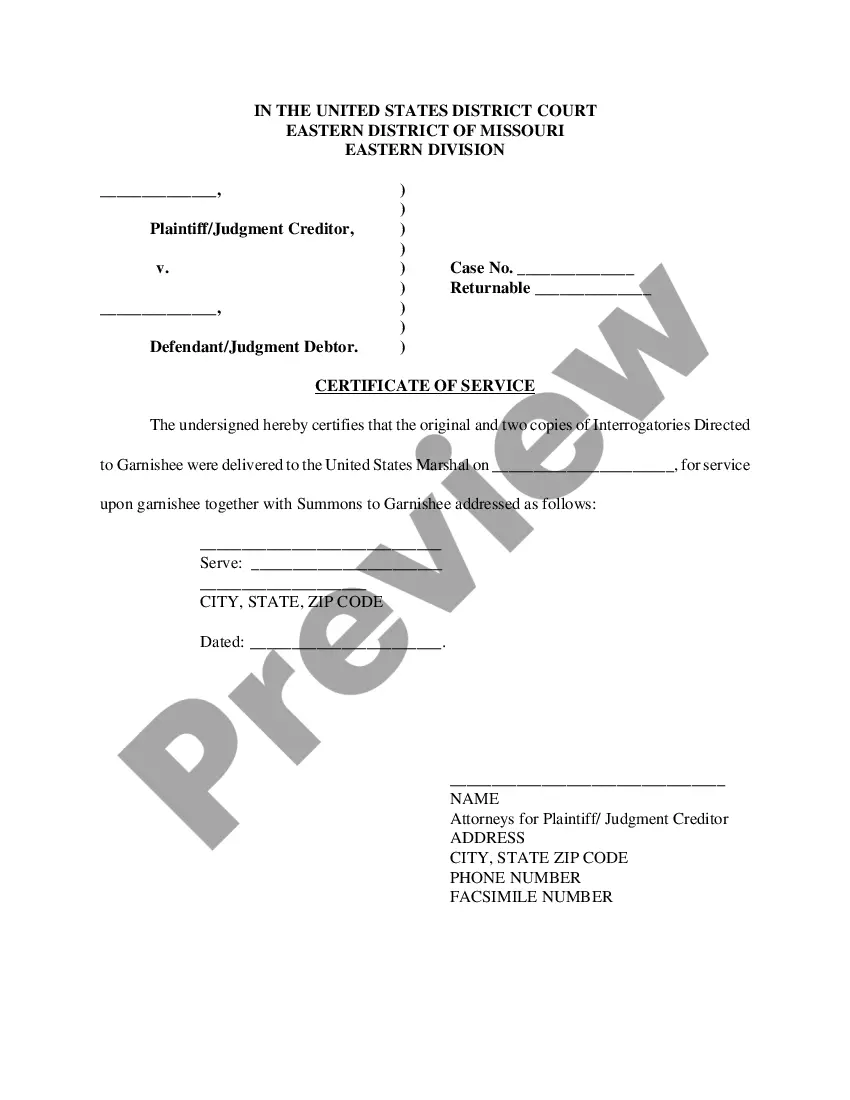

- You can review the form using the Preview option and examine the form details to confirm this is suitable for you.

Form popularity

FAQ

Even if you earned less than $10,000 in New Jersey, it's important to understand your tax responsibilities. Generally, self-employed individuals must report all income, regardless of the amount. Filing your taxes accurately can help you maintain compliance and avoid any future penalties. Using a New Jersey Chef Services Contract - Self-Employed can assist you in documenting your income effectively.

Yes, you need a catering license in New Jersey to operate legally. This license ensures that you meet the health and safety requirements set by the state. Consulting with local authorities will provide clarity on the specifics you need to comply with. A New Jersey Chef Services Contract - Self-Employed can guide you through the licensing process to ensure your catering services are fully compliant.

In New Jersey, if you're selling homemade food, you need to follow specific regulations. Generally, you'll require a business license or a food seller's permit to operate legally. It's essential to review local laws to ensure compliance. A New Jersey Chef Services Contract - Self-Employed can help you understand your obligations and navigate this aspect of your business.

Writing a self-employed contract requires careful consideration of the terms of work. Include details about services offered, payment conditions, and timelines. A precise New Jersey Chef Services Contract - Self-Employed minimizes confusion between parties. Consider using uslegalforms for guidance and ready-made templates to ensure you've covered all important aspects.

To show proof of self-employment, you can provide tax documents such as your Schedule C, invoices, and contracts. A well-prepared New Jersey Chef Services Contract - Self-Employed can also serve as evidence of your earnings and work agreements. Collecting a portfolio of your work can enhance your credibility. Platforms like uslegalforms can help you draft these documents.

To write a self-employment contract, start by clearly stating the names of the parties involved and the nature of the work. Include specific terms about compensation, delivery timelines, and dispute resolution in your New Jersey Chef Services Contract - Self-Employed. Clear language will help prevent misunderstandings. Using resources like uslegalforms can simplify this task.

Writing a contract for a 1099 employee involves several steps. First, identify the nature of the work and include rates, payment schedules, and deadlines. Ensure that your New Jersey Chef Services Contract - Self-Employed does not imply employee benefits, as this is crucial for tax classification. Consider using uslegalforms for templates tailored to your needs.

Filling out an independent contractor agreement requires attention to detail. Start by including your personal information, the scope of work, payment terms, and any deadlines. For a New Jersey Chef Services Contract - Self-Employed, specificity is key to clarify expectations. You can easily use uslegalforms to guide you through the process.

Yes, you can write your own legally binding contract. When pursuing a New Jersey Chef Services Contract - Self-Employed, it is crucial to ensure that the agreement clearly outlines terms, conditions, and responsibilities. A well-structured contract protects both parties and enhances professionalism. However, using a template or platform like uslegalforms can help you avoid pitfalls.

The primary difference lies in their working arrangements. Personal chefs prepare meals for multiple clients on a flexible schedule, while private chefs usually work exclusively for one client or family. Understanding these distinctions is important, and having a solid New Jersey Chef Services Contract - Self-Employed can help clarify the nature of services provided.