New Jersey Tutoring Agreement - Self-Employed Independent Contractor

Description

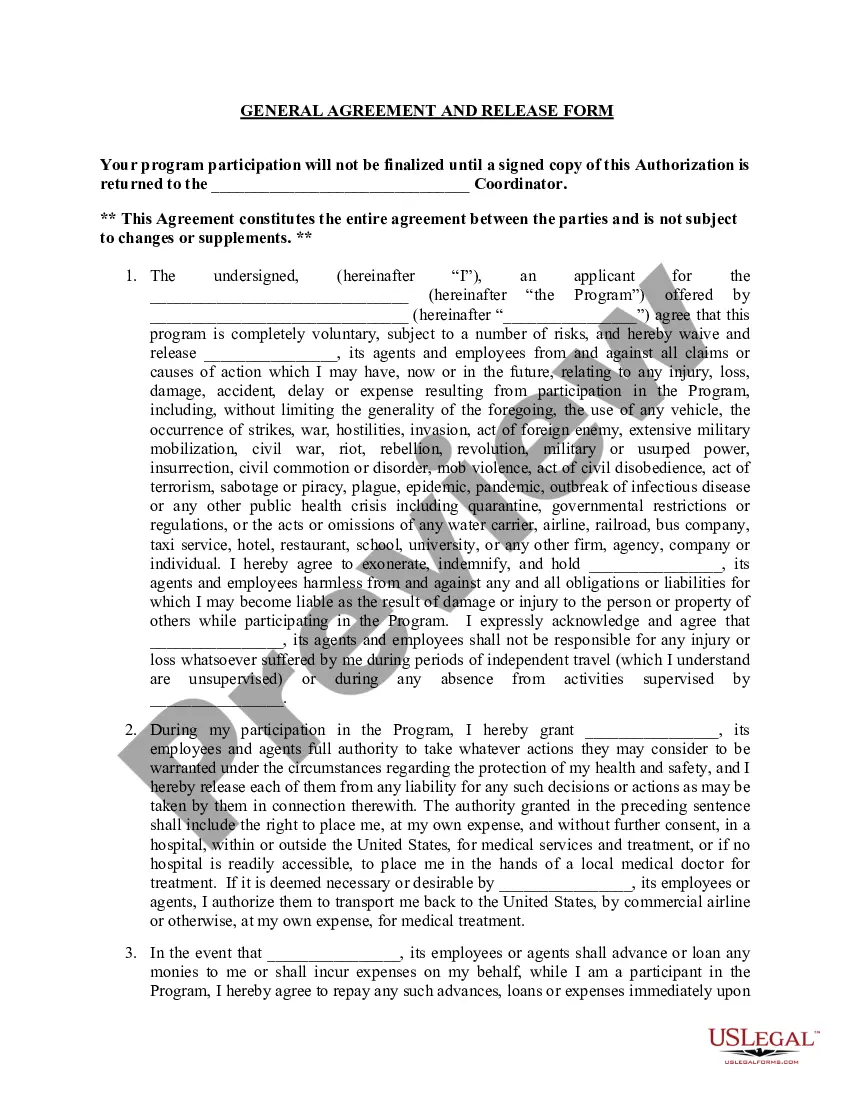

How to fill out Tutoring Agreement - Self-Employed Independent Contractor?

Are you currently in the situation where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust isn't easy.

US Legal Forms offers a wide array of form templates, including the New Jersey Tutoring Agreement - Self-Employed Independent Contractor, which are designed to meet federal and state requirements.

Once you find the correct form, click on Purchase now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Next, you can download the New Jersey Tutoring Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/region.

- Utilize the Review option to examine the form.

- Check the summary to confirm that you have selected the correct form.

- If the form isn't what you are searching for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

Yes, an independent contractor is considered self-employed. This means they operate their own business and provide services to clients without being classified as an employee. In the context of the New Jersey Tutoring Agreement - Self-Employed Independent Contractor, this classification allows you to set your own rates and establish your own working conditions. Understanding your status as self-employed can help you navigate tax obligations and legal protections more effectively.

When filling out an independent contractor agreement, start with the parties' names and addresses. Next, detail the scope of work, payment amount, and frequency. Additionally, include important terms regarding confidentiality and termination. Leveraging a template for a New Jersey Tutoring Agreement - Self-Employed Independent Contractor from US Legal Forms can ensure you cover all critical aspects effectively.

Filling out an independent contractor form involves providing essential information about yourself and your services. Include your name, address, and tax identification details. Ensure you specify the nature of the work, rates, and payment schedule. Utilizing platforms like US Legal Forms can help you navigate this process by providing clear guidance and templates for a New Jersey Tutoring Agreement - Self-Employed Independent Contractor.

To write an independent contractor agreement, start by outlining the parties involved. Clearly define the services to be provided, the payment terms, and any deadlines. It's essential to include specific clauses about confidentiality, ownership of work, and termination conditions. Using a New Jersey Tutoring Agreement - Self-Employed Independent Contractor template can simplify this process and ensure you include all necessary elements.

Tutors hired as independent contractors are often classified as 1099 workers, rather than employees. This means they are responsible for their own taxes and do not receive traditional employee benefits. By using the New Jersey Tutoring Agreement - Self-Employed Independent Contractor, you can confirm their status and ensure compliance with relevant tax laws.

To create a tutoring contract, start by outlining essential details like services provided, payment terms, and schedules. It’s important to include clauses that cover confidentiality and termination conditions. The New Jersey Tutoring Agreement - Self-Employed Independent Contractor template can help you draft a comprehensive contract that protects both parties and clarifies expectations.

A tutor can be considered an independent contractor depending on the nature of the work arrangement. If the tutor sets their own schedule, chooses their teaching methods, and is not closely supervised, they typically qualify as an independent contractor. Using the New Jersey Tutoring Agreement - Self-Employed Independent Contractor can help solidify this classification.

If you hire a tutor as an independent contractor, you generally need to issue a 1099 form at the end of the year if they earn above a certain threshold. This form reports the income received and helps both parties with their tax obligations. The New Jersey Tutoring Agreement - Self-Employed Independent Contractor can help you manage this process efficiently.

Yes, you can require training for independent contractors like tutors, but the level of control you exert matters. If you control how they perform their work and dictate training, you may be crossing into employee territory. To maintain the independent contractor status, refer to the New Jersey Tutoring Agreement - Self-Employed Independent Contractor to outline expectations that allow for guidance without control.

An independent contractor is typically someone who provides services to a client under a contract, rather than being an employee. They control how their work is completed, decide their own hours, and use their own tools. The New Jersey Tutoring Agreement - Self-Employed Independent Contractor clarifies this relationship, ensuring that both parties understand their rights and responsibilities.