New Jersey Visiting Professor Agreement - Self-Employed Independent Contractor

Description

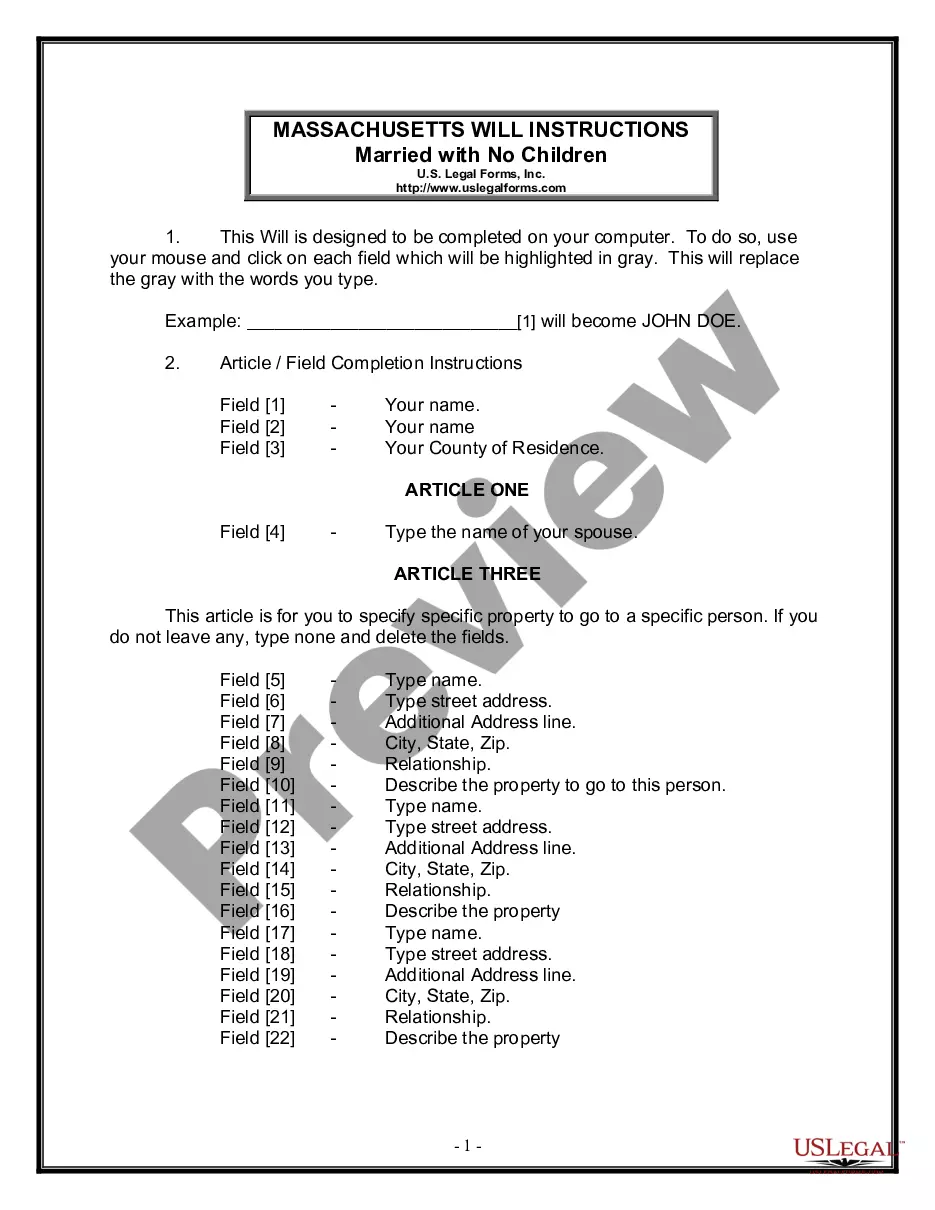

How to fill out Visiting Professor Agreement - Self-Employed Independent Contractor?

US Legal Forms - among the largest collections of legal documents in the United States - provides a broad selection of legal form templates that you can download or print. By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the New Jersey Visiting Professor Agreement - Self-Employed Independent Contractor in just a few minutes.

If you already have a monthly subscription, Log In and download the New Jersey Visiting Professor Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Acquire button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to help you get started: Ensure you have selected the correct form for your city/county. Click on the Preview button to review the form's content. Read the form description to confirm you have chosen the right document. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the payment plan you prefer and provide your details to register for an account. Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Choose the format and download the form to your device. Make changes. Fill out, modify, print, and sign the downloaded New Jersey Visiting Professor Agreement - Self-Employed Independent Contractor.

- Every template you add to your account does not have an expiration date and is yours indefinitely.

- So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the New Jersey Visiting Professor Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

Form popularity

FAQ

An independent contractor in New Jersey is an individual who provides services under a contract without being classified as an employee. The New Jersey Visiting Professor Agreement - Self-Employed Independent Contractor exemplifies how this classification works in an academic setting. Contractors manage their work independently, which entails specific rights and responsibilities that differ from those of traditional employees.

Like professors, teachers can also be classified as either employees or independent contractors. Independent contractors typically work under specific agreements, such as the New Jersey Visiting Professor Agreement - Self-Employed Independent Contractor, where they manage their own schedules and responsibilities. Understanding this classification can help you navigate your work relationships more effectively.

In many instances, adjunct professors are classified as independent contractors. They often operate under specific agreements, like the New Jersey Visiting Professor Agreement - Self-Employed Independent Contractor, allowing them to teach courses without being full-time employees. This arrangement provides flexibility for both the adjunct and the institution.

Jobs labeled as independent contractors encompass a wide variety of roles, including consultants, freelance writers, and even visiting professors. When it comes to academia, a New Jersey Visiting Professor Agreement - Self-Employed Independent Contractor empowers professors to work independently while sharing their expertise. Understanding these distinctions is essential for both self-awareness and legal compliance.

Whether a professor is classified as an employee depends on their contractual relationship with the institution. Many professors operate under the New Jersey Visiting Professor Agreement - Self-Employed Independent Contractor, granting them flexibility and autonomy. However, full-time faculty members may be considered employees with specific obligations and benefits.

Determining your employment status can be complex. Generally, independent contractors, like those covered by the New Jersey Visiting Professor Agreement - Self-Employed Independent Contractor, have more control over their work schedule and deliverables. Employees typically have set hours and may receive benefits, so it's important to review your contract and responsibilities to clarify your classification.

Professors can be either employees or independent contractors, depending on their specific role and the institution's classification. A New Jersey Visiting Professor Agreement - Self-Employed Independent Contractor typically outlines the terms of the relationship, specifying that the professor operates independently rather than as an employee of the school. This distinction impacts things like taxes, benefits, and job responsibilities.

To get authorized as an independent contractor, you first need to understand the requirements for your specific state. In New Jersey, a Visiting Professor Agreement – Self-Employed Independent Contractor typically requires you to register with the state and obtain any necessary licenses or permits. Furthermore, it is essential to have a clear contract outlining your services and compensation. Using platforms like US Legal Forms can simplify this process by providing customizable agreement templates tailored to meet your needs.

Yes, an independent contractor is considered self-employed. This status means that they operate their own business and manage their own taxes. When working under a New Jersey Visiting Professor Agreement - Self-Employed Independent Contractor, you typically invoice for your services and do not receive a regular paycheck. This arrangement offers flexibility and the ability to set your own hours, making it appealing for many professionals.

To fill out an independent contractor agreement, begin with your personal details such as your name and address. Next, describe the services you will provide in line with your New Jersey Visiting Professor Agreement as a Self-Employed Independent Contractor. Clearly state the payment terms and any deadlines. Ensuring all parts of the agreement are detailed helps to prevent misunderstandings and establishes a professional relationship.