New Jersey Educator Agreement - Self-Employed Independent Contractor

Description

How to fill out Educator Agreement - Self-Employed Independent Contractor?

Are you presently in a situation where you need to have documents for both organizational or personal purposes almost every time.

There are numerous legal document templates available online, but finding forms you can trust is not easy.

US Legal Forms offers a vast array of form templates, such as the New Jersey Educator Agreement - Self-Employed Independent Contractor, which are designed to meet state and federal standards.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey Educator Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

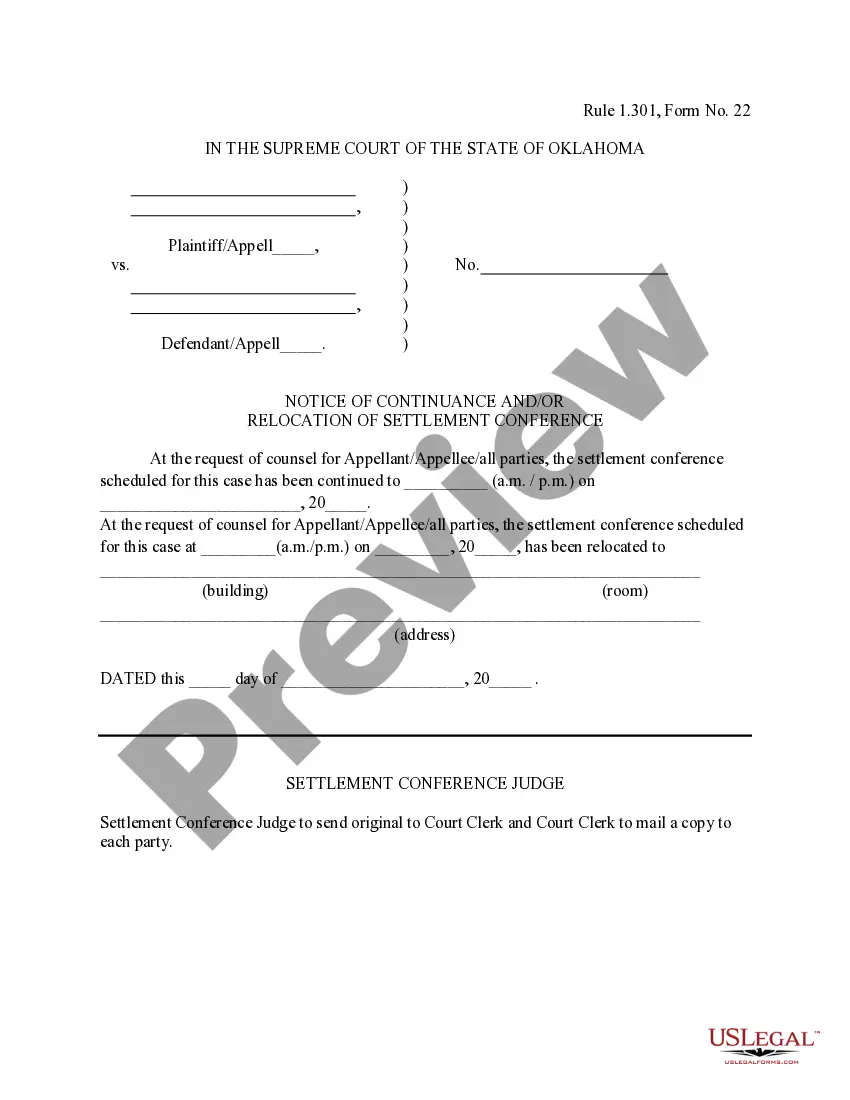

- Use the Preview button to review the form.

- Check the details to make sure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you desire, fill in the required information to create your account, and purchase an order using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Find all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the New Jersey Educator Agreement - Self-Employed Independent Contractor anytime, if needed. Just click the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides properly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

Yes, an independent contractor is considered self-employed. This means that you operate your own business and have the freedom to choose your clients and projects. As a self-employed individual, you manage your own taxes and finances. If you are working under a New Jersey Educator Agreement - Self-Employed Independent Contractor, your status as a self-employed worker is affirmed, providing certain legal protections.

Writing an independent contractor agreement requires a few essential elements. Start with the basic information about both parties, then outline the scope of work and payment details. Additionally, include terms regarding confidentiality, termination, and any legal requirements. For a well-structured agreement, consider utilizing templates from US Legal, designed for the New Jersey Educator Agreement - Self-Employed Independent Contractor.

Proving your income as an independent contractor can be done through various documentation. Common methods include providing invoices, bank statements, or tax returns that reflect your earnings. It's also beneficial to maintain accurate records of all contracts and payments received to present a clear financial picture. If you use the New Jersey Educator Agreement - Self-Employed Independent Contractor, you can demonstrate professionalism while establishing your income.

To fill out an independent contractor form, start by providing your personal information, including name, address, and contact details. Next, describe the services you will provide and specify any terms related to payment. Lastly, complete the form by signing it and ensuring both parties understand the responsibilities. Using US Legal forms can help you access the correct forms for the New Jersey Educator Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor agreement involves several steps. First, clearly outline the scope of work, including specific tasks and deliverables. Then, include payment terms, such as rates and payment schedules, while also defining the duration of the agreement. For clarity, consider using the US Legal forms platform, which provides templates specifically for the New Jersey Educator Agreement - Self-Employed Independent Contractor.

When you work as a self-employed independent contractor under the New Jersey Educator Agreement, you typically need to complete a few essential documents. First, you must fill out the contractor agreement, which outlines the terms of engagement and responsibilities. Additionally, you may need to provide a tax identification form, such as the W-9, to report your earnings. Using platforms like uslegalforms can help you access the necessary paperwork and ensure compliance with all regulations.

The ABC rule in New Jersey provides criteria for classifying workers as independent contractors. To qualify, workers must meet three tests, showing they operate independently, perform work outside the employer's usual business, and have established an independent business. For those entering a New Jersey Educator Agreement - Self-Employed Independent Contractor, this rule clarifies the requirements to be legitimately recognized as independent. Utilizing USLegalForms can help navigate these complexities and ensure you meet necessary standards.

In New Jersey, the 7 minute rule helps assess how a worker's tasks align with independent contractor definitions. This rule allows investigators to scrutinize a worker's responsibilities in short intervals to see if they resemble those typical of an employee. When dealing with a New Jersey Educator Agreement - Self-Employed Independent Contractor, understanding the implications of the 7 minute rule is necessary to ensure proper compliance and avoid misclassification. Investing time to learn this can safeguard your business.

The 7 minute rule operates by evaluating the tasks performed by a worker within a 7-minute period. If the nature of these tasks leans toward employee-like duties, it may necessitate reclassification. For those forming a New Jersey Educator Agreement - Self-Employed Independent Contractor, comprehending how this rule applies is essential. Misclassification can lead to legal and financial complications that one wants to avoid.

The 7 minute rule in New Jersey refers to a guideline used to determine whether a worker is classified correctly as an independent contractor or an employee. If a worker's job, during any given workday, meets specific conditions and activities within a 7-minute time span, it may influence their independent status. Understanding this rule can be crucial when establishing a New Jersey Educator Agreement - Self-Employed Independent Contractor. Accurate classification affects tax obligations and benefits eligibility.