New Jersey MHA Request for Short Sale

Description

How to fill out MHA Request For Short Sale?

Have you found yourself in a position where you require documents for various business or personal reasons almost every workday.

There are numerous legal document templates accessible online, but locating reliable ones is not straightforward.

US Legal Forms offers a multitude of form templates, including the New Jersey MHA Request for Short Sale, designed to comply with federal and state regulations.

Once you find the appropriate form, simply click Acquire now.

Choose your preferred pricing plan, fill in the necessary information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can request an additional copy of the New Jersey MHA Request for Short Sale at any time, if needed. Just select the required form to obtain or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers carefully crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start making your life a bit simpler.

- If you are already acquainted with the US Legal Forms website and have an account, simply sign in.

- After that, you can download the New Jersey MHA Request for Short Sale template.

- If you do not have an account and wish to begin using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

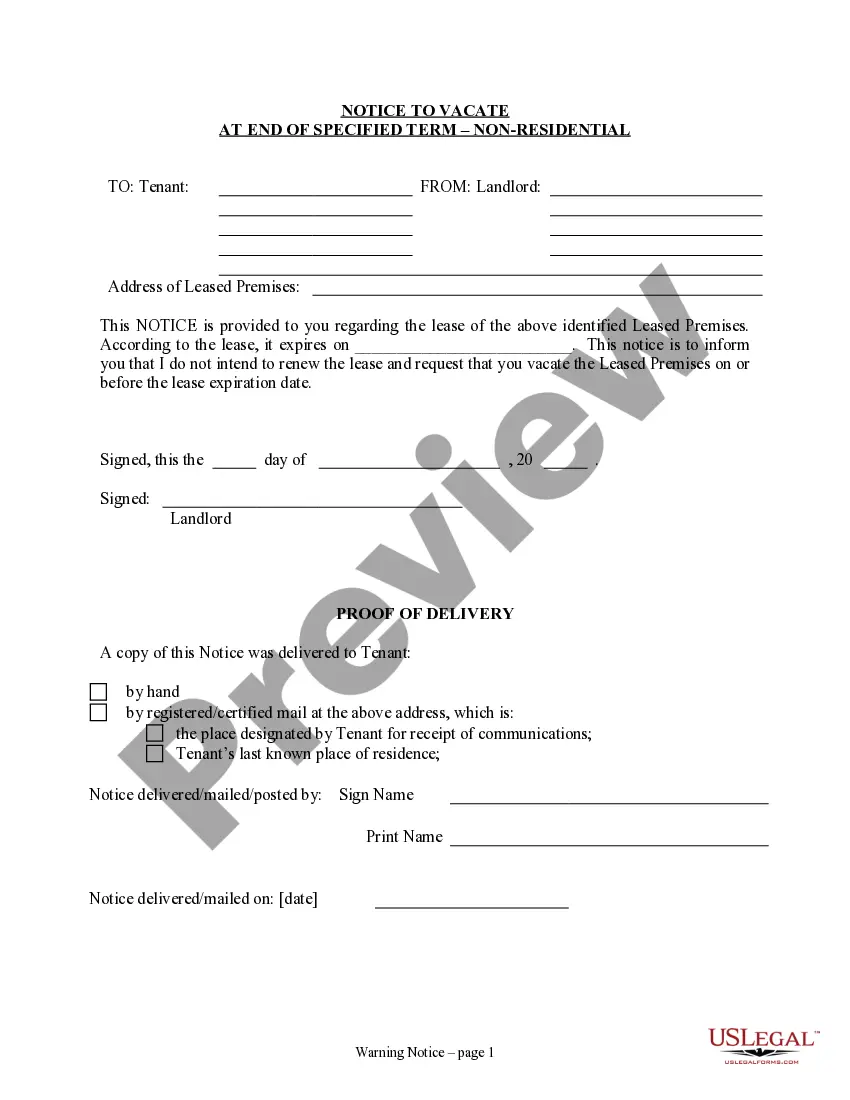

- Use the Review button to examine the document.

- Check the details to ensure you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

To request a short sale in New Jersey, homeowners must first contact their lender to discuss eligibility. It is helpful to gather necessary documentation before submitting the New Jersey MHA Request for Short Sale. Utilizing a platform like USLegalForms can simplify the process by providing the required forms and step-by-step guidance, ensuring that you complete your request smoothly and efficiently.

The new law in New Jersey significantly impacts realtors by streamlining the process for the New Jersey MHA Request for Short Sale. This law provides clear guidelines for handling short sales, ensuring that both realtors and homeowners understand their rights and responsibilities. With these updates, realtors can more effectively assist clients in navigating the short sale process, ultimately leading to more successful transactions.

Writing a hardship letter for your New Jersey MHA Request for Short Sale involves clearly explaining your current financial situation. Begin by stating the reason for your hardship, such as job loss or medical expenses, and provide specific details that support your claim. Next, express your willingness to cooperate with the lender and show how a short sale could benefit both parties. To make this process easier, you can use resources like USLegalForms, which offer templates and guidance tailored for your needs.

There are specific rules governing short sales in New Jersey, including lender requirements for approval and the need for a valid hardship justification. Homeowners must stay aware of their financial status and maintain communication with their lenders throughout the process. A New Jersey MHA Request for Short Sale often requires detailed documentation. Consulting with a knowledgeable real estate professional can help you understand and comply with these rules.

To complete a short sale in New Jersey, start by contacting your lender to discuss your situation and submit a New Jersey MHA Request for Short Sale. You will need to gather necessary documentation, such as financial statements and property information. It’s also beneficial to work with an experienced real estate agent to facilitate negotiations with the lender and ensure the sale meets all legal requirements.

While a short sale can provide relief from a financial burden, it also has potential downsides. Homeowners may experience a negative impact on their credit score, though it's often less severe than a foreclosure. Additionally, the process can be lengthy and may require negotiations that can delay the sale. Understanding these factors and consulting professionals experienced in the New Jersey MHA Request for Short Sale is crucial.

A short sale in New Jersey is a real estate transaction where the seller sells their home for less than the outstanding mortgage balance. This typically happens when homeowners face financial hardships that make it difficult to keep up with mortgage payments. A New Jersey MHA Request for Short Sale allows homeowners to approach lenders for approval to sell the property at a loss. It provides a viable option for those looking to avoid foreclosure.

In New Jersey, a short sale involves selling your home for less than what you owe on your mortgage. To initiate this process, you will need to engage with your lender and submit a New Jersey MHA Request for Short Sale. Your lender must approve the sale and agree to accept the reduced payment. Working with professionals who have experience in short sales can streamline this process.

The duration of a short sale in New Jersey can vary, but typically, it takes about three to six months to complete. Factors such as lender responsiveness and market conditions can influence this timeline. It is essential to work closely with a real estate agent who understands the New Jersey MHA Request for Short Sale process. This can help you navigate the timeline effectively.

To get approved for a short sale under the New Jersey MHA Request for Short Sale program, you must first demonstrate financial hardship. It's important to gather all necessary documentation, such as income statements, tax returns, and a hardship letter. You’ll then submit this documentation to your lender, along with the short sale request. Utilizing US Legal Forms can streamline this process by providing you with the necessary forms and guidance tailored specifically for your short sale needs.